JP Morgan Backs 1% Bitcoin Allocation, Suggests Uncorrelated Hedge

Crypto Briefing | Feb 26, 2021 06:43AM ET

Despite Bitcoin’s limits, strategists still call for a 1% allocation.

Key Takeaways

- In a note to investors, JPMorgan (NYSE:JPM) strategists said that a 1% allocation in BTC can improve portfolio effeciency.

- The firm continues to frame the asset as an off-risk, gold-like asset.

- All markets, crypto included, have since fallen simultaneously.

JP Morgan strategists told investors on Wednesday that they can add a small Bitcoin allocation to their portfolios as a hedge. Since then, both BTC and traditional markets have taken a tumble.

JP Morgan Bets on Bitcoin

Traditional analysts are now suggesting that investors can add BTC to their portfolios. In a recent note, strategists at JP Morgan said :

“In a multi-asset portfolio, investors can likely add up to 1% of their allocation to cryptocurrencies in order to achieve any efficiency gain in the overall risk-adjusted returns of the portfolio.”

Its place serves as an uncorrelated hedge to the broader market, the strategists said.

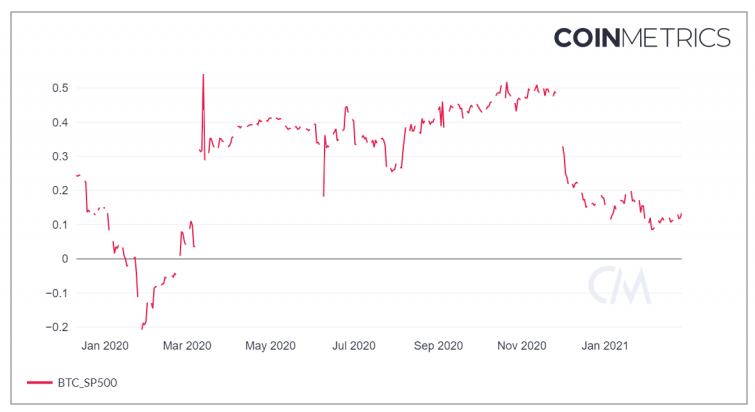

When comparing the S&P 500 with Bitcoin, however, it is difficult to draw such firm conclusions. According to Coin Metrics, the two markets are currently expressing a correlative value of 0.134. This is a rather low correlation. In March 2020, during one of the steepest financial crashes in recent memory, the correlation rose as high as 0.54.

The rise in correlation during this sell-off suggests that these two markets are at least somewhat correlated.

Further, all markets experienced a strong bearish impulse this week. Since yesterday’s market close, the S&P 500 is down 2.45%. Bitcoin is down 6.9%, according to CoinGecko.

Still, with brand name investors and fortune 500 companies buying up the asset in bulk, many have been searching for reasons to buy.

Yesterday, it was revealed that Coinbase has held BTC on its balance sheet since 2012. Earlier this month, electric vehicle manufacturer Tesla (NASDAQ:TSLA) also purchased $1.5 billion in Bitcoin.

JP Morgan has made the digital asset a key focus as of late.

Based on the latest comments and those from the past, the firm clearly sees Bitcoin as a gold-like investment vehicle. Nikolaos Panigirtzoglou, a member of the firm’s global markets team, even suggested that gold ETFs may suffer as investors turn to the crypto-based alternative.

At the time of press, the largest gold ETF, SPDR Gold Trust (GLD), is down 1.88% over the past 24 hours.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.