Join The Mousketeers: Disney Stock On A Tear

Dragonfly Capital | Oct 22, 2013 02:32AM ET

Disney stock (DIS) has been on a tear since it made a bottom during the financial crisis with the market in March 2009. It took the summer off as you can see in this weekly chart, but a little closer analysis of the technical situation shows it was a logical point for it to consolidate some gains. Stocks trade in broad harmonic flows a lot of the time and this stock shows that with the AB=CD pattern over this period. The consolidation beginning in May began at the 138.2% extension of the move from A to B. This is an important Fibonacci level for traders. There are a lot of patterns from this point that we could speculate about going forward. A third move higher in a 3 Drives pattern would target a move over 100 in 2016 if it moved higher now. That is a long way higher and frankly not very useful right now with so much time until the target. It also seems

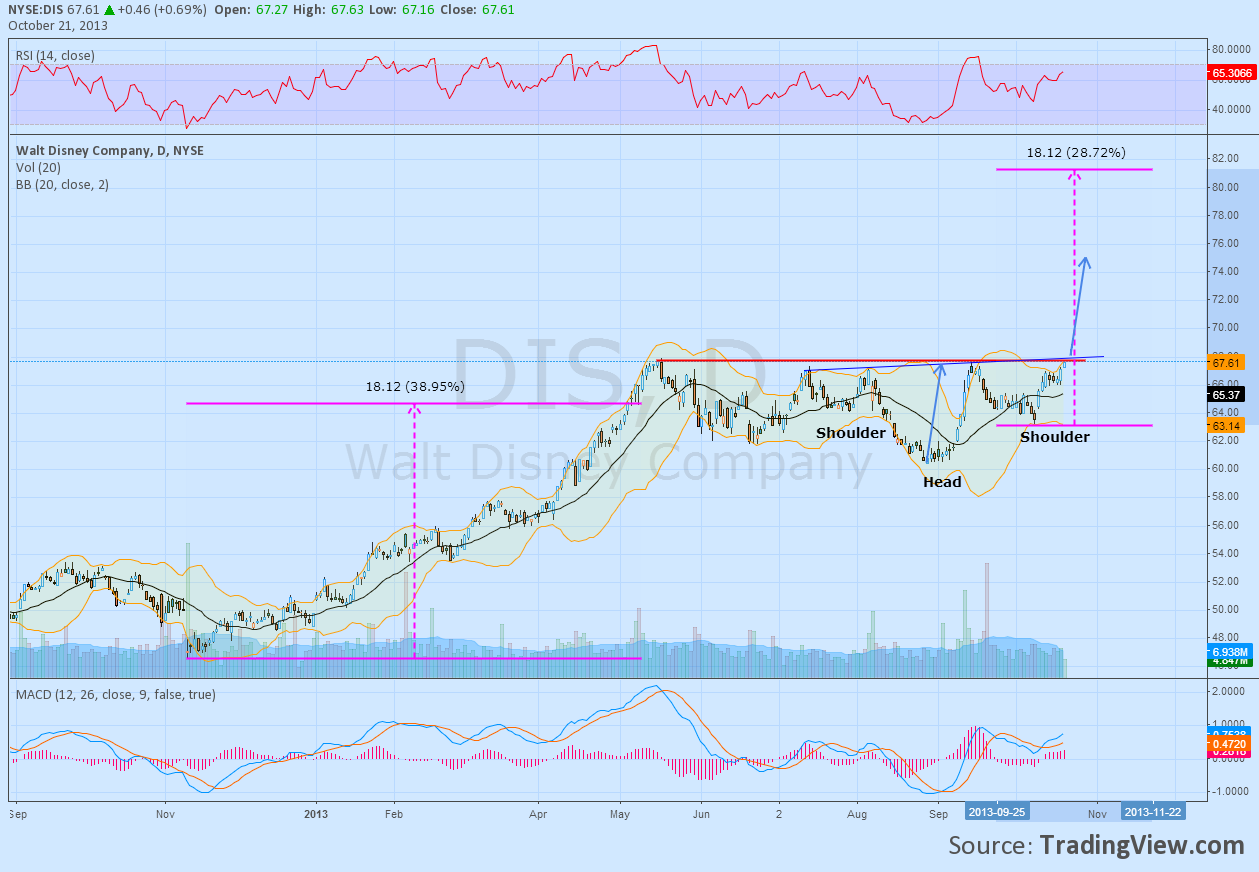

like a target a Fundamental Analyst would use so lets dig in a bit closer first to see what is more reasonable in the shorter timeframe. The daily chart below shows the consolidation zone zoomed in. The red line of resistance at 67.60 is being tested from below Monday. It has support for a move up through it from the momentum indicators. The RSI is rising in bullish territory and the MACD line (blue one at the bottom) moving higher. These are good things. Also the yellow channel around the price formed by the Bollinger bands is opening higher as the price presses on it. This is also positive. A break of that resistance would carry a conservative target of 81.22 on what is called a Measured Move higher, shown with the

pink dotted line. I like to see multiple forms of Technical Analysis re-enforcing each other though to make a trade. In this case the thin blue line will act as a neckline for a Inverse Head and Shoulders pattern if and when the price breaks through it at about 68. This would carry a price objective of at least 75. So a move over 68 has targets of 75 and then 81.22 before the long term view of over 1000 kicks in. I am starting my application to join the Mickey Mouse Club ready for my accounts.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.