Low Interest Rates Alone Cannot Prevent A Bear Market In Stocks

Pacific Park Financial Inc. | Mar 09, 2016 02:19AM ET

The most common definition of a bear market in stocks? A major index needs to fall 20% from a high-water mark. And while that is precisely what has happened for most gauges of stock health – MSCI all-country World Index, Nikkei 225, Stoxx Europe 600, Shanghai Composite, U.S. Russell 2000, U.S. Value Line Composite – the Dow and the S&P 500 remain defiant.

Yet there’s another way to view bulls and bears. In particular, chart-watchers often use the slope of a benchmark’s long-term moving average. It is a bull market when the 200-day moving average is rising. During these times, investors often benefit when they buy the dips. In contrast, when the 200-day is sloping downwards, it may be a “Grizzly.” During these days, investors successfully preserve capital when they raise cash by selling into rallies.

There’s more. During stock bears, stocks frequently hit “lower highs” and “lower lows.” That’s exactly what investors have experienced since May of 2015.

There is little doubt that – at the moment – we are witnessing the “rolling over” of the 200-day moving average. The exceptionally popular measure of market direction is sloping downward, giving support to the notion that a bearish downtrend is in command.

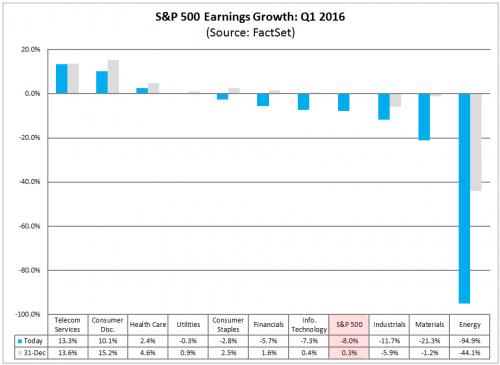

Technical analysis notwithstanding, there are other reasons to believe that the stock bear will maul and mangle. Fundamental analysts note that the Q1 2016 S&P 500 earnings are set to record a decline of -8.0%. That is going to register a fourth consecutive quarter for year-over-year declines in corporate earnings per share – the first such sequence since 2008 (Q1, Q2, Q3, Q4).

“But Gary,” you protest. “It’s only the energy companies. You should just exclude them from consideration.” (Like technology in 2000? Financials in 2008?)

Actually, it is not just the energy sector. Seven of the 10 key economic sectors will serve up profits-per-share disappointments. Telecom, health care and consumer discretionary companies may be the only sectors to provide a positive boost in the upcoming earnings season. Still, get a gander at the earnings expectations at the start of the year versus the earnings expectations at the beginning of March. It only took two months for analysts to lower their expectations for every single stock segment – percentage revisions that have not dropped this fast since the Great Recession.

Keep in mind, reported earnings for the S&P 500 peaked at $105.96 on 9/30/2014. At that time, the S&P 500 closed at 1972 and traded at a P/E of 18.6. With the most recent 12/30/2015 S&P 500 earnings at $86.46, and the 3/8/2016 close of 1979, the market trades at a P/E of 22.9. That’s correct. The market is essentially flat since September of 2014, but it is far more expensive in March of 2016. Nearly 20% more expensive since profits peaked.

It is exceptionally difficult to make a case for the overall market to be “attractive” or “fairly valued.” Not that perma-bulls haven’t tried. The most common argument is the attractiveness of stocks relative to the alternatives in fixed income. Ultra-low interest rates not only forces savers into equities, they argue, but it primes the pump for companies to buy back shares of their own stock through the issuance of corporate debt.

However, history has a similar circumstance when the U.S. had a low rate environment for nearly 20 years (i.e., 1935-1954). In that period, valuations were about HALF of what they are today. If low rates alone weren’t enough to DOUBLE the “P” relative to the “E,” why are low rates enough to justify higher stock prices regardless of valuations in 2016? When top-line sales and bottom-lines earnings are contracting? It is also worth noting that low rates alone did not stop bear markets occurring in 1937-1938 (-49.1%), 1938-1939 (-23.3%), 1939-1942 (-40.4%), or 1946-1947 (-23.2%).

By way of review, the technical picture is inhospitable. The fundamental backdrop is unsavory. And even the perma-bull panacea of low interest rates cannot obliterate historical comparisons entirely.

“Well, Gary,” you decry. “Back then, we were still coming out of the Great Depression. We don’t have anything like that right now… and we are not going into recession.”

I’m glad that you brought up the Great Depression. For starters, Federal Reserve policy error in 1937-1938 went a long way toward reigniting recessionary forces – dynamics not unlike the depression-like disaster that plagued America from 1929-1932. Today, six-and-a-half years removed from the Great Recession, the Fed’s wealth effect ambitions . They may learn, however, that they will be returning the country to zero percent rate policy (ZIRP) and quantitative easing (QE) to squelch a 20%-plus decline in key barometers like the S&P 500.

What’s more, the stock bears in 1939-1942 (-40.4%) and in 1946-1947 (-23.2%) are not attributable to recessions or the Great Depression. Those stock bears had low interest rates and booming economies.

Is the U.S. economy booming right now? The surprising popularity of anti-incumbent candidates like Sanders and Trump suggests that the real economy – jobs included – is shaky at best. This simple chart that plots both manufacturing and non-manufacturing (services) demonstrates that economic weakness is an actuality, not a doom-n-gloom delusion.

One might even choose to consider the most recent business headlines. Chinese exports plummeted by their largest amount since 2009. The International Monetary Fund (IMF) warned today that the world is looking at an increasing “risk of economic derailment.” And stateside, the NFIB’s Small Business Optimism Index fell for the fourth time in five months. It now sits at its lowest level in two years, while demonstrating its steepest peak to trough drop since 2009. Instead of getting more stimulus from the U.S. Federal Reserve, like “Twist” and “QE3,” the Fed is pushing “gradual stimulus removal.”

In sum, the rallies of September-October (2015) and February-March (2016) share more in common with bear market bounces than buy-the-dip opportunities. Technicals, fundamentals, economics and Federal Reserve policy collectively favor a lower-than-usual allocation to risk. For my moderate growth-and-income clients, our 45%-50% allocation to domestic large-caps exists in stark contrast to 65%-70% in a broadly diversified equity mix (e.g., large, small, foreign, emerging, etc.). Some of our core positions? Vanguard High Dividend Yield (NYSE:VYM), iShares S&P 100 (NYSE:OEF) and iShares MSCI USA Quality Factor (NYSE:QUAL). We have pure beta exposure to the SPDR S&P 500 (NYSE:SPY) as well.

On the income side of the ledger? We have benefited immensely from a commitment to investment-grade holdings, including Vanguard Long-Term Corporate Bond (NASDAQ:VCLT), iShares 3-7 Year Treasury Bond (NYSE:IEI) and munis via SPDR Nuveen Barclays (LON:BARC) Municipal Bond (NYSE:TFI).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.