Loss Leader Or Value Creator? Deconstructing Amazon Prime

Aswath Damodaran | Oct 17, 2017 05:22AM ET

I am an Amazon (NASDAQ:AMZN) Prime member and have been one for a long time, and I am completely hooked. Not only do I (and my family) use Amazon Prime for items ranging from tissue paper to big screen televisions, but it has become my go-to for every possession that I need in my working and personal life. In fact, I know (and am completely at peace with the fact) that it has subtly affected my buying, as I substitute slightly more expensive Prime items for non-Prime equivalents, even when I shop on Amazon. It is not just the absence of shipping costs that draws me to Prime, but the reliability of delivery and the ease of return. In short, it makes shopping painless. As I tally how much we save each year because of Prime and weigh it against the $99 that we pay for it, I am convinced that we are getting far more value from it than what we pay, and that leads to an interesting follow up. If many of the 85 million other Prime members in October 2017 are getting the same bargain that we are, is this not an indication that Amazon has not just under priced Prime, but is perhaps selling it below cost? As someone who has wrestled with valuing Amazon over the last 20 years, I have learned never to under estimate the company. In this post, I would like to take the process I used to value a user at Uber and apply it to value not just a Prime member to Amazon but the collective value of Amazon Prime to the company.

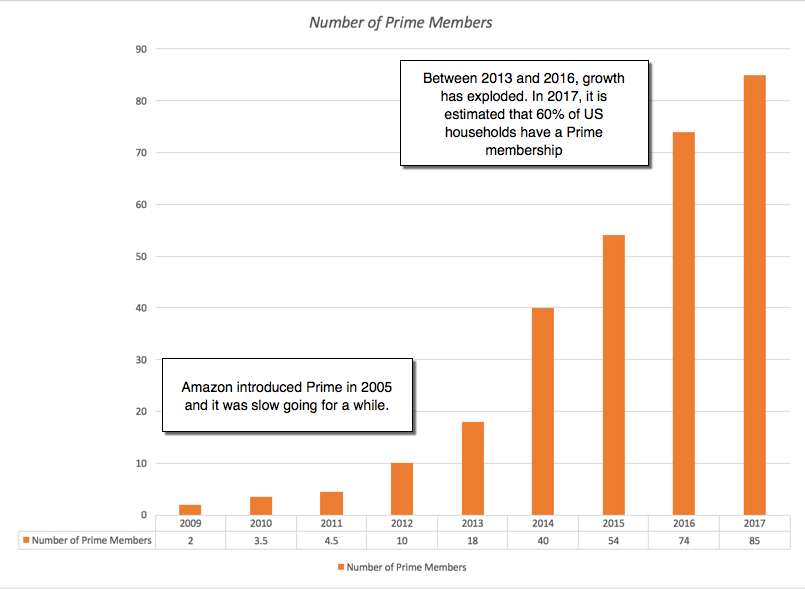

The Growth of Amazon Prime

Amazon introduced Prime in 2005 and the service was slow to take off. At the end of 2011, only about 4% of Amazon customers were Prime members. In the years since, though, the service has seen explosive growth:

In fact, the jump in members in the last three years is particularly impressive, given how much bigger the base has become. In 2016, the company added almost 20 million new members and is on pace to add a similar number this year. In October 2017, the company’s mammoth Prime user base meant that almost 60% of all US households had memberships, suggesting that a non-Prime member is more the exception than the rule for Amazon’s US operations. Growth has been slower outside the US, slowed both by competitive/regulatory pressures and logistical challenges.

The Economics of Amazon Prime To understand how Amazon Prime works, let’s break down the mechanics. Any one (in the countries where Prime is offered) can become a Prime member, either on a monthly or an annual basis. In the US, in 2017, the annual fee for membership was $99, as it has been for the last few years, and the monthly fee was $10.99. With 85 million members, that translates into a total revenue for the company of over $8.5 billion; the monthly members pay more but there is a portion of the membership (including students) who get discounted memberships. The other benefit for Amazon, though, comes from the fact that Amazon Prime members spend more on Amazon than non-Prime members. While the exact numbers are known only to Amazon, the most recently leaked reports suggest that the typical Prime member spends approximately $1,300/year on Amazon products, as opposed to the $700 spent by a non-Prime member . While it seems obvious, then, that Prime membership leads to more spending ($600, if you believe these two numbers), the statisticians will raise red flags about sampling bias since the true incremental revenue is unobservable; it is the difference between what the existing Prime members are spending ($1300/year) and what those same members would have spent, if they did not have Prime memberships. That is a reasonable point, but there is clearly a Prime impact, where Prime members choose Prime items over less expensive non-Prime offerings on Amazon, just as I do.

The biggest cost, by far, to Amazon is the shipping cost that the company now bears on Prime items. In 2016, the company reported net shipping subsidy costs of $7.2 billion (in the footnotes to the 10K) and assuming that almost all of these costs were related to servicing the 60 million members that Amazon had in 2016 leads to a per-member shipping cost of close to $120/ member. The other free services that Amazon offers its Prime members also create costs, though those costs are embedded in larger company-wide items and are more difficult to separate out.

- The company expends administrative costs in providing additional customer service to its Prime members. These costs are part of the total G&A cost of $2,432 million that the company reported in 2016, but we will assume that the servicing cost per member was $10 (or $600 million in the aggregate in 2016).

