Key Events In Developed Markets Next Week

ING Economic and Financial Analysis | Nov 16, 2018 07:36AM ET

The eurozone's weak performance will be seen through the lens of PMIs next week. We also have some US second-tier releases but nothing which will stop the Fed hiking in December.

US: On course for a December hike

We get a few second tier US data releases over the coming week, but none of them are likely to alter the outlook for the December FOMC meeting, where we have a high conviction call that the Federal Reserve will raise its main policy rate by 25 basis points for the fourth time this year.

The economy is growing strongly, inflation is above the Federal Reserve’s 2% target and the jobs market is robust, with wage pressures on the rise. Given good momentum we expect the Fed to continue hiking interest rates next year. However, they are likely to be less aggressive than in 2018 – we expect three rate moves next year. The economy is facing more headwinds with the lagged effects of higher interest rates and a strong dollar set to slow growth, while trade tensions and weaker external demand are also a threat.

Furthermore, there are some tentative signs of softness in real data, particularly the housing market and investment. The durable goods orders report is already pointing to a slower path ahead for corporate investment while higher mortgage rates are resulting in a slowdown in the housing market. Next week’s data is likely to give us more information on whether this is something that is becoming more troubling.

Eurozone weakness through the lens of confidence data

In the eurozone, confidence data will be released. After the dismal third quarter, PMIs will be closely watched to get a sense of economic performance in November. With downside risks ever present, a strong bounce back from the weak 3Q performance seems unlikely.

Canada: Energy will put upward pressure on prices

Canada’s inflation in September was -0.4% month-on-month, largely undershooting expectations. But we're unlikely to see a similar figure in October; we forecast 0.2% MoM, with the main contributor likely to be energy prices.

The oil price rally started at the back-end of September, meaning price gains only made a mild impact and were actually down on the month; the majority of the gains will be seen in October gasoline prices. And despite a high base, there should be an uptick in energy prices on the year too – though more moderate than expected; the heavy WCS discount to WTI and Brent crude will likely add some negative impetus. This should keep the headline print sitting above the Bank of Canada’s 2% inflation target; we forecast a healthy 2.3% YoY.

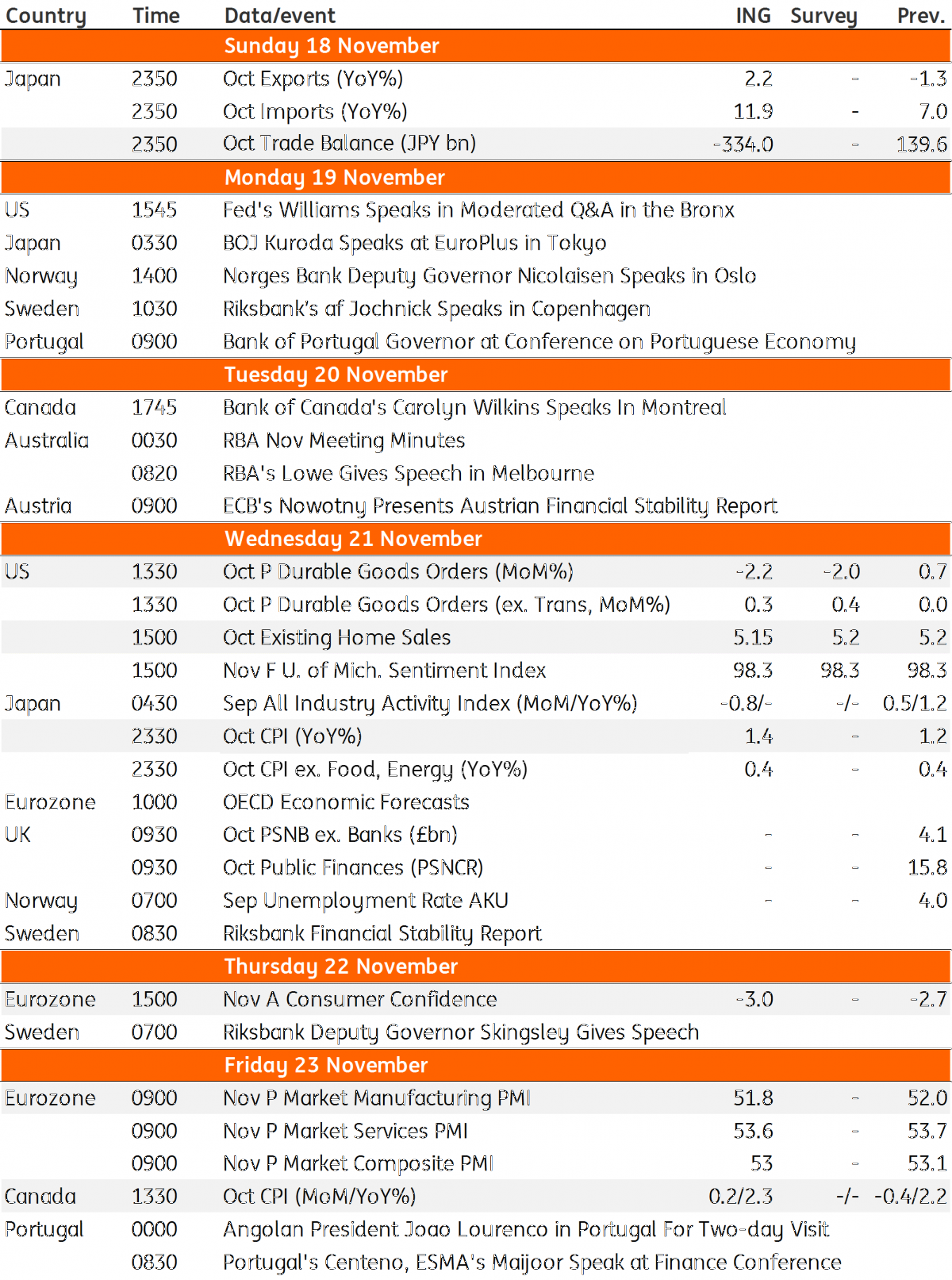

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here .”

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.