June Monthly FX Outlook: U.S. Dollar Remains Pressured, Euro Could Surprise

Marc Chandler | Jun 01, 2021 12:19AM ET

The US dollar, which confounded most observers by appreciating in the first quarter, has fallen broadly in April and May. The drivers, ironically, are the same: US rates and relative economic strength. Treasury yields rose sharply in Q1, and this helped the greenback recover from the accelerated slide in November and December 2020. However, they fell in April and did not get much traction in May. Spikes higher in yields, such as in response to the surprising acceleration of CPI to over 6% at an annualized rate in the first four months of the year, were short-lived.

Federal Reserve officials say it is too early to consider tapering, and even the few that have suggested more willingness to discuss it, require a few more months of data. That means outside updated forecasts, no change in its stance should be expected from the June 15-16 FOMC meeting. A Bloomberg survey found a majority expect tapering to begin in Q4. The December 2022 Eurodollar futures contract has a 25 bp rate hike discounted more than a year before the majority of the Fed (11/18) thinks it will be appropriate.

US economic data has not surprised to the upside as it did earlier in the year. Instead, three significant disappointments, nonfarm payrolls, retail sales, and housing starts, marred April's reports and forced many economic models to temper projections of Q2 GDP. That said, the economy still appears to be accelerating after growing at a 6.4% annualized clip in Q1. Yet, at the same time, the pace of activity will likely peak in the middle two quarters of the year as the sugar-rush of fiscal spending begins to fade, and the surge associated with the re-opening fades.

Meanwhile, the vaccine rollout in Europe has taken off, and economic activity is recovering quickly. Since mid-March, the ECB had stepped up its bond purchases, and there will be a vigorous debate at the June 10 meeting whether some reduction is in order. The rise in yields in recent weeks appears to have been driven by domestic rather than global considerations. Still, if the bond-buying pace slows, it may not be fair to call this tapering. It is more like what the Bank of Canada did last year, and the Bank of Japan and the Reserve Bank of New Zealand have done. For different reasons, there was a recalibration of the long-term asset purchases without the intent of reducing the stimulus.

The European Union's fiscal initiative and budget have still not been ratified by all the members. Nor have all the spending plans been submitted. The recovery fund may not be up and running until well into Q3, and when it does disburse funds, it will be pro-cyclical in the sense of helping economies that are already rebounding. The UK contracted in January and February, but as the vaccine rollout improved, economic growth accelerated. Despite the Indian mutation of the pathogen, the UK is still on track from an economy-wide re-opening on June 21. The Bank of England reduced its weekly bond purchases intending to complete them by the end of the year.

Japan is having a more challenging time of things. It is one of the few countries that is experiencing deflation (negative year-over-year CPI). Although the inflection numbers remain relatively modest, the formal state of emergency covering an area accounting for around 40% of GDP has been extended into June. A proper recovery may begin in Q3, but it may not be in enough time to help Prime Minister Suga, who faces a party leadership contest in September, and his decision to go forward with the Olympics (opening ceremonies July 23) is terribly unpopular. A decision is expected in June whether local spectators will be allowed to attend in person. The number of foreign attendees was cut in March from 600,000 to less than 70k.

Tax reform and coordination have been stymied at the OECD in recent years, largely but not solely because of the US intransigence. The US proposal for a 15% minimum corporate tax rate could be the basis of an agreement, and the first step is to reach a G7 consensus. Separately is the issue of the digital tax, which the US objects to because it singles out US companies. Some level of taxation for where sales are made applied to the largest companies seems to offer the possible basis of a compromise. Successful endorsement by the G7 finance ministers (June 4-5) and the heads of state summit (June 11-13) will also help US President Biden's domestic agenda. He seeks to unwind the 2017 corporate tax cut and lift the rate back to 28% from 21%, with many exemptions and breaks. The average effective corporate tax rate is seen several percentage points lower (Yardeni estimates 2020 effective corporate tax rates were slightly below 16%).

A straightforward way to frame the developments among the major currencies is to consider that the dollar is at the fulcrum of a seesaw. The currencies that have appreciated against the dollar are those from countries that the central bank has adjusted monetary policy or forward guidance suggesting a less accommodative stance: Canada, UK, Norway, and New Zealand. Those laggards, led by Japan (yen is off 6% through May), have weaker currencies. The Australian dollar is posting a negligible gain and is the exception to the pattern.

