Live Cattle: Watch For A 5% Drop

Matthew Bradbard | Aug 06, 2014 02:42PM ET

The cattle market has been overbought for the last week with futures currently trading 2.4% off recent highs made 7/28. The discount of futures to cash of late and the outlook for tight supplies in the future should keep the market bid longer term but this does not mean we cannot get a price correction short term. Outside markets such as weakness in the hog market and a correction in the equity markets could cause spillover weakness. There have been no significant fundamental changes but perceived demand concerns might contribute to selling pressure and a 5% correction is what I am targeting. October Live Cattle did close near a $6.40 discount to the cash markets as compared with the 5-yr average showing a premium of $6.40 to cash. With cash prices in Texas and Nebraska seen above even the recent highs in futures we currently do not see a substantial # of traders wanting to sell near $155/$156 but what if cash prices falter and trade sub $160? Daily stochastics are rolling over from overbought levels and futures have lost ground 3 out of the last 5 sessions. Near-term support in October is seen at $154 followed by $150 then $148.

YTD October live cattle futures have been on a one way train appreciating high/low 22.6% lifting prices to their highest level in history just 9 days ago. Picking tops is a fool’s game and while I am not convinced the bull market in heifers is over I am forecasting a correction at this time. Futures are currently challenging their 20 day MA (dark blue line) and on a settlement under that pivot point an interim top would be confirmed in my eyes. I anticipate 5% depreciation in prices with an objective at $148 in October futures. This is a 40,000 lb. contract so a move from current trade would represent a move of approximately $3,200 per futures contract. Obviously one could opt to take advantage of this trade via futures or options. A trend line that has been in place since the Spring and 38.2% Fibonacci retracement both come in at this level. Assuming we get the move lower in the coming weeks that would serve as my exit door.

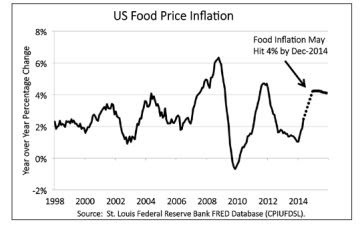

I would be remiss putting out this piece without talking about food inflation. Anyone that has gone to the super market in recent months should be aware that food prices are on the rise. As of May 2014 food price inflation was running at 2.46% (year over year) and possibly heading to 4% by late 2014 or early 2015. (See below) It is comical to me that the Fed prefers to target core inflation and strips out food and energy because we consume food and energy and their price appreciation affects us on a daily basis. Their logic is by not factoring volatile food and energy prices it lessens the chance of a head-fake in the data. Of course if we see a rise in core inflation alongside food inflation the Fed may take this into consideration and look to make a move sooner rather than later. Current market expectations are predicting a potential rate move as early as the March meeting.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.