Key Events In Developed Markets Next Week

ING Economic and Financial Analysis | Oct 11, 2019 04:42AM ET

It's crunch time for the UK and EU but we still believe a Brexit deal is unlikely. Elsewhere, further US data should provide more clues about the possibility of a Fed rate cut

Four key Brexit questions ahead of a key week

- Will a deal be agreed by the European Council (Thurs/Fri)? Unlikely – both sides are heavily divided on the issue of customs alignment in Northern Ireland.

- Will Prime Minister Boris Johnson ask for another Article 50 extension? Without a deal, the law states the government will have to write to Brussels asking for a delay before Saturday, 19 October. However, there have been suggestions the PM may take the issue to the courts, resign, or possibly send a second letter to Brussels detailing why he doesn’t want another extension himself. However, most legal experts think this latter idea could be ruled unlawful if tried. In short: a request from the UK for a delay looks likely.

- Will the EU grant an extension? In short, yes, although the circumstances could be awkward. While an election looks to be on the way, it possibly won't be triggered before the EU is asked to make a decision. Don’t forget the EU has previously said it would require a clear justification for further extensions. Ultimately though, EU leaders will likely grant further time – Brussels wants to avoid taking the blame for ‘no deal’, or for blocking a ‘democratic event’ such as an election/referendum. However, the question of ‘how long’ remains uncertain – it’s possible the EU grants a longer delay than the three months that the UK could ask for.

- Will there be an election? This looks likely, but it relies upon Parliament actually voting for one. The Conservatives are keen to go to the ballot box, eager to try and convert their lead in the polls into a majority. The leader of the opposition, Jeremy Corbyn, has also said he wants an election, although many of his MPs are less convinced. An election still looks highly likely, but there is a tail-risk that Parliament refuses to grant one, or attempts to install a government of national unity with the aim of pushing for a second referendum. However, as things stand there is no agreement among lawmakers on how that might work – or indeed if there is enough support in the first place.

US: Fed's October cut remain a close call

It remains a close call on whether the Federal Reserve will follow up its recent two interest rate cuts with a third one on 30 October. Amidst a weak global growth environment there is evidence to suggest that the US economy is catching a chill with recent surveys and employment numbers disappointing market expectations. Inflation is non-threatening and with trade tensions continuing to be a major concern there is certainly justification for further “insurance” against a downturn. Nonetheless, Fed officials continue to talk positively about the economy so the upcoming data flow will be key to determining whether the weakness is spreading quickly enough to force the Fed’s hand.

Retail sales will be the focus and strong auto sales should give the headline figure a lift, but falling gasoline prices and softer chain store sales numbers suggest growth elsewhere will be more subdued. Industrial production is also likely to edge lower after posting a strong August figure. Employment in the sector was down and with the ISM manufacturing index in contraction territory the prospects aren’t looking good right now. Housing activity may hold onto recent gains, supported by the plunge in mortgage rates, but overall next week’s data flow is likely to stay consistent with moderating growth. Therefore we wouldn’t be surprised to see market expectations for an October cut, currently priced at a 70% probability, push higher.

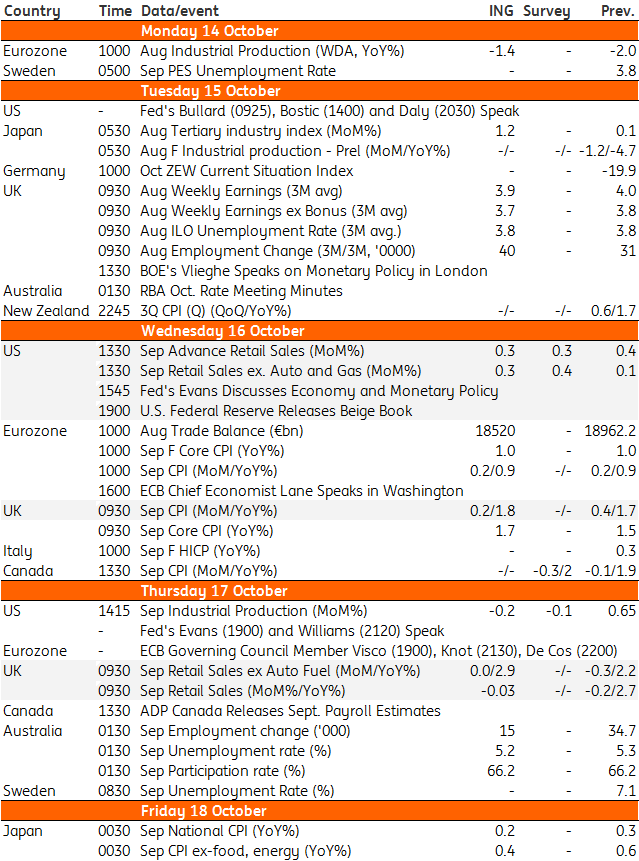

Developed Markets Economic Calendar

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.