ISM Survey Being Driven By Inventory Restocking Cycle

Lance Roberts | Dec 06, 2013 02:11AM ET

Lately, there has been a significant uptick in the ISM Manufacturing Survey's that have raised hopes that economic growth will finally, after three years of disappointment, begin to accelerate. David Rosenberg just recently wrote in his daily missive that:

"The U.S. is in clear expansionary mode."

However, before we get too terribly excited it is important to remember a couple of things. First, the ISM survey is a sentiment survey of how manufacturers currently "feel" about their business. If they are very busy producing products, then it is not surprising that sentiment would increase.

As I discussed recently in "I discussed recently, the weakness in consumer spending and incomes bodes poorly for the upcoming holiday season.

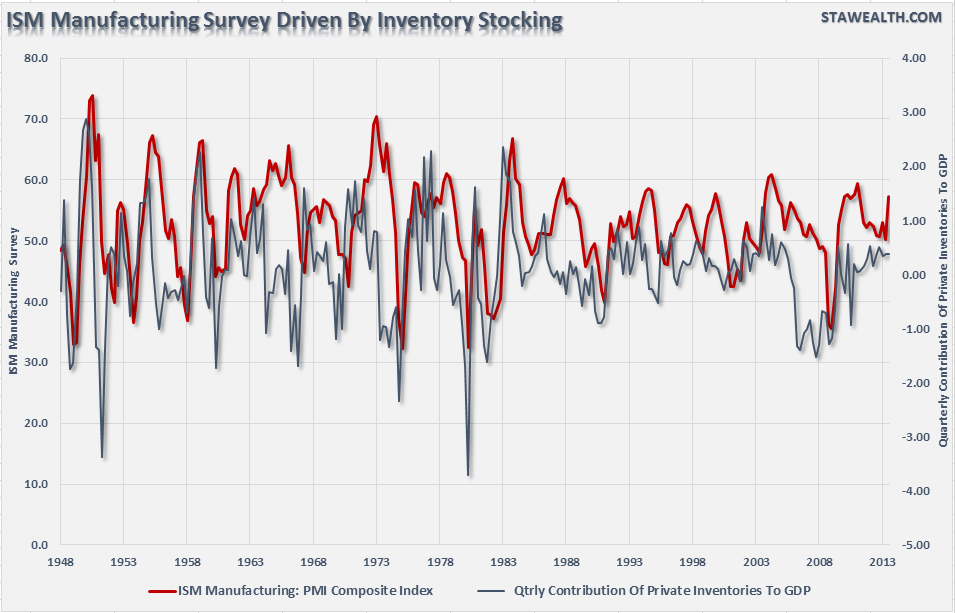

This brings us back to the ISM Manufacturing Survey. In general, survey's such as the ISM, are more of a coincident rather than a leading indicator. When business is brisk, business owners tend to extrapolate the current environment into the future. However, sentiment, as shown in the chart below, can turn negative very quickly. Not surprisingly, there is a historically high correlation between the ISM Manufacturing Survey and the net contribution of the change in private inventories to the economy.

The potential issue with consumer spending on the decline, is that the buildup in inventories will likely begin to weigh on manufacturers sentiment. However, as shown in the chart above, it would not be unusual to see a sharp decline in sentiment in the coming months given the current detachment of manufacturers outlooks from the underlying economic fundamentals.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.