Oil And Stocks Sizzled In May, But Cash And Bonds Are King So Far In 2020

James Picerno | Jun 01, 2020 07:40AM ET

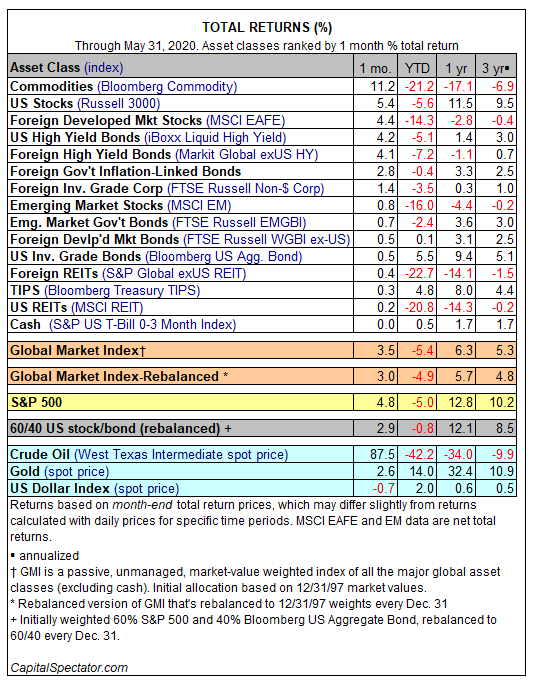

Commodities, led by a sizzling rebound in the price of crude oil, were the best-performing market in May, as some of the concern over the economic impact of the coronavirus pandemic ebbed, but for 2020 so far, government bonds and hard cash are the only assets yielding a return for investors.

Asset prices generally recovered in May, building on April’s widespread gains. The Bloomberg Commodity Index surged 11.1% in the last month — the benchmark’s biggest monthly increase in a decade. Crude oil was the main driver with a record-breaking 87.5% rise, following the hefty declines of the previous two months.

US stocks took second place in terms of performance in May, albeit distantly with a 5.4% gain by the Russell 3000 Index. This solid advance marks the second monthly increase following back-to-back losses for US equities in the first three months of the year.

With trillions in government and central-bank stimulus in the offing, every major asset class rose in May, but thanks to the revival of a risk-on climate, cash put on the weakest performance. The S&P US T-Bill 0-3 Month Index barely budged, with just a 0.01% gain.

While the mood across more cyclical assets might be more upbeat, for the year to date, most markets are still firmly in the red, starting with crude oil, which is still down by more than 40%. The only exceptions are US and foreign investment-grade bonds, inflation-linked Treasuries and cash.

The Global Markets Index (GMI) posted a second straight monthly gain in May. The GMI, an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights, rose 3.5%. For the year so far, however, the GMI remains underwater by 5.4%, courtesy of the steep losses seen across the board in the first quarter.

For the trailing one-year window, the trend looks brighter for the GMI, which is up 6.3%. US investment-grade bonds extended their gains over the last 12 months and US stocks (Russell 3000) are higher by nearly 12% compared with last year, after including dividends.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.