Key Inflation Indicator Negative, But Deflation Is Not On The Way

Ed Dolan | Sep 29, 2013 08:19AM ET

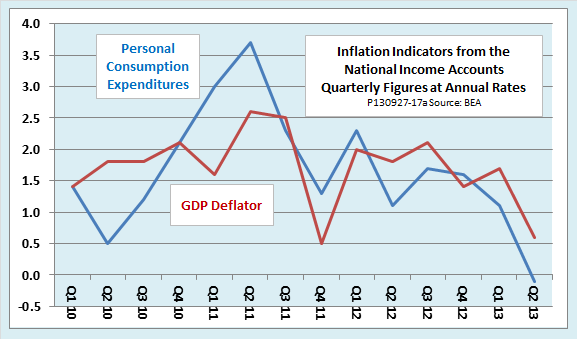

There was an interesting nugget of data buried deep in Thursday’s GDP report from the Bureau of Economic Analysis: The rate of change of the deflator for personal consumption expenditures fell to an annual rate of -0.1 percent from the 0.0 percent rate reported earlier. An even broader measure of inflation, the GDP deflator, was also revised downward, although it remained positive. The PCE deflator, rather than the more widely publicized Consumer Price Index, is the Fed’s preferred indicator of price trends.

The downturn in the PCE deflator prompted University of Michigan professor Justin Wolfers to ask, in a blog post on Bloomberg.com, Where is the Panic over Deflation? To be fair, Wolfers was quick to say that he himself was not panicking at a one-quarter downturn in a single inflation indicator. Still, it is a good question. Is this the time to begin worrying about deflation, or is it not?

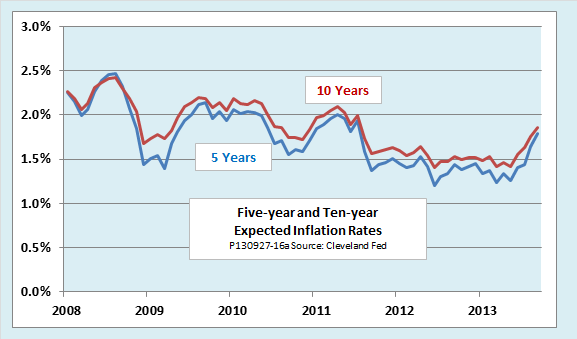

It is not. Before reading too much into the downtick in the PCE deflator for the second quarter, we should check some forward-looking inflation indicators. One of the best is the inflation expectations measure published by the Cleveland Fed. It draws on price trends for Treasury Inflation Protected Securities (TIPS), bonds that carry inflation protection linked to the CPI. The spread between the TIPS price and the price of ordinary Treasury bonds of similar maturity indicates how much investors are willing to pay for inflation protection. The Cleveland Fed decomposes that spread into a measure of inflation expectations and a risk premium. As the next chart shows, after reaching record lows earlier this year, both the Cleveland Fed’s 5-year and 10-year expected inflation rates have moved up. Clearly, the upturn points to a reduced probability of deflation.

Meanwhile, the Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.