Is The Fed Setting The Stage For A Lower Normal Rate Horizon?

MarketPulse | Aug 25, 2016 06:52AM ET

Thursday August 25: Five things the markets are talking about

Currently, the Fed is saying one thing, but the market is trading on something else. Recent official rhetoric expects a rate increase sometime this year, but the U.S yield curve is not pricing that in at the moment. In fact, the first full +25bp increase is not priced in for another 12-months. Will we get clarity from Ms. Yellen at Jackson Hole this Friday?

Maybe not, but a Fed policy change may be in the making. In contrast to the somewhat hawkish near-term guidance, the Fed’s discussion of the longer-term funds rate outlook is somewhat subdued. Do not be surprised that in next month’s “dot plot” guide, a number of officials might lower their projections for the longer-term level of the Fed funds rate further.

Let’s hope Ms. Yellen can break the current monotony of these markets, any further lack of Fed transparency and investors will be condemned to even tighter trading ranges, at least until the other major central banks come back on line in September.

1. Global stocks see red

Euro and Asian bourses are sharply lower in the overnight session, extending yesterday’s North America’s modest losses.

Shares in Shanghai shed -0.6%, even as the People’s Bank of China (PBoC) put more cash into the system through their 14-day reverse repurchase agreements (suggest no further interest rate easing on the horizon). Australia’s S&P ASX 200 fell -0.4% following recent declines in commodities prices.

Germany’s DAX has fallen further into negative territory (-1.1%) after this morning’s data disappointed. German Ifo business climate index fell to 106.2 from 108.3 in July, hitting its lowest level since February, as the mood has deteriorated in most parts of German industry, as well as among retailers and wholesalers.

Elsewhere, banking and financial stocks are leading the losses with the Italian peripheral lenders leading the losses seen in the Eurostoxx. In the U.K, healthcare stocks are leading the losses seen in the FTSE 100 ahead of the U.S open.

Indices: Stoxx50 -1.0% at 2,976, FTSE 100 -0.7% at 6,785, DAX -1.2% at 10,494, CAC-40 -1.1% at 4,385, IBEX 35 -1.0% at 8,573, FTSE MIB -0.8% at 16,758, SMI -1.1% at 8,113, S&P 500 Futures -0.2%.

2. Crude Oil prices splutter, while gold falls

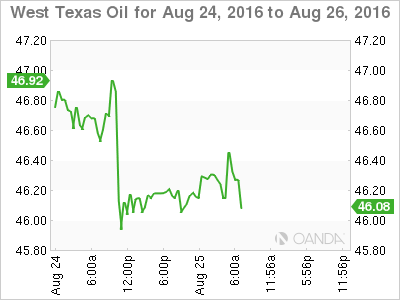

Oil prices continue to trade under pressure for a third consecutive session as the market focuses on oversupply and fading hopes of a production freeze next month – prices rose +20% in the first three-week’s of August on hopes of a a deal.

Brent is trading down -15c at +$48.90 a barrel, having closed down -1.8%yesterday, WTI of light crude remains unchanged at +$46.77 a barrel, after dropping -2.8% on Wednesday.

Also contributing pressure to energy prices are high storage levels. In the U.S, data yesterday showed that commercial crude oil stocks rose by +2.5m to +523.6m barrels – that’s +16% higher than a year ago. In refined products, stocks around the world are also brimming as demand slows while refinery output remains high.

Gold remains under pressure, trading atop of its four-week low (+$1,329) this morning as concerns over the possibility of an interest-rate increase by the Fed is pressuring the weaker ‘long’ positions to close out their bets on the precious metal.

3. Sovereign yields trade in another tight range

The bulk of investors prefer to wade to the sidelines ahead of Jackson Hole. Nonetheless, with equity markets wilting and currency markets being noticeably subdued is providing a small bid for both fixed income and money market product.

Some disappointing German business sentiment numbers this morning has 10-Year Bund yields slipping ahead of the open stateside (-0.09%). In Portugal, it’s own borrowing costs are also pulling away from recent one-month highs helped by a deal to recapitalize an ailing state-owned bank.

The yield on the benchmark 10-Year U.S. Treasury note is +1.562% compared with +1.541% yesterday. EM investors continue to take advantage of price dips to buy more Treasuries – U.S 10’s climbed as high as +1.6% late Sunday night.

4. People’s Bank of China (PBoC) use reverse repos

Central banks are required to be more innovative and that even includes the People’s Bank of China (PBoC). China is again seen willing to provide more liquidity to encourage fluidity throughout their financial system.

After using 14-day reverse repos for the first time in six-months yesterday, the PBoC followed up with a second similar injection in the overnight session. Why? Analysts see their actions as a direct response to tighter liquidity, rising leverage in the bond market, and resulting reluctance by the central bank to undertake more direct response such as RRR or an outright interest rate cut.

One year on since the renminbi revaluation crash, authorities are required to be proactive to avoid another market capitulation. The PBoC meets reqularily with major banks to discuss closer liquidity management, encouraging them to lend in installments and spread out the loan terms. Their aim is add long-term funds to the market, but also to maintain its current monetary policy stance relatively unchanged against expectations of continued easing.

Booming property prices remains a concern for central banks with credit so cheap. China is also reportedly looking at additional curbs to reduce the surge in property prices, with consideration of higher down payments and closer scrutiny over mortgage loan practices.

5. Dollar directionless, market awaits Yellen

The FX markets remains in a holding pattern ahead of Fed Chair Yellen speech tomorrow. Both dealers and investors continue to ponder the question whether Ms. Yellen would sound as ‘hawkish’ as other Fed speakers have of late.

Markets have used Yellen as “the” excuse not to trade, thus expectations are relatively high that she will provide the guiding light on rate normalization timing. In reality, the Fed chair is likely to disappoint as historically, she has always refused in the past years to provide any hints at the on-going policy.

So why would she change tactics now? There are no reasons why she should explicitly signal a rate hike for December or even September.

Currently, USD/JPY is down -0.1% at 100.37, EUR/USD up +0.2% at $1.1292 and AUD/USD up +0.3% at $0.7634.

The USD may pick up if U.S. durable goods data come in strong (exp. +0.4% vs. -0.4%).

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.