Keeping An Eagle Eye On European Equities

Saxo Bank | Jun 09, 2015 07:15AM ET

Background

On Friday ahead of the US Non-Farm Payroll I had suggested that if European equities declined further during that afternoon session I would step into the market.

The main European indices did not decline, they actually picked up some ground to close with reduced losses. Needless to say, I did not acquire any averaging position. Nor did I react yesterday as Mondays can be notoriously volatile especially after the payroll and when one throws Greece into the mix, the conditions can tend toward combustible.

That said I am looking at the slide this morning with some interest. European stocks are little changed in choppy trade on Tuesday. Investors remain cautious after a rally in German 10-year bund yields and as concerns over Greek negotiations persist. So why am I circling the European equity market?

I am looking at the US equity markets futures which point to a steady open. The Dow Jones Industrial Average futures pointed to a 0.08% uptick, S&P 500 futures signalled a 0.09% gain, while the Nasdaq 100 futures indicated a 0.06% rise.

Using an indexed form of the DAX, CAC 40 and FTSEMIB (ignore IBEX for now) I have looked at the DAX as my proxy.

The index was set at 100 at end of 2011 and last week settled at 189.84. The European market structure is sound unless there is a retracement back to the levels last seen on February 6th 2015 when the DAX was at 10840. I am quite comfortable about the outlook at the moment.

Management and risk:

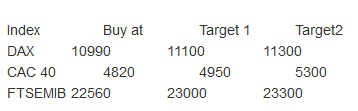

I am setting the following targets at which I will buy further exposure to Europe:

I am not running stop losses at the moment as these positions are core/strategic and would be added to current exposure levels…

DAX 10584…CAC 40 4626…FTSE MIB 20490

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.