Loonie Goes To War: Dropped To New Four Month Low

MarketPulse | Apr 25, 2017 06:40AM ET

Tuesday April 25: Five things the markets are talking about

Yesterday’s price action across the various asset classes would suggest that the French presidential elections are no longer an issue for markets.

The EUR, French government bonds (OAT’s) and European equities closed sharply higher Monday after centrist candidate Emmanuel Macron secured the top spot in the first round of French presidential elections on the weekend.

For the time being, at least until the second round vote on May 7, the markets focus turns to Trumps Tax agenda, the possibility of the U.S. government shutting down, North Korea’s saber rattling and a simmering U.S/Canada trade war.

Fresh dollar selling is expected to emerge for the mighty ‘buck’ if tomorrow’s looming tax proposal from Trump skimps on details and finally, U.S. earnings season swings into high gear.

1. Asia stocks near two-year high, Europe sees green

Global equity markers appear to be still lingering in the glow of relief after the French election result. In Japan, the Nikkei rallied more than +1% to a three-week high, while the broader Topix and South Korea’s KOSPI each rose +1.1%.

In Taiwan, the Taiex jumped +1.3%, while the Philippines benchmark soared +1.7%.

Note: Australia and New Zealand were closed for Anzac Day.

On Monday in China, indexes posted their worst day this year amid signs Beijing will tolerate further market volatility as regulators clamp down on shadow banking and speculative trading. However, in the overnight session there was some relief, the Shanghai Composite rose +0.2% after falling -1.4% in the previous session.

In Hong Kong, the Hang Seng rallied +1.2%, while the Hang Seng China Enterprise (CEI) jumped +1.7%, the most in a month.

In Europe, equity indices are trading mixed across the board after a raft of corporate earnings pre-market, and as market participants further digest Sunday’s first-round French election results. Banking stocks are trading generally lower in the Eurostoxx, while energy stocks are trading higher as oil prices trade higher intraday in the FTSE 100.

U.S. equities are set to open in the black (+0.1%).

Indices: Stoxx50 +0.2% at 3,581, FTSE +0.2% at 7,282, DAX flat at 12,457, CAC 40 +0.2% at 5,277, IBEX 35 -0.3% at 10,734, FTSE MIB +0.2% at 20,728, SMI +0.5% at 8,753, S&P 500 Futures +0.1%

2. Oil edges up after six straight sessions of losses, gold prices stable

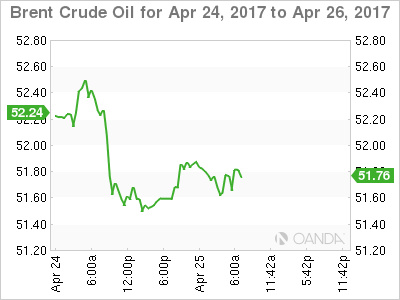

Oil prices recovered some ground overnight, but the market remains under pressure as traders lose confidence that pledged output cuts by OPEC and non-OPEC members would rein in oversupply.

Brent crude futures rose +14c, or +0.27%, to +$51.74 a barrel, while U.S. West Texas Intermediate (WTI) crude futures have added +14c, or +0.3%, but remains below the psychological $50 mark pierced late last week, at +$49.37 a barrel.

To many, OPEC and other non-OPEC producers continue to struggle to clear oversupply, given that oil supplies remain at or near record highs despite last Novembers record cuts.

The ‘bulls’ believe that OPEC will be forced to renew, and possibly deepen this agreement in the coming weeks if they wish to keep prices well above $50 per barrel.

Russia said yesterday that its oil output could climb to the highest rate in three decades if OPEC and non-OPEC producers do not extend a supply reduction deal beyond June 30.

Note: On the weekend, a panel made up of OPEC and other producers has recommended an extension of output cuts by another six-months from June.

Gold prices (-0.2% at +$1,272.67 per ounce) have eased overnight as investor sentiment remains skewed towards riskier assets in the wake of the French election results. However, saber rattling from Korean is limiting the safe-haven’s losses.

3. Global yields back up

A percentage of the risk premium that had been priced into the fixed income market this year has been taken off now that Macron has won the first round voting in the French presidential election and solidified his prospects of becoming the country’s next leader.

U.S. Treasury prices are heading for a fifth day of declines, with yields on 10-Year notes climbing +1 bps to +2.29% overnight after rising +3 bps yesterday.

The yield on French 10-year notes (OAT’s) dropped -1 bps +0.82%, after tumbling -11 bps Monday. German 10-year Bunds added +2 bps to +0.34%.

The spread between 10-year French OAT’s and German bunds widened +2 bps to +51 bps after dropping -20 bps on the French election results.

4. Canada – Protectionism moving from theme to reality

The CAD or ‘loonie’ has dropped -0.4% (C$1.3551) to a new four month low as Trump intensified a decades old trade dispute with Canada, slapping tariffs of up to +24% on imported softwood lumber that is typically used to build single family homes. Canada is the U.S’s second largest “two-way” trading partner.

The EUR (€1.0892) remains within striking distance of its five-month high print (€1.0933) after the results of the French first-round Presidential election. The single unit continues to benefit from growing confidence that the market-friendly Macron would beat Le Pen to become the next French president on May 7.

Note: The Eurozone money market is pricing an ECB rate hike in 2018 in the aftermath of the French first-round. ECB’s Draghi is not expected to send any strong new signals on monetary policy at its Thursday meeting ahead of the second round of the French presidential election.

Elsewhere, improved risk appetite is supporting Asian EM currency pairs. The USD is down -0.8% vs. KRW, -0.6% vs. MYR and -0.3% vs. INR.

However, the USD could bounce on Trump’s looming tax plan while tensions involving North Korea could quell demand for EM currencies.

5. China unemployment rate falls below +4%

Data overnight showed that China’s urban unemployment rate fell below +4% for the first time in years. This could be considered a hopeful sign that slower economic growth is not creating the massive unemployment that Beijing had feared.

The social security ministry said that +3.34m new jobs were created in Q1 and that the registered urban unemployment rate was +3.97%.

Note: China has kept employment generally stable even as economic growth has slowed to a 26-year low and the government shuts down out-dated industrial capacity.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.