Is ISM Manufacturing A Silver Bullet For Business Cycle Analysis?

James Picerno | Jun 23, 2016 07:52AM ET

Former hedge fund manager Raoul Pal is a fan of the ISM Manufacturing Index. In fact, the one-time co-manager of the GLG Global Macro Fund in London puts this widely followed benchmark at the center of his analytical universe for all things related to global macro investing.

“The ISM is our best guide to the business cycle,” he says in a new 40-minute video. The index is regularly featured in his monthly newsletter, The Global Macro Investor. Pal’s reasoning for using this index inspires a fresh look at how the ISM numbers stack up for estimating recession probabilities in the US.

The idea that the ISM data is valuable information for modeling the business cycle isn’t new or controversial—many economists and investors eagerly read the monthly updates for this dataset in search of big-picture insight via the most sensitive slice of the US economy.

Here at The Capital Spectator, this data is one of several metrics for analyzing the business cycle in our monthly economic profile and in The US Business Cycle Risk Report. But Pal effectively argues that the ISM numbers deserves high priority—perhaps much more so than most investors recognize.

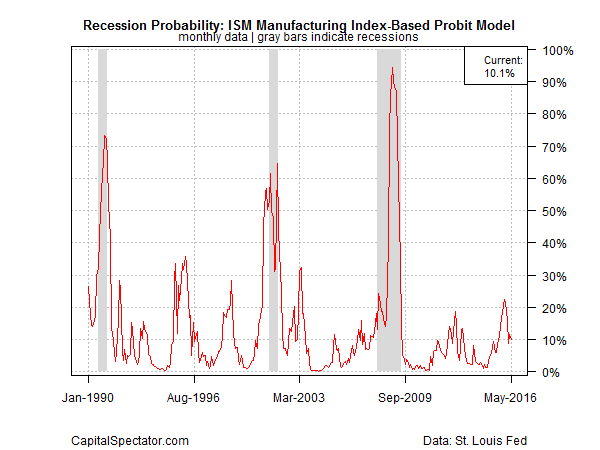

To test that advice, let’s run the ISM data through a NBER’s monthly recession signals. The goal is to search for a degree of objectivity by translating ISM’s raw numbers into recession probabilities. (As a preview, this methodology assigns a low probability that a US recession started in May.)

The chart below zooms in on the results of this modeling excercise since 1990, during which time there were three US recessions, as indicated by the gray bars. There’s certainly a relationship between the ISM and the business cycle. But the probit model output history suggests that there are also hazards in relying on the ISM alone for estimating recession risk.

Consider the last recession, which started in Jan. 2008 (the economy peaked in Dec. 2007), according to NBER. A clear warning of recession didn’t arrive in the ISM-based probit model data until October 2008, when the recession probability estimate jumped above 50% for the first time—to 75% in Oct. of that year.

Perhaps probit modeling isn’t well suited for the ISM and so looking at the raw data directly may offer a clearer and earlier signal. Pal recommends this approach. It’s true that the ISM numbers slipped below the neutral 50 mark in Dec. 2007, falling to 47.6 by Feb. 2008. But the ISM strengthened in subsequent months, reaching 50 again in Jul. 2008. All’s clear now, of course, but it’s not obvious that using the ISM in isolation would have offered a high degree of confidence for deciding that a recession was underway.

In practice, there’s no reason why we should rely on the ISM data alone. In fact, looking to one dataset for recession estimates is probably asking for trouble, or so history suggests. To be fair, Pal’s analysis tends to look far and wide for analyzing the business cycle. His new video, however, may lead some to believe that the ISM numbers are all that you need.

Fortunately, there’s rich supply of indexes at our disposal for generating timely and relatively reliable recession signals for the US in real time. The gold standard on this front is the multi-factor Chicago Fed National Activity Index—the three-month moving average (CFNAI-MA3) in particular. For example, the index’s vintage data shows that CFNAI-MA3 issued a recession warning on Mar. 24, 2008—roughly three months after the peak in economic activity.

Let’s recognize that there was no shortage of analysts predicting a recession prior to Mar. 24, 2008. But there were also many advising that the economy would continue to grow as Q1:2008 came to a close. The challenge is that most of the recession and growth predictions were more or less ad hoc. A credible methodology for analyzing the business cycle in real time requires a clear set of rules.

You can argue that the ISM data issued an earlier warning than CFNAI-MA3 in 2008. But the question is whether you’re willing to put all your business-cycle eggs in one basket? Before you answer, consider that the ISM has a habit of dipping below the neutral 50 mark–a sign of contraction–without an accompanying US recession.

In short, noise infects the ISM numbers, which is true for every other indicator. The solution is looking at a spectrum of benchmarks, which helps to minimize the noise inherent in any one dataset. In the cause of supplementing the Chicago Fed’s macro index, the ISM certainly deserves scrutiny. But no less is true of the Philly Fed’s ADS Index, initial jobless claims, and other datasets.

Ultimately it comes down to deciding how much reliability and timeliness you require in the dark art of estimating recession risk in real time. There’s an inherent tradeoff between the two.

The higher the bar for one takes a bite out of the other. That said, reliability deserves a higher weight in this delicate balancing act. A timely signal, after all, is worthless if it’s wrong.

The solution is to look far and wide for modeling recession risk. It’s tempting to think that one indicator is a silver bullet, and at times a single benchmark may live up to that standard. But across the landscape of multiple business cycles there’s really no substitute to modeling a diversified set of indicators.

As for manufacturing, it’s a critical source of business-cycle insight and deserves careful review. But expecting the ISM data to tell you most of what you need to know about recession risk is going too far in my view.

Indeed, history shows that manufacturing can be weak, and perhaps even in its own isolated recession, without dragging down the broad economy. The trouble is that it’s hard to tell when this is true, or not.

Fortunately, we can look beyond manufacturing numbers to decide if the broad trend is tightly bound up with this sector’s boom-bust cycle at any given point in time.

What’s the reason why we should take a broader view? There isn’t one.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.