Is The Massive Drop In Lumber Futures Telling Us Something?

Sober Look | May 16, 2013 03:59AM ET

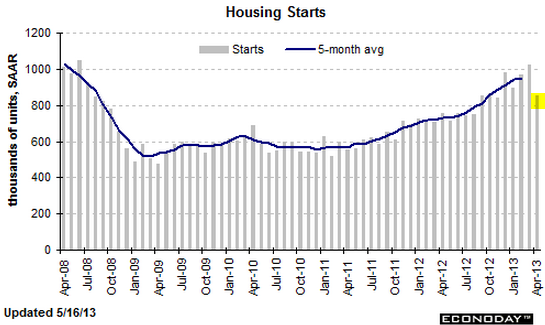

According to Nick Timiraos from the WSJ, the latest drop in the seasonally adjusted housing starts measure is nothing to worry about.

In fact he lists 4 reasons why this unexpected decline isn't in any way a sign of potential slowdown in the housing market.

WSJ: - Thursday’s housing report isn’t as much a signal that the sector is cooling - at least not until there are a few more of these report - and instead a sign that the housing rebound isn’t going to unfold in a straight line.

Perhaps. If we are not witnessing a cooling in new home construction, maybe Mr. Timiraos can explain why lumber futures have declined over 20% over the last couple of months. In April the explanation for the decline was related to cooler than usual weather conditions hampering construction. What happened in May? Some have rationalized this by the economic weakness in China. The last time we checked a large chunk of this Globex-settled lumber still goes into new home construction - while the supply certainly hasn't changed. We look forward to hearing Mr. Timiraos' explanation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.