Junior Miners Should Be Rallying – What’s Holding Them Back?

Sunshine Profits | May 14, 2021 12:02PM ET

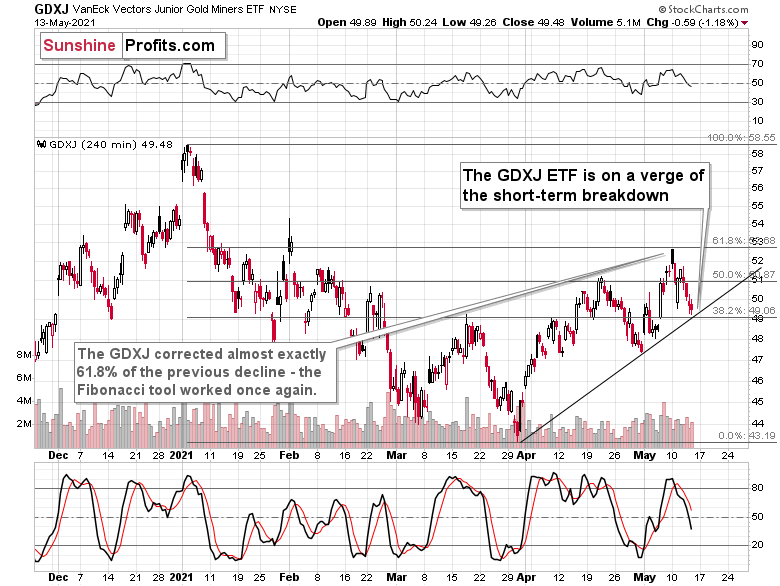

Junior miners may soon suffer a breakdown of the short-term support line. So, what’s responsible for their underperformance of gold and stocks?

Today’s technical part of the analysis is going to be brief, as I have discussed multiple things this week and my comments remain up-to-date. There’s not much to add today, and we’ll go over only one technical chart – the one where we have trading positions – the VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) chart. Unlike in the previous days, today I’m going to look at it from the more short-term point of view – through the four-hour chart.

Before looking at it, please note that yesterday’s (May 13) session was relatively boring in the case of gold futures (they ended the day $1.20 higher), and quite positive for the GLD (NYSE:GLD) ETF, at least at first sight, as it closed $0.70 higher. The seemingly odd discrepancy between the two is just a result of different times that are taken into account for calculating both markets’ performance. All in all, yesterday’s session was positive for gold.

The S&P 500 index ended yesterday’s session 1.22% higher. At face value, this seems positive. Technically, it was just a comeback to the previously broken lows (mid-April and early May ones), which was followed by a small move lower before the end of the day, so from this point of view, this session was bearish.

Taking day-to-day price changes, though, yesterday’s session was positive for both: gold and the general stock market. Consequently, the GDXJ ETF should have rallied as its price is generally influenced by both. And what actually happened?

The GDXJ ETF declined by 1.18%.

This is an extremely bearish short-term sign as its obvious that exactly the opposite happened to what was actually supposed to happen. The most likely reason? Junior miners simply can’t wait to decline.

trading performance compared to gold and stocks, it seems that we won’t have to wait for it to materialize.

And speaking of relative performance – it’s not just the day-to-day performance. Yesterday’s intraday low in the GDXJ ETF was just one cent above the intraday March high. For comparison, gold’s intraday low yesterday was over $50 above its intraday March high. And the S&P 500 was 91.12 index points (over 2%) above its intraday March high.

on the additional reason behind juniors’ weakness remain up-to-date:

But what about juniors? Why haven’t they been soaring relative to senior mining stocks? What makes them so special (and weak) right now? In my opinion, it’s the fact that we now – unlike at any other time in the past – have an asset class that seems similarly appealing to the investment public. Not to everyone, but to some. And this “some” is enough for juniors to underperform.

Instead of speculating on an individual junior miner making a killing after striking gold or silver in some extremely rich deposit, it’s now easier than ever to get the same kind of thrill by buying… an altcoin (like Dogecoin or something else). In fact, people themselves can engage in “mining” these coins. And just like bitcoin seems similar to gold to many (especially the younger generation) investors, altcoins might serve as the “junior mining stocks” of the electronic future. At least they might be perceived as such by some.

Consequently, a part of the demand for juniors was not based on the “sympathy” toward the precious metals market, but rather on the emotional thrill (striking gold) combined with the anti-establishment tendencies ( are the anti- metals, but cryptocurrencies are anti-establishment in their own way). And since everyone and their brother seem to be talking about how much this or that altcoin has gained recently, it’s easy to see why some people jumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away in the near term, so it seems that we have yet another reason to think that the GDXJ ETF is going to move much lower in the following months – declining more than the GDX (NYSE:GDX) ETF. The above + gold’s decline + stocks’ decline is truly an extremely bearish combination, in my view.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.