- The company also buys some content for its media and Kindle reading sections specifically to back up its Prime membership. Again, that cost is part of the $16,085 million that the company as its technology and content cost in 2016 and we will assume that 10% of those costs (approximately $1.6 billion) can be attributed to Amazon Prime.

There is one final component of cost that we would like to know, but have to guess at and that is the cost to Amazon of acquiring a new member. That promotional/marketing cost is part of the total marketing cost of $7,233 million that Amazon reported in 2016 and we will assume that this cost is $100/member; in 2016, this would have translated into a total cost of $2 billion to acquire 20 million new members, leaving the remaining $5.2 billion in marketing costs as conventional advertising/marketing cost. Pulling all these numbers, real and imagined, into a picture, here is what we get as the economics of an Amazon Prime member.

The closing statistic that is worth emphasizing here is that once someone becomes an Amazon Prime member, they tend to stay as members with an annual renewal rate of 96%.

The Value of an Existing Prime Member

Using the numbers from the previous section as a starting point, we are on our way to valuing an existing Prime member. To get to that value, we have to make some estimates for the future that reflect how the base numbers will evolve over time:

- Renewal Rate: We will assume that annual renewal rates will stay high, at 96%, since the subscription model and the dependence on free shipping makes dropping the service difficult to do.

- Incremental Revenue/ Member Growth: As Amazon looks for new products and services to sell its Prime members, we will assume that the company’s legendary marketing skills will work and that the incremental revenue (which we estimated to be $600 and attributed entirely to Prime membership) will grow 10% a year for the next five years. That growth rate will scale down to the inflation rate (1.50%) in year 10, but that cumulated effect will result in incremental sales of $1,275/member in 2027.

- Shipping Costs: The biggest cost to Amazon is shipping and much of what the company seems to be doing both in terms of new investments (in distribution centers, trucks and drop off locations) and acquisitions (Whole Foods) seems to be designed to keep these costs in check. We will assume that shipping costs will grow 3% a year for the next five years (well below the incremental revenue growth), before settling into growing at the inflation rate thereafter.

- Customer Service Costs: The cost of Prime member customer service will increase 5% a year for the next 5 years and the inflation rate thereafter.

- Risk and Cost of Capital: I will assume that Amazon’s overall cost of capital applies as the right risk adjusted rate to use on all of its member valuations, since they partake in its entire product line. That cost of capital, in October 2017, given a US treasury bond rate of 2.35% was 8.00%.

With those assumptions in place, we can estimate the value of a Prime member:

Again, with our estimates, the value of new Prime Members is approximately $53.9 billion and that number, in addition to being sensitive to our estimates of growth in members, magnifies the effects of incremental revenue and shipping cost growth that affected the value of an existing member. Thus, setting shipping costs to grow at the same rate as incremental revenues makes the value of new members a negative number, suggesting that growth will become value destructive if shipping costs are not brought under control.

The Corporate Drag While it is tempting to stop and add the value of existing members and new members to arrive at the value of Amazon Prime, you would be missing a significant cost that we will term the corporate drag. To feed its ambitions with Prime, Amazon is spending far more on media content (books, movies, TV shows) than it would otherwise have and those costs will continue to grow with Prime. Earlier, we assume that 10% of the company’s current technology/media costs are attributable to Prime, yielding a base year cost of $1,609 million. We will assume that these costs will grow with the number of Prime members, yielding the following value for future costs:

In effect, we will lower the value of Amazon Prime by $32.8 billion to reflect these additional costs. Note that though I treat this cost as a drag, it is not wasted, since it is the additional media that is being offered as a sweetener for existing Prime members to stay on and new ones to join.

The Value of Amazon Prime Now that we have valued Amazon Prime’s existing members, its new members and the corporate drag, it is a matter of bringing them all together into a consolidated value. In our judgment, Amazon Prime is worth $62.2 billion to Amazon:

I know that I have made a multitude of assumptions along the way to get to this value and that you may disagree with many of them. As always, you can download my spreadsheet and make the changes that you think need to be made. If you work at Amazon or view yourself as an expert on Amazon (I am not), your numbers should be much better than mine, and I would hope that your valuation will reflect the better information. While I have made a few optimistic assumptions to get to the value of Amazon Prime, I believe that there is an additional value that I have not counted in. Amazon is building a base of loyal, intense members that it can draw on to promote whatever its next product or service is, whether it be in retailing, technology, entertainment or cloud computing. That value is what you could call a real option, though those words are used far too frequently in places where they should not be, and that real option may be Amazon’s ultimate wild card.

Conclusion I have long described Amazon as a Field of Dreams company, one that goes for higher revenues first and then thinks about ways of converting those revenues into profits; if you build it, they will come. In coining this description, I am not being derisive but arguing that the market's willingness to be patient with the company is largely a the result of the consistency with Jeff Bezos has told the same story for the company, since 1997, and acted in accordance with it. Amazon Prime symbolizes how Amazon plays the long game, an investment that has taken a decade to bear fruit, but one that will be the foundation on which Amazon launches into new businesses. I know that there are many companies that model themselves after Amazon, but unless these "Amazon Wannabes" can match its narrative consistency and long time horizon, it will remain a one of a kind.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.