Market Forces Are Inverting The Yield Curve, Not A Looming Recession

Michael Kramer | Jul 12, 2019 06:23AM ET

This post was written exclusively for Investing.com

In recent weeks, investors have latched onto the yield curve, frenetically trying to decipher the cryptic message it may be sending, worried it may be flagging a pending U.S. recession. And not without reason. In the past, when the yield curve has become steeply inverted for a long period, it has signaled recession. However this time may be different: this time, rates around the world have plunged.

And that means the yield curve may be signaling nothing more sinister than the fact that we live in a world of very low rates, depressed by easy monetary policy. A world where countries like Italy, Spain, Thailand, and Singapore have 10-year rates that are lower than or equal to the U.S. 10-year Treasury.

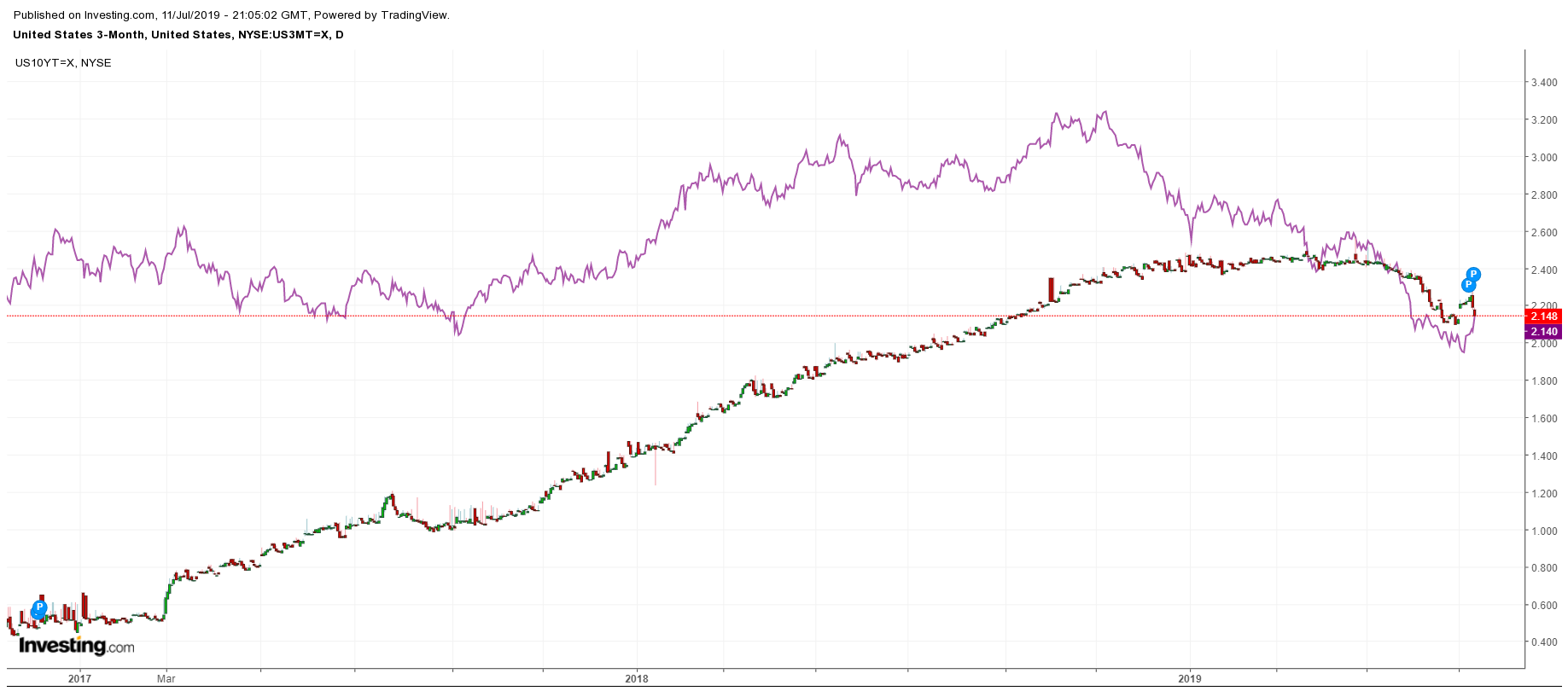

'Mixed' Inversion

The yield curve for U.S. Treasurys has indeed inverted for differing maturities. For example, the 10-year yield and 3-month yield is inverted, but the 10-year minus 2-year is not. The question, though, is what is driving that inversion? Is it the rising risk of recession, or are market forces taking hold pulling the 10-year rate down, while the Fed props up the 3-month rate? Remember, yields on the shorter-dated side of the curve are more influenced by monetary policy, while market forces drive the longer-dated yields.

Attractive Yields Compared With Global Bonds

Believe it or not, U.S. 10-year bonds have a yield that is about 45 basis points higher than Italy's. Meanwhile, Spain’s 10-year rate is about 165 basis points higher than the U.S. 10-year rate. As an investor, is it better to hold Italian government debt at a yield of 1.7% or a U.S. 10-year at 2.15%? The answer seems obvious.

Swing over to Singapore and Thailand, and one would find 10-year rates on government debt trading at near parity to the U.S. rate. It is indeed a low rate world in which we live.

Easy Money

As central banks signal further easing to boost inflation and growth, it forces investors who require yield to buy government bonds. That drives rates down and forces investors to buy the higher yielding U.S. bonds, which in turn drives U.S. rates lower.

However, there is another force at play, and it will come from the biggest bond buyer of them all, the U.S. Federal Reserve. This fall the Fed will begin to buy as much as $20 billion in U.S. Treasurys as MBS holdings mature. Knowing the Fed will be stepping into the market, in size, may be a contributing factor to why bond yields in the U.S. continue to fall, as investors anticipate the Fed’s arrival.

Recession, Really?

The notion that the U.S. is heading into a recession seems farfetched at this point. The latest ISM manufacturing survey had a reading of 51.7%, indicating the sector is still expanding. Additionally, the report notes that the reading corresponds to a second quarter GDP growth rate of 2.6%, far from contraction or recession.

Markets At Work

It is these market forces that are weighing on bond yields and dragging U.S. Treasury rates lower, not a looming recession. It is also higher rates in the U.S. that have caused the significant strengthening of the U.S. dollar, which is also weighing on inflation rates while dragging commodity prices lower. These low rates of inflation are likely the driving force that will cause the Fed to cut interest rates in the future.

The next time you hear about the yield curve inversion and the cryptic signals it may be sending about days of doom ahead, look around the globe and at the rates in other countries and think about which bonds you would rather own. It may really be that simple.

The only message the bond market may be sending is that we live in a low-interest rate world, and the U.S. offers the most attractive bonds.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.