Joe Sixpack’s Economy Is Already In A Recession

Econintersect LLC | Jun 17, 2012 12:05AM ET

It comes as no surprise to me that many believe we are in a recession. Joe Sixpack’s portion of the economy sucks (e.g. not good, for those who are uncertain what “sucks” means).

The metric used to gauge economic growth by APP (Academics, Pundits and Politicos) is GDP (Gross Domestic Product). It includes elements which have no direct relationship to Joe. GDP is a metric to understand the economy of the 0.01%, or the country as a whole. Joe lives in a world of income, expenditure and net worth. If Joe sees growth in his world, then his economy is growing.

Joe’s world is contracting – literally. Joe’s world is in a recession. Instead of looking at aggregate growth, the way to view Joe’s world is to look at per capita growth, and specifically at the money flows that involve Joe directly.

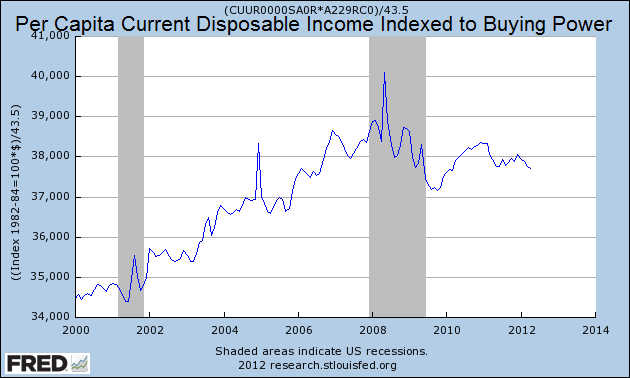

The graph below shows April 2012 per capita disposable income 0f $37,711 (current dollars) indexed to the buying power of the dollar. Joe’s world is operating at the same levels as five years ago. This is Joe’s REAL income growth – and it shows Joe’s real income is shrinking.

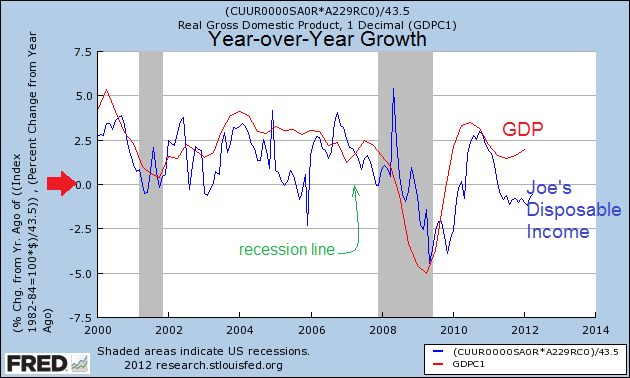

Taking the data in the above graph, and comparing growth year-over-year with GDP – I argue that Joe’s world has been shrinking since mid 2011 – just as the establishment was telling Joe the economy is growing.

And Joe’s assets suck. Joe’s primary asset is his house. Although pundits (including me) are telling you the housing market has bottomed, there is a big difference between a “bottom” and a “recovered” market. Joe on average is worth half as much as he was before the Great Recession.

My view continues to be that the economy overall is in a depression at least since the beginning of 2008. A depression per Click here to view the scorecard table below with active hyperlinks.

News Releases this Week:

Bankruptcies this Week:

Allied Systems Holdings, Northstar Aerospace’s U.S. subsidiaries [Northstar Aerospace (USA), Northstar Aerospace (Chicago), Derlan USA and D-Velco Manufacturing of Arizona]

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.