China demonstrated that it is a force to reckon with. Officials reiterated its 2019 ban on banks and payment companies transacting in crypto and underscored that the prohibitions included mining (creating tokens by solving highly rarified math problems). While some other countries are banning crypto, the G7 seems more likely to regulate it, tax it, ensure that it is not being used to conceal payments for criminal activity.

More importantly, China officials sought to limit the increase in commodity prices. It appears to be doing this through its regulatory authority. One illustrative example is the local government of Tangshan, the main steel-making city. According to reports on Reuters and Bloomberg, it warned that it would look into illegal behavior and suspend production from mills found to be manipulating prices by spreading rumors or hoarding materials. The local government also introduced output curbs on steel as part of the crackdown on pollution. The central government has also been explicit with similar threats. And it appeared to have the desired effects of commodity prices, where various industrial commodities snapped multi-week advances.

The JP Morgan Emerging Market Currency Index rose for the second consecutive month after falling every month in Q1. However, there was a significant variance in performance. Eastern and Central Europe dominated the advancers, with Russia counting for five of the top ten. The Hungarian forint was the strongest in the region last month, rising almost 5% against the dollar and 3.50% against the euro. Among emerging market currencies, Asian currencies underperformed. The Indian rupee was a notable exception. It rose by about 2.25%. Latam currencies were mixed. The Brazilian real and Mexican peso gained about 4% and 1.6%, respectively, against the dollar. Political jitters dragged the Chilean peso down by around 1.8%, making it the weakest. The Columbian peso proved fairly resilient to S&P's decision to take away its investment-grade status and rose by about 0.6% in May.

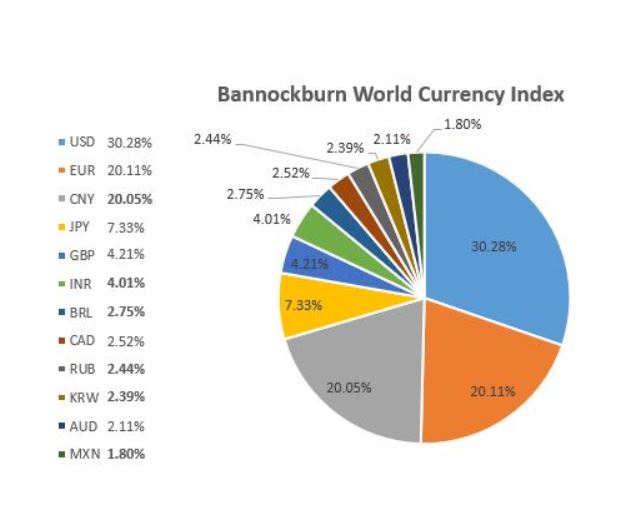

Bannockburn's World Currency Index, a GDP-weighted basket of the 10-largest economies, made new three-year highs in May as it continued to recover. The pullback in Q1 (dollar bounce) seems more clearly a counter-trend correction. The US dollar fell against all the currencies in the index, but the South Korean won. The won was among the weakest currencies in May, falling 1.3%. Weaker tech shares and re-allocation by foreign investors (~$8.6 bln in May after buying ~$245 mln in April). The related outflow was blunted by foreign purchases of $5.6 bln of Korean bonds. Foreign investors bought almost $30 bln of bonds in Q1.

It is often difficult to divine the intent and meaning of the People's Bank of China. Our working hypothesis is that officials allow it to move in line with the other major currencies within certain bounds. For example, the euro and the yuan both comprise about a fifth of the Bannockburn World Currency Index. On a 60-day rolling basis, the correlation of the percent change of the yuan and euro is at a three-year high of nearly 0.58. Some observers argue that the causal arrow begins with China, but we are less sanguine. The PBOC seems largely reactive, including in the setting of the daily reference rate, which had become more transparent.

