Lagging Gold Miners Signal Interim Top

Jordan Roy-Byrne, CMT | Aug 09, 2020 01:47AM ET

A few weeks ago, we wrote that a precious metals-related correction was imminent. Wrong choice of words.

However, we were just too early.

As we write this article, VanEck Vectors Gold Miners ETF (NYSE:GDX) and VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) have corrected 8% and 10%, respectively. More downside is needed to confirm a correction is underway, but I think that will happen soon enough.

There are a plethora of reasons the miners are going to correct.

First, the miners have underperformed the metals severely in recent days.

Over the past 9 trading days, Gold and Silver gained 7% and 16% respectively, but the miners are up only 1% to 3%. GDX has gained 0.9%, GDXJ +1.8%, and ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ), +2.9%.

When the stocks underperform the metals after weeks and weeks of substantial gains, they signal a coming shift.

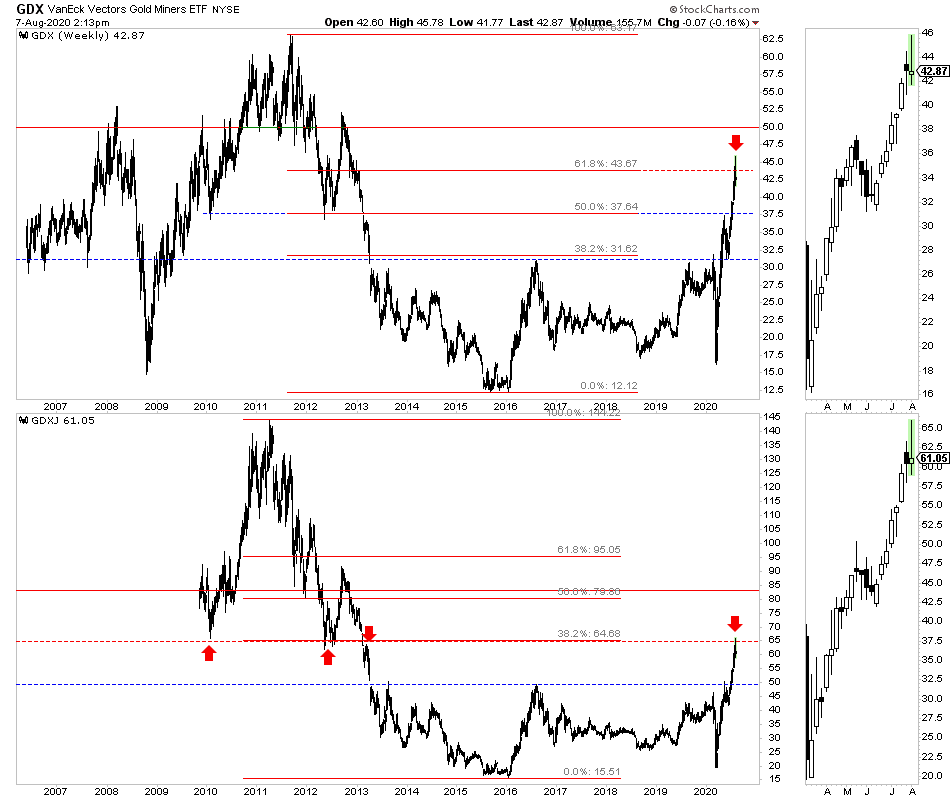

Second, the miners hit very strong resistance levels and have formed back-to-back bearish candles on the weekly candle charts.

GDX hit $45, which was the measured upside target from the 2016-2019 consolidation and 2018 low. Also, note nearly $44 is the 62% retracement of the bear market.

GDXJ peaked around the 38% retracement of its bear market, which also happens to be resistance from the 2010 and 2012 lows.

Finally, breadth indicators have been at extremes for more than a few days. There are quite a few to list.

A few days ago, the entire HUI and GDXJ (yes 100% of the stocks) were trading above their 50-day and 200-day moving averages.

The bullish percentage index, a breadth indicator has ranged between 96% to 100% in recent weeks.

Finally, new highs in both GDX and GDXJ (smoothed by a 20-day moving average) hit the same levels as they did at the 2019 and 2016 peaks.

So with that said, what do we do with this information?

In recent posts, I wrote that in bull markets, we buy and hold. Now is not the time to buy, but it could be soon enough.

Considering the 2009 recovery analog (which miners may or may not be following), miners could correct at least 20%.

Furthermore, in taking a look at the above chart of GDX and GDXJ, we can see potential strong support levels of $37 GDX and $50 GDXJ.

The metals will also correct, but what excites me is the potential floor in the metals (the coming lows) could be levels that were deemed high just a month or two ago.

In the meantime, stay patient and let the market and various individual stocks find their equilibrium at lower levels.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.