Is The Weak Data On U.S. Industrial Production A Warning Sign?

James Picerno | May 18, 2015 07:51AM ET

Last week’s disappointing economic news has raised new worries about business cycle risk for the US. It’s still premature to assume the worst, but it’s clear that there’s still not much support for a strong second-quarter rebound after Q1’s weak performance. That could change in the updates in the weeks ahead. Meantime, the macro profile for April looks weak.

The crucial exception: the labor market. Payrolls posted a solid gain last month and jobless claims continue to suggest we’ll see more of the same in the months to come. But other corners have been soft so far in 2015 through last month. Is this more than a temporary stumble? It’s prudent to answer “no” until we see a compelling case in a broad set of indicators that tell us otherwise. We’re not at that point, but April’s numbers on industrial production look worrisome because they mark an ongoing deceleration in growth that’s becoming harder to ignore.

As such, the economic data for May could be decisive for deciding if the business cycle is dipping over to the dark side. But those numbers are still weeks away. Meantime, let’s dig a bit deeper into industrial production through last month in search of big-picture perspective.

Looking for peaks and troughs in industrial output as a proxy for the business cycle has a long history in macroeconomics. Like any one indicator, however, its value is limited in the quest to find reliable and timely signals about recession risk. But let’s put that caveat aside for now and review industrial production through the prism of a probit model .

I published a similar analysis a few weeks ago for GDP. Despite the weak Q1 report, GDP’s virtually flat performance in the first three months of this year didn’t mark a clear warning that a new recession had started. Let’s apply the same econometric analysis to industrial activity.

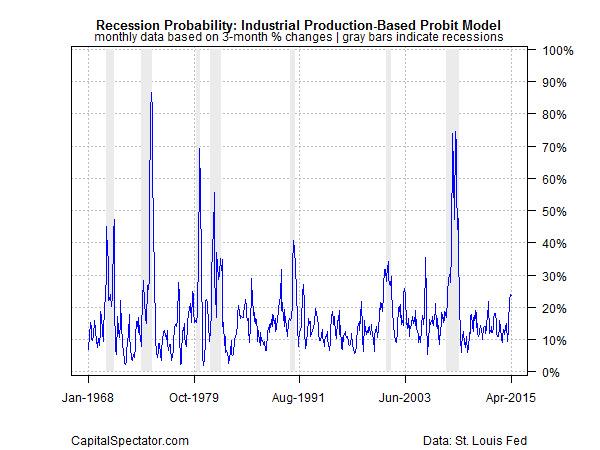

Once again, in line with the results in the GDP analysis for Q1, we find that business-cycle risk has increased via industrial production’s trend through April, but it’s still below a tipping point of no return. In the first chart, we see that the implied recession risk has edged up to roughly 24% in April. (This result is based on a probit regression of industrial production’s 3-month percentage changes against the historical record of recessions’ start and end dates as per NBER. ) The current reading represents the highest risk since June 2009, when the Great Recession ended. The recent rise is worrisome, but for the moment we’re still below—albeit only slightly–a level that history suggests marks a dark turning point—somewhere in the 25%-to-30% range.

The question is whether a 3-month percentage change is optimal for analyzing industrial production in the search for recession-risk signals? For another perspective, let’s run the analysis with 12-month percentage changes, with the results shown in the next chart below.

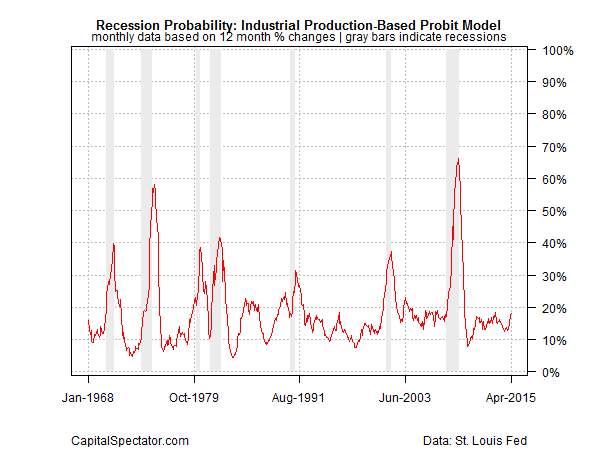

Risk has increased here as well, although the change is considerably less stark. Nonetheless, the current 18% reading is the highest in five years, although that’s below what is arguably a 20% tipping point for one-year changes.

Overall, it’s clear that the recent weakness with industrial output has raised business cycle risk. Based on the numbers to date, it’s unlikely that April will be declared as the start of a new recession. But another month or two of macro stumbling could dispense a different result. The margin for disappointing data, in short, has just about run out. As a result, the stakes are high for the yet-to-be-published figures for May.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.