Major Asset Classes Correlations Profile | 18 October 2018

James Picerno | Oct 18, 2018 07:06AM ET

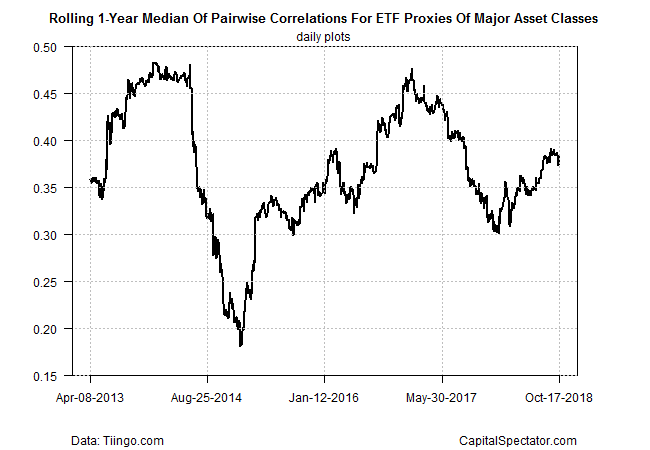

Return correlations for the major asset classes continue to trend higher this year, based on the median of pairwise relationships for rolling one-year periods via a set of exchange-traded products. The median correlation is still well below levels reached in 2017, but the upward bias of late implies that finding diversification benefits through a multi-asset class portfolio will face stronger headwinds on the margins in the near term.

The median correlation for the major asset classes was 0.38 at yesterday’s close (Oct. 17), based on daily returns for the latest one-year rolling period (252 trading days). That’s just slightly below the year-to-date high of 0.39 that was posted in mid-September. The median correlation has been moderately higher in recent years, reaching the 0.45-0.50 range. Based on the trend this year, it’s reasonable to project that the median correlation will continue to rise. (Note: correlation readings range from -1.0 (perfect negative correlation) to zero (no correlation) to +1.0 (perfect positive correlation.))

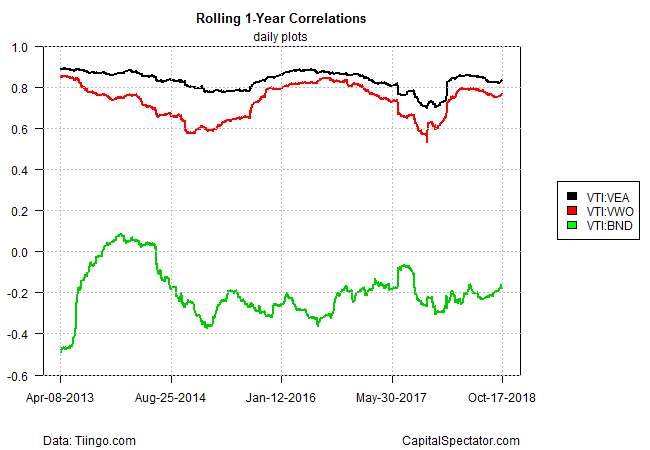

For a slightly more granular profile, let’s turn to the evolution of correlations between the US stock market vs. foreign equities in developed and emerging markets and vs. US bonds. Here, too, the correlations have been edging higher recently between Vanguard Total US Stock Market (VTI) vs. Vanguard FTSE Developed Markets (VEA), Vanguard FTSE Emerging Markets (VWO), and Vanguard Total Bond Market (BND), as shown in the chart below.

For a deeper review of correlations, let’s turn to the complete dataset for all the major asset classes, based on the following proxies:

Using the funds above, most of the correlations are positive in varying degrees, although there are several pockets of mildly negative pairings. The deepest negative correlation is currently found between US stocks (VTI) and US inflation-indexed Treasuries (TIP) at -0.19. Keep in mind that even positive correlations can provide significant diversification benefits for portfolio design, particularly with pairings that post relatively low readings (below 0.6).

The next table below organizes all the pairwise correlations based on daily returns for the current five-year trailing window. Using this longer time frame uncovers a slightly deeper level of negative correlations. Notably, the connection between US stocks (VTI) and bonds (BND) is a moderately negative 0.23.

Finally, let’s consider one other perspective using rolling one-year returns (252 trading days) to calculate correlations for the trailing five-year period through yesterday. By this definition, there are slightly more negative correlations, with the deepest pairing registering at -0.39 for foreign bonds in developed markets (VEA) vs. US bonds (BND).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.