Large Caps Signal Trouble

Declan Fallon | May 30, 2018 12:03AM ET

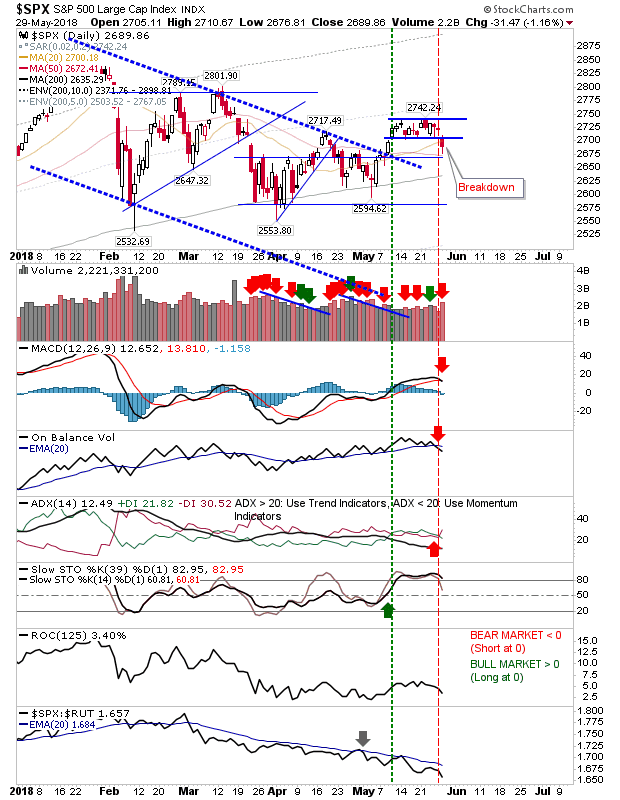

There was a shot across the bow from Large Cap indices yesterday as the consolidations which were playing out the last few weeks took a step south.

For the S&P this amounted to a clear breakdown, and the risk is for further losses to take things back inside the 2,575-2,675 range. However, if this does occur I would look for further losses as the momentum which drove the initial advance fades. Not surprisingly, yesterday's breakdown also came with technical 'sell' triggers for MACD, On-Balance-Volume and +DI/-DI

The Dow Jones Industrial Average fared little better. The breakout from the pennant has shifted to a breakdown. I have re-graded the action from April as a minor rising channel and would look to the lower channel line as a chance for buyers to have another go at shaping a swing low. As with the S&P, there were 'sell' triggers for the MACD, On-Balance-Volume and ADX.

The NASDAQ remained range bound and was relatively immune to the selling of Large Caps. Volume climbed to register as distribution with just a 'sell' trigger in On-Balance-Volume.

The NASDAQ 100 lost some ground yesterday, but still has a breakout from the bullish flag to protect. For now, the breakout is intact.

Another index holding on to its breakout is the Russell 2000. Despite the selling in the S&P and Dow Jones Industrial Average it was still able to recover the intraday's losses by the close. Bulls will be funneled into this index as other opportunities fade.

For today, shorts will be looking to attack any advance in the S&P and Dow. Bulls can focus on the Russell 2000 unless there is a loss of 1,610.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.