JP Morgan Caught Reading Crowdability

Crowdability | Jul 21, 2016 02:27AM ET

Has anyone ever “borrowed” one of your ideas and used it as their own?

If I’m not mistaken, it just happened to me—and I’m thrilled.

After all, isn’t imitation the sincerest form of flattery?

And since it was JP Morgan doing the imitating—and since the idea it borrowed was about how investors like you can make more money with less risk—

I thought you might be interested in hearing about it.

Core Investment Principle

Wayne and I believe that everyone should invest in start-ups.

That’s the core investment principle of Crowdability.

First of all, investing in start-ups is great for job growth and our economy.

Secondly, it’s the only investment strategy we’re aware of that can consistently help you turn a tiny investment into a fortune.

And thirdly, by shifting a small amount of your portfolio to start-ups, not only are you giving yourself a shot at big gains… but you’re also decreasing your overall risk.

This third point about start-up investing—that it allows you to enhance your investment returns and reduce your risk—is what I’m focusing on today.

Diversification Into “Alternatives”

If you’re like most folks, you probably have a traditional investment portfolio.

For example, maybe your portfolio consists of 70% stocks, 30% bonds.

But by moving just a small piece of your portfolio (say 10%) into “alternative” investments like start-ups, not only can you increase your returns—but you can reduce the risk of your overall portfolio.

That’s because alternative investments aren’t correlated to traditional investments. Meaning, when the stock market “zigs,” an alternative investment “zags.”

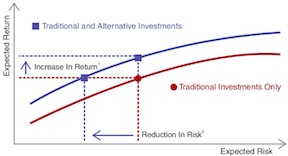

Let’s see the benefits of this zigging and zagging in a simple picture.

Here’s What Happens When You Add Alternatives

The graph below is based on the work of Nobel Prize winning economist, Harry Markowitz.

Essentially, the red line shows a “traditional” investment portfolio.

And the blue line shows a portfolio that includes alternative investments.

As you can see in this chart, adding alternatives allows you to increase your returns without increasing your risk. (To earn the same returns with a “traditional” investment portfolio, you’d need to expose yourself to far higher risk).

That’s the benefit of adding a small amount of alternatives to your portfolio:

Higher overall returns, less overall risk.

You’re Welcome, JP Morgan.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.