It's Only The Fed, Stupid. Hike Or Not, Here's How To Profit

Joseph L. Shaefer | Sep 21, 2016 12:25AM ET

Democratic strategist James Carville’s “It’s the economy, stupid” catch-phrase catapulted Bill Clinton into his second term. These days economic progress and the real economy have taken a back seat to the Fed and the other central banks.

Too many market participants obsess over each inflection or raised eyebrow of a Fed, ECB, BOJ, or PBOC official. Enough already.

Here’s what I sent our clients about obsessing over the Fed—and what we are buying.

Every hiccup, eye blink or clearing of the throat from some Fed governor or their counterpart in the European Central Bank, the Bank of Japan or the People's Bank of China is carefully observed and parsed by analysts from London to Canberra to Ottawa.

And for what? World economies—and world markets—have fared no better since the advent of central bank interventions in the economy and artificial jiggering of markets than they did in the decades prior. Their latest depredation, keeping rates so low that savers are penalized and risk-taking is rewarded, may yet come a-cropper.

No, not in the short term; in the short term we can party hearty courtesy of low margin rates and cheap financing of cars, land, houses, etc. But long term? What the hell are we thinking?

$60,000,000,000,000. $60 trillion. More than the combined gross national product of the US, the EU, China and Japan. That's how much sovereign (issued by governments) debt is currently outstanding. More than 25% of this debt carries a negative interest rate. Investors are paying governments for the privilege of getting less money back in 10, 20 or 30 years —and that's less money back in today's dollars.

As central banks strive to increase inflation, they enjoy the double benefit of having investors pay them once for the privilege of holding their money, then yet again as the bankers depreciate the value of the dollars, yen, yuan or euros they have "invested" in. Nice work if you can extort it, nicer when people are dumb enough to line up for it.

By the way, the $60 trillion is but a drop in the bucket of actual "indebtedness." Yes, that figure accounts for the sovereign bonds currently outstanding. But it does not include the indebtedness of promises made. All developed nations and many developing ones have assured pensioners that they will enjoy a social security safety net when they end their working years. Still others have added the assurance that heath care, no matter the cost, will be provided to all.

Given advances in health care technology, enhanced drug therapies and significantly longer life spans, this last political promise alone could dwarf the $60 trillion in currently-outstanding sovereign debt! (Of course, it might also allow us to be more productive longer, allowing each individual to contribute to an expansion of the national wealth well into our 70s or 80s - or, worst case, it could create a generation of people barely alive or at a significantly diminished level of competence and health. We simply don't yet know).

To cover such expenditures, governments enjoy the benefits of taxation, of course, so they can always raise taxes while steadfastly decrying the fiscal irresponsibility of previous generations of investors, taxpayers, politicians and central bankers. But the conundrum then becomes: at what point do taxes to cover yesteryear's promises become so confiscatory that they destroy entrepreneurial incentive and greater individual or national productivity?

The founder of hedge fund Elliott Management, Paul Singer, has said it most succinctly: "...the entire developed world is insolvent." He may be right.

By punishing saving and thrift, what kind of society are we creating? Economic actions have consequences that go well beyond the economic realm. The central banks of the developed world have succeeded in saving the big banks and broker-dealers, which is of course the universe in which the Fed and its clones in other nations exist and are defined by. But by encouraging corporate and financial risk-taking without consequence and punishing those on a fixed income, they are testing the limits of the law of unintended consequences.

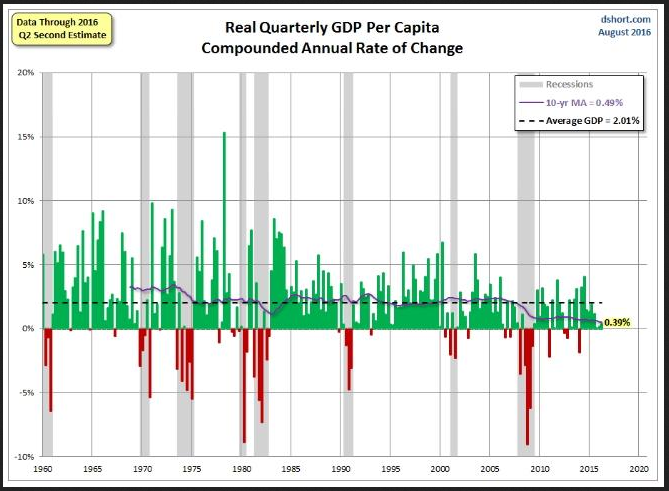

Even if the social fabric is not irrevocably altered by this 7-year experiment, there is a more pragmatic problem: the central bankers have failed to accomplish even their single-minded goal of creating economic growth. That's what they promised if only we'd go along with their prescriptions. Look around the country, the continent, the entire developed world. Is 1% growth really better than individual workers and companies have done previously on their own with lower taxes, better education, more trade, and a whole lot less intrusive regulation? I doubt it.

