Lack Of Details Unwind The Trumpflation Trade

MarketPulse | Jan 12, 2017 07:11AM ET

Thursday January 12: Five things the markets are talking about

U.S dollar bulls should be preparing for many more Trump disappointments. Yesterday’s was the first, but certainly not the last.

In his first press briefing as U.S. president-elect, Trump presided over a wide-ranging session that touched on many topics, but with little substance.

The briefing did not break new ground as it contained no details on tax cuts and infrastructure spending, which have been the two factors that’s instigated a five-week global bond market selloff and an equity and dollar rally after his surprise presidential win in November.

The ‘bulls’ will now look to the Fed today for support. A host of Fed Reserve presidents including Philadelphia, Chicago, Atlanta, Dallas and St. Louis will be speaking on a range of issues, while their boss, Chair Janet Yellen, appears at a webcast town hall meeting with educators this evening.

Philadelphia Fed Harker speaks at 8:30 a.m. EST, Atlanta Fed Lockhart at 11:30 a.m., St. Louis Fed Bullard at 1:15 p.m. and Fed Chair Yellen at 7:00 p.m.

1. Investors’ book equity profits

Overnight, Asian bourses reversed their early gains to end broadly lower, as investors preferred to book profits amid the prevailing global political uncertainties.

The Shanghai Composite Index ended down -0.6%, while Hong Kong’s Hang Seng Index declined -0.5% and Aussie ASX 200 fell -0.1%.

With the President-elect naming Japan as a net benefiter from a trade imbalance with the U.S contributed to a -1.2% slump in the Nikkei Stock Average. A stronger yen (¥114.33) is also punishing Japanese exporters.

In European, equity indices are trading lower as market participants digest Trumps first press conference. The lack of details has financial trading generally lower on the Eurostoxx and FTSE 100. However, energy, commodity and mining stocks are trading notably higher on the FTSE.

U.S futures are set to open in the red.

Indices: Stoxx50 -0.4% at 3,294, FTSE -0.3% at 7,269, DAX -0.6% at 11,579, CAC 40 -0.4% at 4,867, IBEX 35 -0.2% at 9,390, FTSE MIB -0.5% at 19,395, SMI -0.8% at 8,357, S&P 500 Futures -0.3%

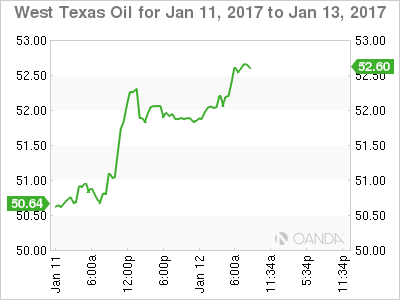

2. Oil rises on OPEC output cuts

Oil prices have rallied overnight, supported by reports that OPEC was starting to cut output and expectations of strong demand growth in China.

Note: Rising U.S. crude inventories continue to reinforce concerns over plentiful global supplies. Yesterday’s EIA report implies ongoing ‘oversupply’ as crude stocks unexpectedly rose by +4.1m barrels to +483.11m last week.

Brent crude futures are up +25c at +$55.35 a barrel, while U.S. crude (WTI) is up +5c at +$52.30.

OPEC agreed in November to cut oil production to try to reduce a global supply glut that has depressed prices for more than two years. Several OPEC members appear to be implementing the deal, for now at least.

Iraq had reduced its oil exports by -170k bpd and was cutting them by a further -40k bpd this week. Kuwait had already cut its oil output by more than it promised, while the Saudis has earmarked some supply reductions for next month to China, India and Malaysia and is focusing most of its cuts on Europe and the U.S.

Gold prices (+1% at $1,203.54) continue to edge higher, trading atop of its two-month high print from yesterday’s session, as the dollar remains on the back foot after Trumps lack of clarity on future fiscal policies.

3. U.S curve flattens after strong 10-year auction

With Trump providing no new details in his first press outing as the new Commander-in-Chief set the stage for a competitive U.S. 10-Year note auction yesterday.

There was a strong demand for the 10-year $20B Treasury note with yields decreasing slightly as investors reassessed the speed of future interest rate hikes and inflation: average yield came in at +2.342% from the prior +2.485%, the bid-to-cover was 2.58, a shade higher than the past eight reopening average of 2.57.

U.S 10’s are trading at +2.32% ahead of the U.S open, their lowest level since Nov. 30. Elsewhere, Aussie 10’s have lost -6bps overnight to +2.67%, while those in New Zealand dropped -8bps to +3.10%.

4. Dollar pummeled on lack of details

For this year in particular, investors can expect political disappointment to be expressed very strongly through currency price moves. Yesterday’s first press conference by the new POETUS is a good example.

The mighty dollar has seen a sharp decline right across the board; the absence of clarity on fiscal policy has supported a notable correction in the “Trumpflation trade.”

Against Asian currencies, the greenback is off -0.5% vs. the Chinese yuan (CNH), -0.3% lower against the Thai baht (THB) and -0.7% lower against the Korean won (KWN).

Against the majors, the EUR/USD is up +0.4% at €1.0626, having earlier reached a one-month peak of €1.0665. USD/JPY has fallen -0.7% to ¥114.30, having hit a one-month low around ¥113.77, while the pound received a small reprieve to trade at £1.2266.

However, expect USD bulls to be looking for support from strong inflationary pressures and a ‘hawkish’ Fed to push U.S. yields and the dollar higher once again.

5. Eurozone industrial data stronger than expected

This morning’s Eurozone industrial production (IP) came in much stronger than expected for November. It was up +1.5% on the month and +3.2% on the year, against consensus estimates of +0.5% and +1.8%, respectively.

October also saw a positive revision; it now readjusted to +0.1% m/m rise, rather than a fall of the same magnitude.

Digging deeper, France led the pickup, mostly supported by Spain. Non-durable consumer goods drove the surge, which would suggest that household spending was picking up.

The headline print is further proof that the Eurozone experienced a pickup in economic growth during H2 of 2016. Analysts are revising up their Q2 and Q3 tallies to +0.5% as against the previous +0.3%.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.