M&A Activity Up 61.5%, While Spinoffs Up 160%: What's Happening This Week

Christine Short | Mar 15, 2021 11:51AM ET

Executive Summary

- Merger & Acquisition activity is back on the rise after a catastrophic decline during the pandemic; the count of spinoffs is also up versus Q1 2020 as investors reward newly spun-off stocks

- Q1 2021 earnings are expected to jump versus a year ago

- Starbucks and Siemens Energy host corporate events this week to give color to the global consumer and renewable energy trends

M&A And Spinoffs Higher From a Year Ago

Wall Street Horizon tracks a dozen corporate event types. We noticed an interesting trend during the first quarter of 2021 versus the same quarter a year ago within two such event types. Merger & acquisition activity is up substantially, and the count of corporate spinoffs is at the highest level since Q3 2019. What could be going on in this space and why should investors care?

Like many American consumers, firms are flushed with cash following the pandemic. It’s an odd-sounding statement given the intense fear all of us felt this time last year – uncertainty was extreme regarding jobs and the global economy. Immense monetary and fiscal support buoyed businesses and gave consumers confidence.

Corporate managers are now putting that cash to work and pouncing on perceived opportunities in the marketplace. Our data shows that M&A activity is up 61.5% so far this quarter versus Q1 2020. Bear in mind this is a global figure, and the COVID-19 pandemic hit many of the international developed markets before the U.S., so we are working off a low base.

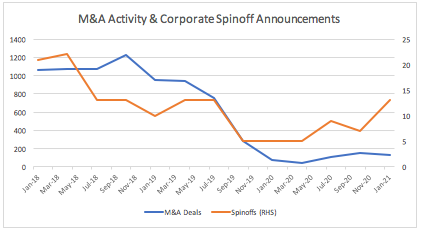

In Figure 1 below, you can see the recent increase in M&A announcements and spinoffs, but the M&A number is still considerably below pre-pandemic levels. These stats will be fascinating to monitor as 2021 progresses. Do CEOs keep on the prowl in search of key deals?

Figure 1: Wall Street Horizon’s Data of Announced M&A deals and Corporate Spinoffs by Quarter

