Macro Update As DC Dithers

Kevin Davitt | Oct 10, 2013 01:16AM ET

Macro highlights (or low-lights depending on your perspective):

- Janet Yellen is expected to be named Bernanke's replacement as head of the FOMC today. She's unequivocally a policy dove. 2014 FOMC voting members, however, swings more hawkish.

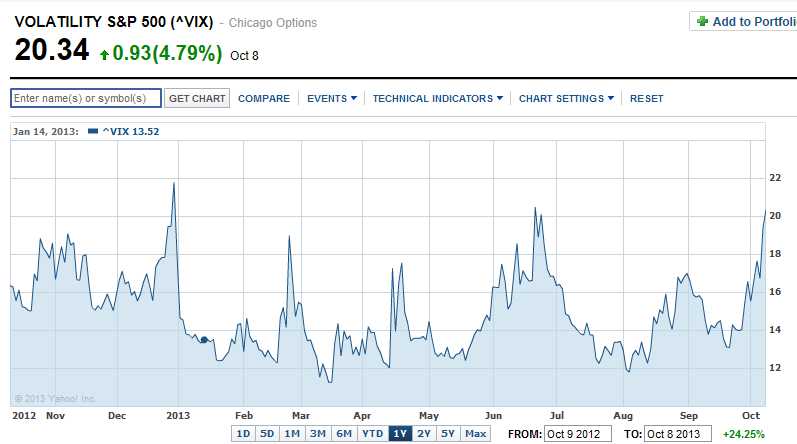

- The Cash VIX traded up toward 52 week highs yesterday/today as equities struggle with DC dysfunction.

- The market leaders (Nasdaq and RUT) have become laggards during this spat of risk off. Look at momentum darlings like Priceline, Netflix, Google, Tesla, etc. Also interesting to note that Interactive Brokers raised margin requirements on small cap stock holdings on Monday.

- Short term (funding) markets are in turmoil because of the debt ceiling overhang.

- The S&Ps are testing important trendlines - 100 day SMA which has held all of 2013 and the move off the November 2012 (DC inspired) lows.

In my opinion, the market will force the hand of Obama, Boehner, Reid, Cantor, etc.. I also imagine some of the more influential lobbyist have been on the phone a great deal of late. Their clients don't (big banks and healthcare/device companies) don't like this uncertainty. Money talks in DC....more so than ever since Citizens United.

I would not be surprised if SHORT TERM LOWS were put in this morning with:

- ESZ13 @ 1647 (S&P futures)

- TFZ13 @ 1040 (Russell 2k futures)

Finally, from a big picture standpoint, the Aussie/Yen cross matter. It was the carry trade de jour for a decade plus (borrow in low yielding currency, invest in higher yielding). I've written about it extensively in the past.

I believe the cross is at/near important support around 90. In my estimation it should hold near term, but eventually it will give way. When it does.....be very careful. This area of congestion is a confluence of some old highs (2005, 2010, 2011, 2012) as well as lows in 2007 and 2008 before it cratered during the global selloff. Watch it carefully in the coming days and weeks.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.