Market Confidence In Ruins

Vantage | Jul 06, 2016 02:39AM ET

The Bank of England overnight published their twice-yearly Financial Stability Report, spooking markets and sending the British Pound to fresh lows.

“There is evidence that some risks have begun to crystallise. The current outlook for UK financial stability is challenging.”

You can find the full Financial Stability Report on the BoE website at that link, and can even watch the press conference in full on YouTube. 2016, I know. What a time to be alive.

One major headline printer has been Carney lowering the amount of capital that banks are required to hold in reserve. The idea here is that an extra £150 billion has now been freed up for lending in a hope to stimulate a post Brexit economy with zero business confidence.

With bank stocks continuing to be hit, freeing up cash to lend is a positive step in theory, but with no end in sight to the Brexit uncertainty, whether this will have any effect on real numbers and confidence, we’ll have to wait and see.

Onto the Pound itself and the huge re-pricing to the downside we have seen in Cable:

“That adjustment has moved in the direction that is necessary to facilitate some of the economic adjustments that are needed in the economy.”

Well… that certainly is one way of looking at things.

GBP/USD is again seeing some panic selling as Asia sits down at their trading desks, carrying on from the battering the pair received last night. Fear and uncertainty is back!

GBP/USD 4 Hour:

Technically Cable has re-tested and held the GFC lows as support and the latest round of selling has seen fresh lows print. Catch this falling knife at your own peril!

Carney also has this to say around the latest bout of ridiculous stock market strength:

“I would focus on the domestic stocks in the FTSE 250. There’s been a much more significant movement in those stocks. The movements in financial asset prices related to banks has been quite telling.”

This is because the next tier of companies in the 250 are much more dependant on the health of the UK economy than the larger companies represented in the 100.

We’ve talked about the system being broken and when you stop and think about stock markets going parabolic vertical on the back of Brexit simply because it means seemingly endless low interest rate conditions, that it is just crazy. Carney’s comments add a little more context to the Brexit’s effect on the economy, and ties that back into stock market moves.

FTSE 100 4 Daily:

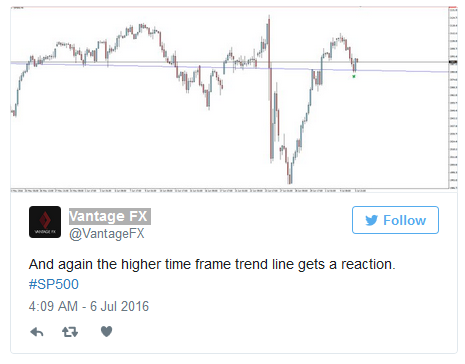

From a technical point of view following a major fundamental re-pricing such a what has occurred follow the Brexit vote, of course we aren’t going to expect a subjective trend line to act as a brick wall. But even though we’ve chopped through it, price has still been respecting the higher time frame trend line on both sides along the way.

The same thing can be seen on the same S&P 500 chart that I’ve been Tweeting over the last few weeks (click the tweet itself to view the conversation):

One last side story which I haven’t had a chance to touch on yet is that of where a weakened Euro leaves Italy.

It has been reported that Italy actually has €360 billion of bad loans on the nation’s book, accounting for nearly 20%. To put this in perspective, this is over three times the bad debt (on a percentage basis) that US banks were holding during the GFC!

While EU banking regulations have helped shift the risk if a collapse were to occur onto share and bondholders rather than every day taxpayers, this obviously doesn’t help already low confidence.

I’m more inclined to focus on the charts, but this is a space to watch as Italy heads into its own political referendum.

EUR/USD 4 Hour:

And as you can see, EUR/USD received a steady Brexit retrace as things settled down, but all good things must come to an end in today’s financial world (ZeroHedge eat your heart out!) and the counter-trend flag has been broken and price is targeting lows on this currency pair as well.

There is certainly no lack of opportunity for Forex and Indices traders who are aware!

On the Calendar Wednesday:

EUR ECB President Draghi Speaks

CAD Trade Balance

USD ISM Non-Manufacturing PMI

USD FOMC Meeting Minutes

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.