Dollar: Given the large fiscal shortfall and the record trade deficit, US interest rates need to rise in absolute terms and relative to other major countries, or the dollar bears the burden of adjustment. The Federal Reserve has made it clear it is not ready to take its foot off the monetary accelerator and will continue to buy $120 bln a month of Treasuries and mortgage-backed securities. It is unlikely to change its stance at the mid-June FOMC meeting, but the market will emphasize the possible fraying of the consensus that a rate hike will not be appropriate until after 2023. Last December, five disagreed (of 17), and in March, seven (of 18) thought that a move earlier would be needed. Disappointing April jobs growth and weakness in consumption speak to the uneven recovery underway. The implied yield of the December 2022 Eurodollar futures contract stands near 38 bp, down from 50 bp at the end of March and about 44 bp at the end of April. The base effect on inflation should diminish until later in the year. However, the bottlenecks and supply chain disruptions still may be evident, lifting prices and dampening activity, such as auto output.

Euro: In contrast to the US, European data has generally surprised on the upside as the vaccination efforts intensified and some social restrictions eased. By the end of July, the EU will have enough vaccines to inoculate 70% of its adult population. Economic growth is accelerating after the Q1 contraction. There is arguably too much attention being devoted to the debate at the ECB about reducing the bond purchases under the Pandemic Emergency Purchase Program after increasing it in March. Since the March ECB meeting, the euro appreciated by about 2.5% after falling almost the same magnitude from the end of 2020 until that March decision. Arguably, more importantly, the US premium over Germany for both two and ten-year borrowings narrowed after rising in Q1. Geopolitical tensions with Russia and Belarus have had little market impact. The EU continues to resist UK efforts to revise the Withdrawal Agreement and the Northern Ireland protocol. Until Beijing's retaliatory sanctions are lifted, the EU Parliament will not ratify the Comprehensive Agreement on Investment deal struck with China at the end of last year.

(May 28 indicative closing prices, previous in parentheses)

- Spot: $1.2190 ($1.2020)

- Median Bloomberg One-month Forecast $1.2100 ($1.2010)

- One-month forward $1.2200 ($1.2025) One-month implied vol 5.7% (5.3%)

Japanese Yen: The link between the US 10-year yield and the dollar-yen exchange rate had slacked last year, but it has returned to near pre-crisis levels (~0.65 60-day correlation on changes in two instruments). On the other hand, the correlation between the exchange rate and the S&P 500 (proxy for risk) has become inverted (yen strengthens when stocks rise), which rarely happens, and by the most since 2012. The slowness to roll out the vaccine in Japan, the extended emergencies, negative terms of trade shock (i.e., rising commodity prices), and the return of deflation provide a weak backdrop for the yen. A poor Olympics may be more of a drag on Prime Minister Suga's chances of remaining LDP leader and therefore Prime Minister than having canceled them. Higher US rates can lift the dollar toward this year and last year's highs in the JPY111.00-JPY112.25 area.

- Spot: JPY109.85 (JPY109.30)

- Median Bloomberg One-month Forecast JPY109.00 (JPY108.60)

- One-month forward JPY110.00 (JPY109.00) One-month implied vol 5.5% (5.5%)

British Pound: Sterling led the major currencies higher against the dollar, rising 2.5% in May. It was the fourth month this year it has appreciated against the dollar and the sixth in the past seven months. This still does not do justice to sterling's advance. The pound typically falls in May. Last month was the first time it appreciated in 12 years. The economy is accelating. The Bank of England slowed its bond purchases and intends on completing them before the end of the year. Plans to re-open the economy fully on June 21 are being challenged by the rising infections and hospitalizations as May drew to a close. Until the course of the virus and the impact of the end of the furlough job-subsidy initiative, expectations for a policy change will be restrained. A rate hike in late 2022 appears to be discounted in the futures market. The UK holds the presidency of the G7, and a successful summit that will be held in picturesque Carbis Bay would be a good way to launch post-Brexit UK diplomatic leadership.

