Losing Control Of Federal Funds: What’s Transmission Got To Do With It?

Alhambra Investment Partners, LLC | Sep 19, 2019 02:33AM ET

What’s transmission got to do with it? An odd question perhaps, but not when you step back and think about everything you’ve been taught or told about when it comes to this stuff. From the very beginning, they tell you unequivocally how the Fed is in the middle and everyone must simply obey. It does things with its printing press and the markets, all of them, responds accordingly.

Never, ever fight the Fed.

What happens when the Fed does things…and the market doesn’t respond accordingly? Transmission.

way more than a year already (so much for those September 2019 “technical factors”, the latest excuses).

But in purely mechanical terms, what are now two overnight repo operations may more closely resemble China’s RRR’s. When you think about what those latter truly are, meaning how they function in a way that isn’t stimulus, the resemblance is uncanny.

There’s a huge liquidity hole which the Chinese central bank is trying to manage. How? By inviting Chinese banks to fill it in with reserves they already hold. A lower RRR is the PBOC giving these institutions a bigger pile with which to work, effectively more usable reserves for all sorts of functions up to and including money markets.

And the biggest danger, as I always write, is that Chinese banks will simply refuse the license (like they did in the middle of 2015). A lower RRR may mean holders are able to use more reserves, but that doesn’t necessarily mean they will be used. Banks may instead choose, for their own reasons, to hoard that liquidity. Which turns it into its more nefarious and hugely misunderstood cousin, “liquidity.”

It is misunderstood precisely because the media uniformly, uncritically calls it that when in fact it doesn’t function in that way. Transmission.

Tuesday’s Fed overnight repo took up $53.15 billion. Who took it, though? Some unidentified bank in Singapore desperately in need of dollar funding because global repo won’t transform EM junk bonds any longer? Nope. That $53.15 billion was bid for by only the 24 primary dealers registered with the Fed in NYC (and even that was too difficult, as the whole world witnessed one embarrassing snafu after another yesterday).

What that means in functional terms is the central bank is providing these New York banks (which, going back to TAF, may mean “New York” banks) with that “additional” $53.15 billion in order to offset what must already be a major liquidity hole. The Fed is therefore counting on these same primary dealers to use these reserves in money markets, to take advantage of these arb opportunities such as fed funds.

Given more of these reserves, the central bank expects that primary dealers will then forward them into the rest of the marketplace – as a second step to lend them to that desperate bank in Singapore who is so desperate it is willing to pay essentially a penalty rate for funding. With more dealers having more reserves, the theory is that through dealer competition the penalty will shrink, rates everywhere will come down as dealers like Chinese bank put their newly sanctioned reserves to work.

And what happened yesterday? To some degree, the primary dealers seem to have refused. Transmission.

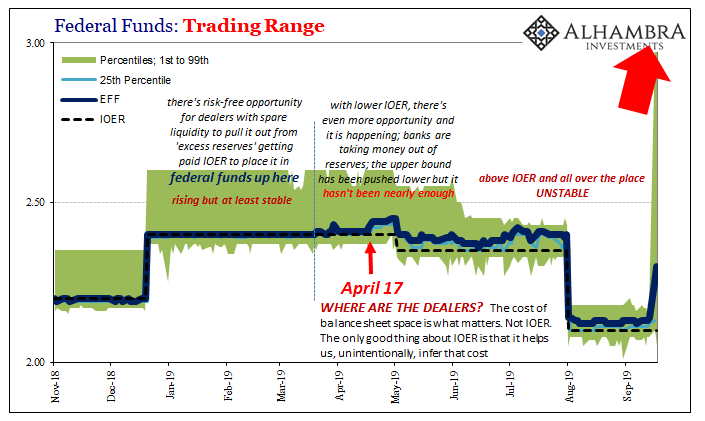

So, the media uniformly writes up this additional liquidity when all the numbers come back and tell us it was “liquidity.” Despite that $53.15 billion, the repo rate shot up higher and for the first time since the “somehow” Global Financial Crisis the Federal Reserve totally lost control of the federal funds rate. As we said yesterday was likely to happen, FRBNY published today an effective federal funds rate for September 17 of 2.30% – 5 bps above the central bank’s target range.

What’s much worse than that was the whole fed funds range. As we pointed out, the most remarkable part of Monday’s fiasco was the percentiles; the 99th being 3.00%! With IOER sitting at 2.10%, that meant banks were choosing to hold reserves and get paid by the Fed only 2.10% instead of moving into fed funds and getting paid as much as 3.00% (and so much more in repo).

In comes the Fed with this additional $53.15 billion in liquidity yesterday, and what happens to the ranges? On a day when the Fed is conducting a major operation, the 99th percentile shoots up another 100 bps to 4.00%! That $53.15 billion doesn’t seem to have been used much or very effectively by those 24 dealer banks, at least not in the way it was meant to have been used.

“Liquidity” not liquidity. Transmission.

Banks refused an additional 90 bps of fed funds opportunity Monday, and despite more “reserves” from the Fed Tuesday they begged off 190 bps. What’s their problem ?

At what point do we begin to suspect US primary dealers are simply hoarding? At the very least, they are refusing to enter the markets even with additional reserves in hand so as to keep orderly function. That’s another way of saying hoarding, though.

Because of the fiasco in fed funds, not because of the more important problems in repo, the Fed was back with this second overnight repo operation this morning. Both of them were capped at $75 billion total; Tuesday’s, as we noted, only used up $53.15 billion. Wednesday’s saw bids for $80.05 billion – meaning there was substantially more demand today for “liquidity” than the central bank was willing to offer.

Hoarding and liquidity holes. Transmission.

The reason I keep using that word is it may have been the one brief moment of clarity in Ben Bernanke’s tumultuous, disastrous tenure at the Fed. I’ll repeat it again here (and probably many more times in the days to come), a confused man in 2011 wondering what in the hell was going on in…the repo market.

CHAIRMAN BERNANKE. I think a point that was somewhat underemphasized is that our transmission of monetary policy is an issue here as well. So to take an example, doing repos to keep the RP rate from uncoupling from the federal funds rate, arguably there are issues there relating to transmission.

And as System Open Market Account Manager Brian Sack would go on to add, that was happening with $1.6 trillion in bank reserves out there in the system getting paid a lower IOER. What’s going on today is not new. The Fed has offered reserves and banks turned them into nothing other than “liquidity.” They were not liquidity, not without other factors that were more importantly bank-centered (the real liquidity).

The Fed says, the market does. Nope. The Fed or any central bank just is not central. If “something” is bothering banks and the central bank doesn’t want to know what it is (and even if it did couldn’t do anything about it, like collateral) then the result is the liquidity hole, hoarding, and “liquidity.”

Transmission. A euphemism for, this doesn’t seem to work the way we think it does.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.