Kiwi Tumbles As RBNZ Signals A Pause

ActionForex | Jul 24, 2014 02:54AM ET

The Kiwi experienced sharp drops today after RBNZ hike OCR by 25bps to 3.50% as expected, but signaled a pause. Governor Wheeler noted in the statement that "it is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level." The comments regarding exchange rate were also seen a bit strong as Wheeler noted that the level of the Kiwi is "unjustified and unsustainable" versus prior description that it's not "sustainable at current levels". RBNZ even went further as warned "there is potential for a significant fall." Markets are now pricing in for RBNZ to stand pat within this year. Also released from New Zealand, trade surplus narrowed less than expected to NZD 247m in June.

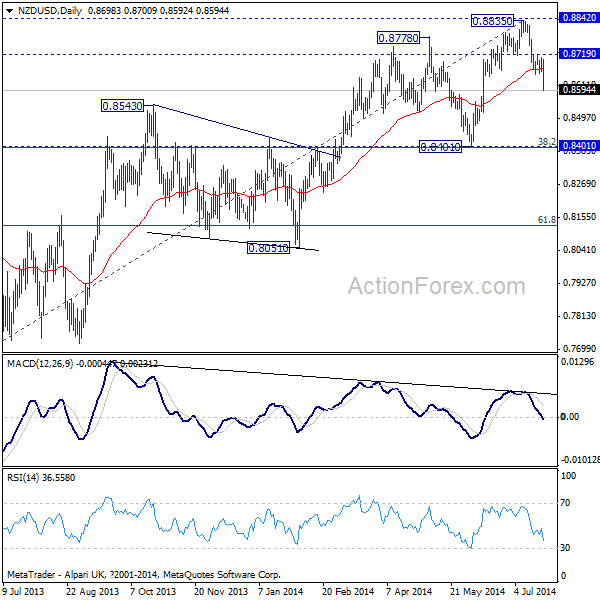

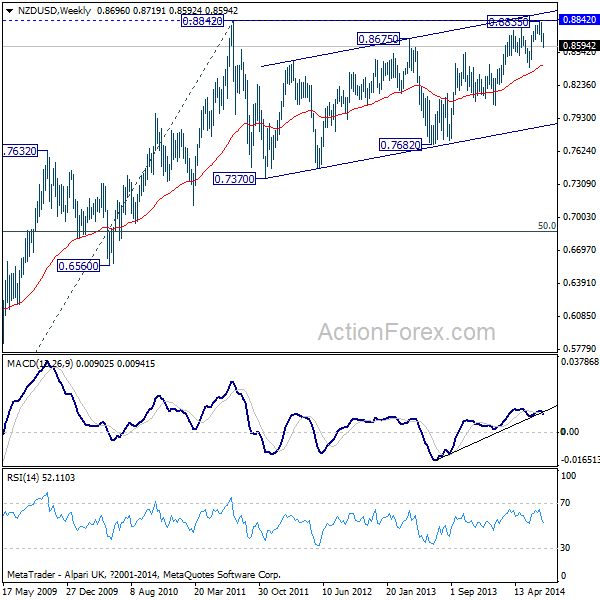

Technically, the NZD/USD's sharp decline today pushed it through the 55 days EMA firmly. The development further affirmed the case that an important top is formed at 0.8835, just ahead of key resistance level of 0.8842. Near term outlook stays bearish as long as 0.8719 resistance holds. Deeper decline is expected to 0.8401 cluster support (38.2% retracement of 0.7682 to 0.8835 at 0.8395).

In the bigger picture, it should be noted again that the pair is staying in the long term sideway pattern fro 0.8842 (2011 high). Fall from 0.8835 could be the third leg inside the pattern, which is a medium term fall. Sustained break of the above mentioned 0.84 cluster support will pave the way to 0.7682 and below in medium term.

Released from China, the HSBC manufacturing PMI rose to 52.0 in July versus expectation of 51.2. That's the highest level since January 2013. HSBC noted that "economic activity continues to improve in July, suggesting that the cumulative impact of mini-stimulus measures introduced earlier is still filtering through." And, HSBC expected "policy makers to maintain their accommodative stance over the next few months to consolidate the recovery." The data gave AUD/USD a lift in Asian session today but the pair is still stuck in recent range below 0.9504.

Elsewhere, Japan trade deficit came in at JPY -1.08T in June, manufacturing PMI dropped to 50.8 in July. PMI data will be the main focus in Eurozone today. Meanwhile, UK will release retail sales and US will release jobless claims and new home sales.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.