- Spot: $1.4190 ($1.3820)

- Median Bloomberg One-month Forecast $1.4000 ($1.3860)

- One-month forward $1.4200 ($1.3825) One-month implied vol 6.7% (6.9%)

Canadian Dollar: The Bank of Canada's decision to reduce its bond-buying and bring forward when the output gap would be closed (to H2 22) on April 21 sparked about a 4.5% rally in the Canadian dollar. The US dollar found support just above CAD1.20, an important technical area. Although the greenback's downside momentum stalled, it continues to struggle to sustain upticks. Still, the risk is that the market has gotten a bit ahead of itself. Speculators in the futures market have the largest gross long Canadian dollar position in four years. The market has nearly three rate hikes discounted by the middle of 2023. Another weak jobs report (unexpected loss of almost 130k full-time positions in April) could prompt the Bank of Canada to soften its rhetoric at the June 9 meeting. In the middle of May, Prime Minister Trudeau announced an extension of the border restrictions with the US until June 21. Polls suggest there is not much public pressure to lift it until at least after the summer.

- Spot: CAD1.2075 (CAD 1.2290)

- Median Bloomberg One-month Forecast CAD1.2300 (CAD1.2400)

- One-month forward CAD1.2080 (CAD1.2300) One-month implied vol 6.6% (6.2%)

Australian Dollar: Contrary to conventional wisdom, the Australian dollar is not a proxy for commodities. The Australian dollar peaked in late February, a little above $0.8000. While commodity prices have risen until recently, the Aussie has moved broadly sideways between around $0.7675 and $0.7855. Through the first five months of the year, the Australian dollar is up an inconsequential 0.25%. Capital flows are more important than trade flows, and the usual premium Australia typically offers over the US to borrow for two years remains at a discount. Although the Reserve Bank of New Zealand signaled that it could raise rates in H2 22, the Reserve Bank of Australia is in no hurry to follow suit. The June 1 meeting is less important than the July 6 meeting at which the RBA will announce whether it will extend its bond-buying program (which currently expires at the end of September) and whether it will continue to its yield curve control efforts.

- Spot: $0.7710 ($0.7715)

- Median Bloomberg One-Month Forecast $0.7750 ($0.7705)

- One-month forward $0.7715 ($0.7720) One-month implied vol 8.5 (8.6%)

Mexican Peso: The peso gained almost 1.7% against the dollar in May, twice April's gain, and it is now flat on the year. The JP Morgan Emerging Market Currency Index is also virtually unchanged through the first five months of the year. The growth prospects have improved, helped by the strength of the US economy. Worker remittances remain strong. Price pressures have accelerated, and the central bank recognizes upside risks. Although Banxico seems to be in no hurry to signal a hike, the market appears to be pricing in nearly 100 bp of hikes over the next year. Brazil has hiked the Selic rate twice by 75 bp each time and has signaled it will do so again at the June 16 meeting. This will take it to 4.25% compared with Mexico's 4.00% target. At the beginning of the year, the Selic was at half of Mexico's 4% cash target. From a particularly violent campaign season, Mexico holds legislative and local elections on June 6. President AMLO's party (Morena, or National Regeneration Movement) is expected to do well

- Spot: MXN19.9380 (MXN20.2460)

- Median Bloomberg One-Month Forecast MXN20.2250 (MXN20.3820)

- One-month forward MXN20.01 (MXN20.3150) One-month implied vol 11.6% (12.5%)

Chinese Yuan: Beijing took action to curb the rise in commodities and reaffirmed its ban on the crypto ecosystem, but it seemed to do little to check the yuan's steady advance in May to new three-year lows. It only fell in four sessions last month. However, at the end of the month, the PBOC raised the reserve requirement for foreign exchange by two percentage points to 7%, which may temper the enthusiasm. If the persistence was notable, the pace was not. The yuan rose about 1.4% against the dollar. PBOC officials say that they monitor the currency against a basket of 24 trading partners and the yuan rose to five-year highs against it. Inflows into China's bonds and stocks were reported after they had appeared to have slowed. Talk that officials would embrace currency appreciation to offset the rise in commodity prices was explicitly rejected by the PBOC. That said, given that the yuan is closely managed, the fact that it has appreciated would seem to reflect the fact that key officials judge that the costs of a modest rise in the yuan (~2.25% year-to-date) are worth the price of resisting.

- Spot: CNY6.3685 (CNY6.4750)

- Median Bloomberg One-month Forecast CNY6.4650 (CNY6.4885)

- One-month forward CNY6.3760 (CNY6.4900) One-month implied vol 5.0% (4.7%)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.