Manufacturing In Focus As Busy Week Opens With Weaker USD

Jeremy Cook | Dec 02, 2013 03:48AM ET

The dollar has entered December on the back foot as investors continue to bet on the global recovery with the world’s manufacturing sectors in focus today. Measures of manufacturing strength should show the fastest pace of expansion in the Eurozone for 2 years, while the UK’s is set to show the 7th consecutive month of growth, the best run since June 2011.

China’s figure has started the day off in a good vein with expansion running at 50.8, a slight dip from October but the 4th best reading of the year, with the new business component particularly encouraging. Jobs did fall however, and until they are growing steadily, we would anticipate there will be little desire to end current accommodative policies. China will be hoping that the US consumer comes to the party and bails out the world economy as it has done in the past. Current US dynamics, in particular the shrinking current account deficit, tend to suggest otherwise however.

We must also emphasise that we are not of the belief that the Chinese economy is still in danger of a hard landing – it will need help from its export markets soon though. Skirmishes between China and Japan over the disputed Senkaku islands have also restarted recently and pose some event risk.

PMIs and ISMs are due for release throughout the day with notable ones coming from Italy (8.45am GMT), France (8.50am), Germany (8.55am), Eurozone (9am), UK (9.30am) and the US (3pm). France apart, we should see all come in above the 50.0 level that denotes the line between expansion and contraction.

As if on cue, following S&P’s decision to upgrade the Spanish credit rating outlook on Friday, we saw Spanish unemployment hit another record in October according to the new stats; 26.7% of those of working age in Spain are without work with youth unemployment now north of 65%. The Eurozone-wide measure remained close to record levels, the October reading coming in at 12.1%.

Eurozone inflation data showed continual, low CPI on Friday. Italian consumer prices fell 0.4% in November following a 0.2% decline in October. Eurozone wide inflation of 0.9% beat expectations but remains stubbornly low and less than half of the ECB’s target. Following the European Central Bank’s decision to cut rates last month, and the initial reticence of many members to follow up that cut with one that will push deposit rates into negative territory, we expect no movement from Draghi and the Executive Council this week.

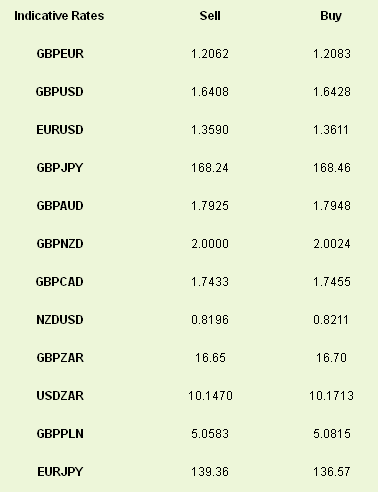

The market’s belief that this week’s set of PMI data and the chances that Thursday’s Autumn Statement from the Chancellor will show an economy growing at a good clip and with decreasing fiscal headwinds has pushed GBP further onwards this morning. GBPEUR has pushed as high as 1.2085 and GBPUSD to 1.6446 – 11 and 27 month highs respectively.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.