Managed Futures ETFs Are Having A Good Year So Far

James Picerno | Apr 14, 2020 08:03AM ET

There have been few places to hide from this year’s dramatic crash in stock markets around the world. Cash, U.S. Treasuries and a select group of government bonds in foreign markets have been a rare source of safety. For funds that held risk assets, managed futures strategies have also been an island of calm, at least for some portfolios, including several of the largest ETFs in this niche.

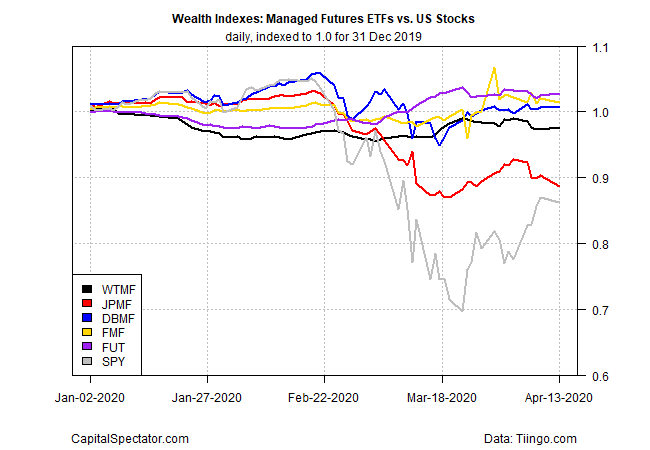

Consider the largest-five managed futures ETFs, based on assets, according to ETFdb.com. Four of the five funds have delivered relative stability vs. the U.S. stock market, as represented by the SPDR S&P 500 ETF (NYSE:SPY). A fifth managed futures fund has been a weak performer vs. the rest of the field, although year to date it’s managed to beat SPY, albeit only modestly.

For investors well-versed in the details of managed futures strategies, the results will ring familiar. Advocates of this corner of portfolio management have long promoted the strategies’ capacity for delivering ballast to the beta risk of stocks. Andreas Clenow offers a compelling history in Following the Trend: Diversified Managed Futures Trading , which documents the strong performances in these portfolios since the 1970s, in absolute and relative terms.

For many years these strategies were available only to high-net-worth investors through private partnerships. More recently, publicly traded versions have become available, in both open-end mutual funds and ETFs formats.

Critics point to high fees and aggressive trading as reasons to be wary. But as recent results remind, managed futures can also provide valuable diversification benefits. What’s the source of the diversification? Several factors, including a mix of long and short positions across a range of financial, currency and commodity futures.

As Clenow explains, the common trading theme for most managed futures strategies is the use of trend following rules. Depending on your perspective, that’s either a plus or minus. Skeptics are quick to point out that trend following-based strategies generally have faced a challenging period in recent years, in part because plain-vanilla equity portfolios have delivered stiff competition.

Has the tide shifted in favor of managed futures this year? Unclear, although recent history certainly shines an encouraging light on this corner of money management, or so the largest ETFs in this space suggest.

Keep in mind, however, that managed futures strategies tend to vary widely from fund to fund, as do results. In short, choose wisely by doing your homework. The bottom line: managed futures is an active strategy, even if there are hard and fast rules for trading.

Another caveat: managed futures ETFs are a relatively new arrival among publicly traded products and the results since inception tend to be mixed, at best. Consider the best performer in the chart above: ProShares Managed Futures Strategy (FUT). Although the ETF is up 2.7% so far this year vs. SPY’s 13.8% tumble (through Apr. 13), FUT’s results since its 2017 launch are distinctly unimpressive, at least vs. US stocks. In 2019, for instance, FUT slipped 0.9%, a dramatically weak run when measured against SPY’s 31.2% surge last year.

Does FUT’s relatively strong run so far in 2020 compensate for its previous mediocrity? Minds will differ, although the compelling answer, one way or the other, depends on how managed futures perform going forward. For the moment, however, this niche stands out as a rare exception to the widespread losses that weighed on most slices of risk assets. Deciding if the recent stability warrants a dedicated allocation, on the other hand, remains open for debate.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.