Is The Fed The Cause And Solution To The World's Problems?

Eric De Groot | Oct 29, 2014 06:55AM ET

In the movie Weekend at Bernie's (1989), two young insurance corporation employees, Larry and Richard, discover their boss, Bernie, is dead. They also uncover a plot in which Bernie ordered their deaths to cover up his embezzlement. The order included a provision not to kill if he's around, so Larry and Richard attempt to convince people that Bernie is still alive. Moderate hilarity ensures.

I often think of Weekend at Bernie's when a headline implying Fed responsibility for the stock market rally crosses the wire. How long can they keep dragging out the Fed (and Fed policy) as the sole driver of rising equity prices? This domestic, US centric view of the world died is long dead.

Capital, fleeing a slowing economy, oppressive taxation, the growing threat of confiscation, loss of liberty, and more, has been moving from Europe to the United States since 2009. The US media, no longer known for its independent thinking abilities, loves to position the Fed as the cause of and solution to the world's economic and financial problems. The Fed, which often uses this perception to their advantage, knows better.

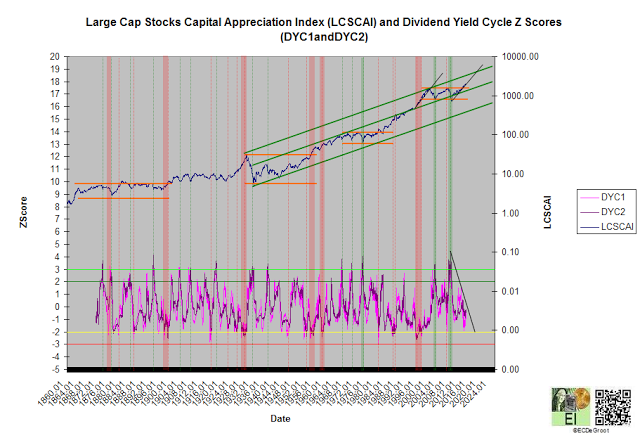

Capital, regardless of Fed policy, is flowing into markets and countries with the lowest relative risk. These flows could send trends and valuations to concentration not seen for many cycles (chart 1 and 2).

Headline

: World stocks gain as focus shifts to Fed meeting

TOKYO (AP) — Global stock markets swung higher Wednesday, cheered by a surge in U.S. stocks that were buoyed by solid earnings, while investors were also waiting for signs from the Federal Reserve on U.S. monetary policy.KEEPING SCORE: Germany's DAX rose nearly 1 percent to 9,153.70 and the CAC 40 in Paris inched up 0.3 percent to 4,126.38. Britain's FTSE 100 rose 0.5 percent to 6,433.18. It was unclear whether Wall Street was headed for another day of gains. Futures for the S&P 500 were little changed at 1,979.90. Dow Jones industrial average futures were up 0.1 percent to 16,955. On Wednesday, the S&P rose 1.2 percent, and the Dow Jones industrial had added 1.1 percent.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.