Leveraged ETFs And Margin Accounts For High-Risk Traders Only

Dr. Alan Ellman | Oct 23, 2016 01:43AM ET

Covered call writing results can be enhanced through the use of leveraged ETFs and margin accounts. However, so too is the risk elevated. In this article, the pros and cons of these strategies are examined.

Definitions

Leveraged ETF: An exchange-traded fund (ETF) that uses financial derivatives and debt to magnify the returns of an underlying index.

Margin account: A brokerage account where the client has the ability to borrow money from the broker to buy securities. The loan is collateralized by the cash and securities in the account.

QQQ: This is the ticker symbol for the Nasdaq 100 Trust, an ETF that trades on the Nasdaq exchange and consists of 100 of the largest non-financial companies that trade on the Nasdaq.

TQQQ: ProShares UltraPro QQQ seeks daily investment results, before fees and expenses, that correspond to three times (3x) the daily performance of the NASDAQ-100 Index. Since goals are daily-based, longer-term results will not usually coincide with triple the returns of QQQ.

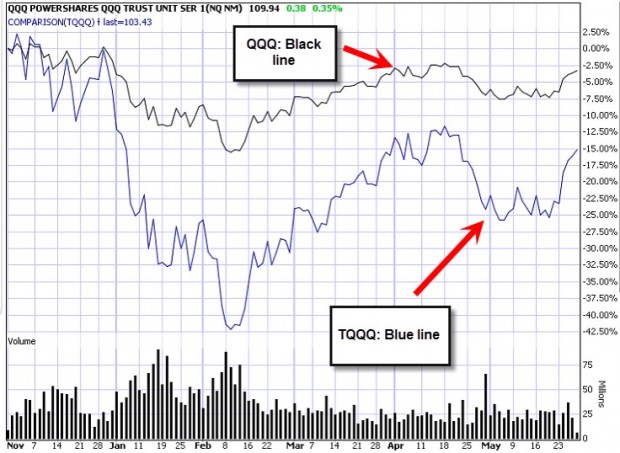

6-month comparison chart as of 6/27/2016

In the past 6 months, QQQ is down 2.5% while TQQQ is lower by 15%, clearly reflecting much worse than long-term triple results and highlighting the risk involved with leveraged ETFs. Of course, if QQQ had appreciated over the same time frame, TQQ would have appreciated significantly more.

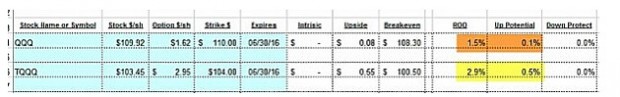

Calculation results for slightly out-of-the-money strikes using the Ellman Calculator

QQQ has the potential to generate a 1.6% (1.5% + 0.1%), 1-month return while TQQQ offers the possibility of a 3.4% (2.9% + 0.5%), 1-month return, highlighting the advantage of leveraged ETFs.

Margin accounts

If trading was in a margin account where 50% of the cash is borrowed to buy the leveraged ETF, the gains and losses would be magnified by approximately two-fold, accounting for the cost to borrow (interest paid to broker). We must also factor in the chance of margin call wherein if security prices fall to a certain level, investors may be required to add more cash into the account or sell certain securities perhaps at a loss. Click here for more on margin accounts.

Discussion

Utilizing leveraged ETFs and margin accounts is not appropriate for most retail investors because of the enhanced risk inherent with these strategies. However, for some sophisticated investors with a high risk-tolerance, these tools may be appropriate.

Upcoming live events

November 5, 2016

Plainview, New York

Saturday morning 3-hour workshop at the Plainview Holiday Inn . I am the only speaker and plan an information-packed presentation covering 5 actionable ways to make money or buy a stock at a discount using both call and put options. We will also evaluate the stocks you currently own for option-selling. Bring a list of stocks currently in your portfolio.

December 6, 2016

Options Industry Council Webinar Summit

Tuesday afternoon…information to follow:

Market tone

Global equities advanced slightly this week. While it is early in the third quarter earnings season, reports seem to indicate that the earnings decline of the past four quarters may be ending, with S&P 500 Index earnings expected to rise by 0.5% this quarter. Revenues are also expected to increase, by 2.5%, according to Thomson Reuters. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX) declined to 13.38 this week from 15.2 a week ago. US oil prices moved a bit higher, with West Texas Intermediate crude advancing to $51 from just above $50 last week. This week’s reports and international news of importance:

- US Federal Reserve Vice-Chair Stanley Fischer said this week that the central bank is very close to achieving its twin goals of full employment and inflation near 2%. The comment seems to indicate a probable hike in the federal funds rate at the December meeting of the Federal Open Market Committee (FOMC

- The Fed’s Beige Book, prepared in advance of the November FOMC meeting, said that economic activity increased at a modest to moderate pace in most US regions

- Inflation in the United Kingdom rose 1% in September, the fastest annual rate in two years

- The Chinese economy continued to grow at an annual rate of 6.7% in the third quarter, unchanged from the prior two quarters. The economy appears to have stabilized after turbulence in late 2015 and earlier this year, but economists worry that much of the growth is being driven by an unsustainable credit surge

- The Kingdom of Saudi Arabia this week sold a total of $17.5 billion 5-, 10- and 30-year bonds, the largest single bond sale ever for an emerging market

- Matching an 11-year low, the UK unemployment rate held steady at 4.9% in the three months ending August 31st

- Labor markets have largely shrugged off Brexit concerns thus far, though the process of leaving the European Union has yet to officially begin

- The European Central Bank left monetary policy unchanged at its October 20th meeting and did not extend its quantitative easing program, which is scheduled to expire in March 2017

- The Bank of Canada lowered its outlook for economic growth for the balance of 2016 and for 2017, citing weak exports to the United States as a result of low US business investment and on increased global competition

- There was an uptick in the Philadelphia Fed Manufacturing Index (9.7 versus 5.3 expected)

- Existing home sales (3.2% versus 0.4% expected) beat expectations

- However, there was a drop in Empire State Manufacturing Index (-6.8 versus 1.0 expected) and a decline in housing starts (-9%, on a decline in multifamily units

- Single- family starts were solid

THE WEEK AHEAD

- Flash purchasing managers’ indices are released globally on Monday, October 24th

- September US durable goods orders are reported on Thursday, October 27th

- Japan reports its September consumer price index on Friday, October 28th

- US preliminary Q3 GDP is released on Friday, October 28th

For the week, the S&P 500 rose by 0.38% for a year-to-date return of +4.76%.

Summary

IBD: Uptrend under pressure

: 1/6- Sell signal since market close of October 12, 2016

BCI: My plan for the November contracts is to continue to favor in-the-money strikes 2-to-1. I’m factoring in the upcoming election and Fed watch.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts point to a neutral to slightly bearish outlook. In the past six months the S&P 500 declined by 1% while the VIX rose by 5%.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.