Kick The Tires On 4 Stocks This Market Should Favor

David Brown | Aug 13, 2013 03:22AM ET

Yesterday was a flat market day with the DJIA and the S&P off a small amount while NASDAQ gained a few points. But it was better than last week when all style/caps ended the week in the red. Large-cap value was down the least, at -0.8%, while small-cap value was down the most, at -1.11%.

Not much different from a sector viewpoint last week, except Basic Materials gained nearly 4%,chiefly due to a fall in the dollar versus other major currencies (approximately 2%). The remaining sectors fell from a little less than -0.3% for Consumer Non-Cyclicals to nearly a full percent for Consumer Cyclicals. Not much of a spread there.

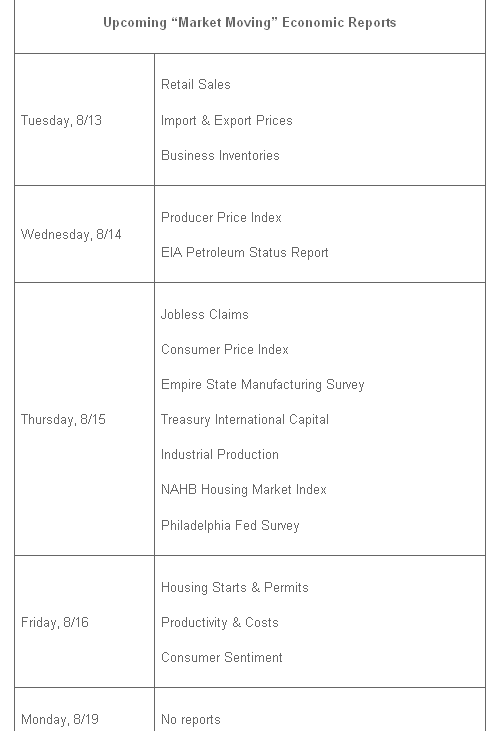

As for economic releases last week, there was a fairly even split between small positive surprises and small negative surprises. This week will be busier on the economic front with fairly important announcements on Tuesday (retail sales), Thursday (industrial production among a whole slew of other reports), and Friday (housing starts and permits). See the economic calendar below.

All in all, it was a lackluster week with the loss primarily due to the U.S. dollar’s fall against the yen and continued statements by Fed members that reductions in QE3 may start in September.

Look, the QE3 reduction is going to happen, if not in September then perhaps later in 2013 or early 2014. But it will happen. So let’s just assume it will happen and not worry about when.

What should we do under these market conditions?

As most of our readers know, Sabrient builds model portfolios for ETFs, UITs, and other institutional investors. We have finished our fourth UIT portfolio of the year, and I wondered what we might have missed. You see, these large portfolios rarely accept stocks with capitalizations much below $500M. The dividend-based models rarely accept constituents with less than a 2% yield, and we generally do not include companies with fewer than three analysts following the company, as reported by a service called IBES.

So I thought, Why not search for companies that barely missed one or more of these requirements?

4 Stocks this Market Should Favor

Four such stocks piqued my interest: SanDisk (SNDK), Lithia Motors (LAD), Encore Wire (WIRE), and Trinity Industries (TRN). One had only two analysts reporting estimates through IBES. All had dividends, but none were as high as 2%. For these reasons, they were eliminated from consideration for our institutional portfolios. Yet all are interesting growth companies, reasonably priced, and in multiple sectors.

SNDK (SanDisk Corp) was expected by many analysts to fall short of expectations in Q2 due to the competitive landscape in flash memory, but SNDK beat earnings by more than 30%! After a two-day rally of only 6%, the stock has fallen nearly 10% to well below its pre-announcement price, which makes for a good entry point. Over the past 30 days nearly all of the 30+ analysts who follow the company have the raised their estimates for 2013 and 2014. No one has lowered estimates. The stock has been a growth machine over the past 15 months, but it is currently selling barely over 10x next year’s earnings. True, there are competitive issues that need to be thought through carefully, but I put this one out there for your analysis.

Maybe you would rather own your own car dealership? Well, you can for about $2 billion, the current market cap of LAD (Lithia Motors). That‘s a little much for most of us, but surely we can afford 68 bucks for a single share. Then we will own (a piece of) a car and truck dealership, just like those sports team owners that used their profits from car dealerships to buy a major league sports team! Check out the stats on this company. The story of Lithia Motors is worth reading just to learn about the 27 models of cars and trucks, including Tesla (TSLA), that they sell all over the West and Midwest. Lithia is growing like wildfire. Make sure you check out the cash flow and debt, but it is worth a look.

Then there is WIRE (Encore Wire Corp.), the small-cap company covered by just two analysts. The company wires homes and offices and who know what else. It is a copper play with little or no risk that copper prices will rise or fall. Look at the growth over past couple of years and the projected growth over the next few, even if those projections were made by just two analysts.

Finally, there is TRN (Trinity Industries). Trinity moves just about every kind of energy commodity except electricity itself with its rail cars, tugboats, road building, etc. Again, look at the recent and projected growth that you can buy for 8.8x forward earnings. You can be an energy baron on the cheap and maybe make yourself a buck or too.

Incidentally, none of these companies are newbies. They were founded in 1933 (TRN), 1946 (LAD), 1988 (SNDK) and 1989 (WIRE). Two are headquartered in Texas, one in Oregon, and the other in California; and together they employ more than 25,000 people.

Have fun kicking the tires.

More About Those 4 Stocks

Our stock picks for this market include one large-cap, one small-cap, and two mid-caps. All have good growth expectations and reasonable forward P/Es.

SanDisk Corporation (SNDK) -- Technology Sector, Large-cap

SanDisk Corporation designs, develops, manufactures, and markets flash storage card products that are used in various consumer electronics products. SNDK has a huge number of upward revisions of analysts' estimates over past 30 days, and it beat last quarter's estimate by 30%. It scores well in our system, is rated a Strong Buy, and has a dividend yield of 1.5%. Website: here Price when selected (8-12-13): $40.98

Disclosure: The author does not hold positions in any of the stocks mentioned in this article.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.