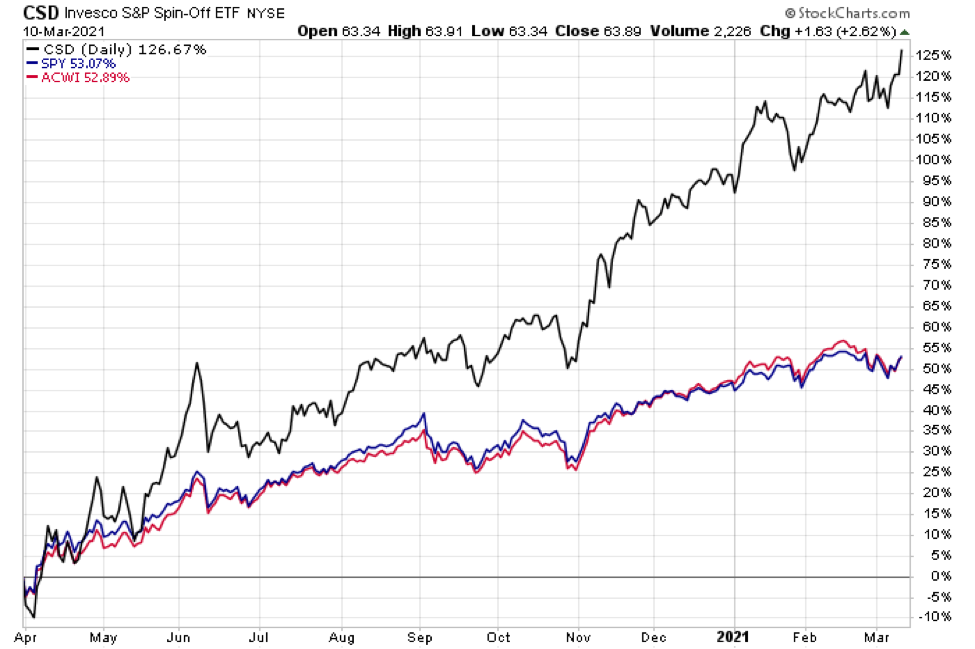

It’s not all consolidation though. Our data shows that spinoffs are up significantly of late. We tallied just 5 spinoff announcements during Q1 2020. How does Q1 2021 look so far? Survey says – 13. That is a 160% jump with still a few weeks left in the quarter from when we last surveyed the market. One motivation for the surge in corporate spinoff activity could be that the market has been rewarding shares of spinoffs. The Invesco S&P Spin-Off ETF (NYSE:CSD) has easily outpaced the S&P 500 ETF (NYSE:SPY) and the iShares MSCI ACWI ETF (NASDAQ:ACWI) since the start of Q2 2020 (Figure 2).

Figure 2: Performance of the CSD, SPY, ACWI since April 1, 2020 (Stockcharts.com)

“If you build it, they will come” is an old sports movie quote, but it also applies to the financial markets. If traders reward a certain investment theme long enough, CEOs often begin to pay attention, then hop aboard the trend. Monitoring trends in this space will also be of interest to traders for the rest of the year. CEOs will likely continue to spinoff pieces of their business in hopes of creating near-term value for shareholders.

Looking Ahead To Q1 2021 Earnings Season

March is a month for investors to catch their collective breath following the Q4 earnings season. We are only a few short weeks from the start of the Q1 reporting period, so there is little rest for the weary. Earnings growth is expected across the global corporate landscape relative to Q1 2020. FactSet notes that Q1 2021 earnings for the S&P 500 are anticipated to grow at a whopping 21.8%. That would be the highest year-over-year increase for a quarter since the third quarter of 2018. In the meantime, portfolio managers can focus on company-specific corporate events. We feature two such firms this week.

Shareholder Meetings And Investor Conferences This Week

We turn our attention to more granular corporate news at shareholder meetings and investor conferences. These are two important corporate event types we track closely at Wall Street Horizon. These are key events to mark on your calendar if you are a trader – stocks mentioned at shareholder meetings and investor/analyst days can often move when executives give color to product development, industry trends and consumer preferences. Just the tone of executives can have impacts on stock prices.

Starbucks Corporation hosts its Virtual Shareholder Meeting on Wednesday, March 17, at 10 a.m. Pacific Daylight Time. Shareholders as of the record date of Jan. 8 will be able to vote and ask questions at the meeting. Shares of Starbucks have performed impressively given the sharp change in consumer activity since the onset of COVID-19. Gone are the days of quickly grabbing a morning brew on your way to the office, although those busy mornings could be returning in a few months if workers indeed come back to the office. Starbucks Corporation (NASDAQ:SBUX) is up 26% since the start of 2020, while the Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY) is up 43%, outpacing the S&P 500’s 23% return in the same timeframe.

Siemens Energy AG (ENR.DE) holds its Hydrogen Day on Friday this week. Keeping the theme of corporate spinoffs, Siemens Energy (DE:ENR1n) was spun off from the German technology powerhouse Siemens in Q3 last year in what was the biggest German spinoff ever. European investors will want to pay close attention to news out of this meeting for clues on where Siemens Energy looks to put its assets to work within the rapidly growing green hydrogen space. Renewable energy has only grown in notoriety following 2020’s tumultuous year in the energy markets.

Conclusion

Investors must prepare for a post-pandemic world. The corporate landscape is shifting under our feet with increasing mergers and acquisition activity as well as corporate spinoffs. Firms flushed with cash and investors eagerly looking to put their stimulus money to work in the market are paying-up for interesting stocks and themes. The spinoff factor has been one of the winners of the last year as these ‘new’ stocks appear glamorous to young investors. Fundamentally, some trends could make a comeback later this year – ones as simple as picking up a morning latte. Others are bigger and more seismic, such as the trend toward a sustainable future that hydrogen technology can bring. We cover the gamut of corporate events to keep clients ahead of a rapidly evolving business world.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.