Managed economies have failed miserably, from the USSR to today's Venezuela. Yet we see no recognition of this from the developed world's central bankers. Adam Smith's enlightened self-interest with appropriate and necessary regulation created the economic miracle that lifted the world from the whims of absolute monarchy, not meddling by dictators or unelected nannies with an agenda.

Depriving central bankers from "but it looked good on paper" solutions would go a long way to allowing the natural flow of funds between companies and individuals to lift the economy from its moribund ways.

More specifically, to deal with the events of today and tomorrow, what will the markets do now? Short answer: I don't know and neither does anyone else. All are guessing, guesstimating, playing an informed hunch or, if they are proven correct, "engaged in deep research and analysis to reach this inescapable conclusion." If wrong, they're just figuring you'll forget what they said. My personal take, worth every penny you are paying to read this, I expressed in a private note to clients 10 days ago:

It's Still The Central Bank. The excuse for the recent volatility after 51 days of never moving as much as 1% is that the Fed might raise rates this week. People panicked and sold municipal bonds, preferreds, gold, oil, everything. We are keeping our trailing stops but otherwise didn't sell anything of late. We may have to yet, but I think this is a pretty silly over-reaction. Either the Fed will raise rates a whole 25/100 of 1%, in which case the most likely scenario is that there will be a relief rally and we'll move on to the next crisis, or they won't, in which case the most likely scenario is that there will be a relief rally.

So what are we doing? First, we are working to increase our yield by buying closed-end funds (CEFs) at a discount. Many tout CEFs because they often sell at a discount to NAV. That in itself is meaningless. Buying $1 of value for 82 cents does not mean the investment "must" someday sell at full NAV. The discount may never close and, for most CEFs, it never does. However, buying at a discount does ensure that a portfolio of 5%-yielding securities, selling at a significant discount, will effectively yield a greater amount without reducing the quality level of the portfolio to gain the extra yield. That's the benefit of buying quality holdings at a discount.

I particularly like buying municipal bond CEFs In this manner. Whenever there is some scare—the Fed is going to raise again, Puerto Rico is going to default, Illinois can't pay its bills, etc., I've been able to buy muni CEFs at increased discounts. This boosts our yield and also, thus far, has given us some nice capital gains.

If you follow my writing but haven't yet joined me in buying these muni CEFs, I recommend BUYING Invesco Value Municipal Income (NYSE:IIM). A month ago it sold at a slight premium. The NAV hasn't changed since then but panicky investors have driven it to a 5% discount in 30 days! Another BUY is BlackRock Investment Quality Municipal Trust (NYSE:BKN). BKN only sells at a 1% discount to NAV but that's the deepest it's been since May.

We have also chosen to invest in solid REITs that yield more than other alternatives because their valuation metrics are a bit harder to understand for investors. Real estate tends to move in different cycles than equities, so even with Fed increases, they are often able to pass along their increased borrowing expense to their commercial and retail tenants. Among my favorites is Ladder Corp (NYSE:LADR), a commercial properties mortgage REIT that has been beaten down in fear of a rate rise.

That might make sense if rates were expected to rise 2% or so but, for a ¼ of a percent...really? For this the trust has fallen from 13.85 at the beginning of the month to 12.90 today. Somehow I don't see a .0025 rate increase eating into developers' profits enough to stop them from building needed commercial infrastructure.

There is, of course, always the risk that the Fed will be decide to reverse course and raise rates much more quickly, which will impact all income holdings. For that event, we have hedged this risk by buying mutual funds and ETFs that have zero or close to zero correlation to US and Euro markets. One example is MCRDX, which consists of bonds of faster-growing firms in Singapore (a favorite of ours), Taiwan, Korea, China, et al. These firms are not as well-known in the US but they want to sell bonds in US dollars and pay a premium for that visibility.

Another example is long/short funds like our OTCRX. A third hedge we use are merger arbitrage funds like VARAX. No matter the market, companies are acquiring and merging. We are currently using alternative funds like OMOAX as well. I've discussed all of them in previous articles and all form part of our Un-Beta Portfolio.

We are poised to buy more of all the above if the market falls, or only nibble then wait for a reaction to add to our positions. We heed Coach Wooden's advice in such things: "Be quick, but don't hurry." Or, be ready to move but don't do something stupid just because the media trample one way or the other.

For us, these are additions to existing positions and you can read more about them in my articles in preceding months. If you have not taken any positions, please be advised if this strategy is appropriate for you we suggest you do as we are doing: BUY IIM, BKN, LADR, OMOAX, VARAX, MCRDX and OTCRX.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they might be of value in your own investing. Past performance is no guarantee of future results. Our many years of success might have been just dumb luck.

Disclosure:I am/we are long IIM, BKN,LADR OMOAX VARAX OTCRX MCRDX.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.