Is The Fed Altering Asset Prices?

Chris Ciovacco | Oct 22, 2014 04:44PM ET

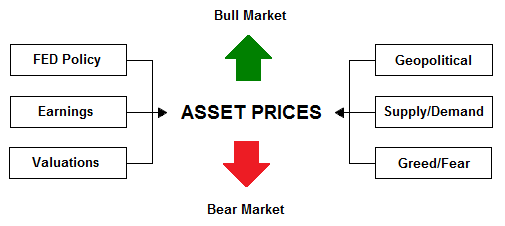

Markets are never driven by any single factor at any moment in time. Asset prices are impacted by an almost limitless amount of inputs including Fed policy, earnings, valuations, geopolitical events, supply, demand, conviction, greed and fear.

The Fed And ECB Are Important Factors

Central banks, including the Fed and European Central Bank (ECB), can alter the supply of money, provide loans to struggling banks, and even pick winners and losers (see 2008). Therefore, central bank policy represents one of the most important factors impacting markets and the prices of all assets, goods and services.

This Is Nothing Particularly New

When you are new to the markets and begin to understand what the Fed can do (print money, buy assets, inject new funds into the financial system, etc.), there is a certain shock value along the lines of “do people understand what is going on here?” While the concept of central banking is odd in the context of free markets, central banks have been impacting, altering, skewing, goosing and/or propping up asset prices long before most of us were born and they will most likely be doing so long after we are dead.

Blaming The Fed Is Not The Answer

Any successful trader or investor will tell you a key point in the market’s cruel learning process is accepting that we are 100% responsible for our own actions and results. It is easy to blame the Fed when things go wrong in trading and investing. Rather than blaming, it is better to understand the Fed is an important part of the markets, the U.S. central bank is not going away anytime soon, and we must account for Fed policy when making investment decisions.

Many Ways To Skin The Market Cat

A great thing about the financial markets is there are an almost infinite number of ways to skin the risk management and market cat. One way is to focus on price or the markets themselves, based on the premise that “price captures everything”, including the impact of central banks.

Are Central Banks In Full Control?

One of the biggest misconceptions held by some investors is that the Fed can always bail out the markets. If that were true, why did the Fed let stocks fall over 50% in both the dot-com (2000-2002) and financial crisis (2007-2009) bear markets? If they lost control then, then it seems reasonable they can lose control again.

The Next Inevitable Bear Market

The Fed is one of many factors impacting asset prices…not the only factor. At some point the economy, earnings, inflation, deflation, geopolitical events, or the next crisis will overshadow the attempts by central bankers to keep everything propped up, which is when the next inevitable bear market will arrive. When that will be is the million dollar question, but we know one thing with 100% certainty; price and the charts will not miss the turn from bull to bear. If that sounds crazy to you, watch this video, which explores the question,

There Is No Magic Moving Average Or Indicator

The video above uses moving averages to illustrate basic concepts. Are moving averages a perfect way to manage risk? No, there is no such thing as a perfect moving average or indicator. Since moving averages have some known drawbacks (whipsaws, lag-effect), it is important to diversify our risk management inputs and make decisions based on the weight of the evidence. We would never manage risk using a single moving average or moving average pair on a single chart…it is not that simple. There are many methods that can improve our probability of success. Unfortunately, the term probability also speaks to the limitations of any method used in isolation, including moving averages. This table shows an example of using diversified inputs across multiple timeframes (moving averages are only one of the inputs).

Investment Implications – The Weight Of The Evidence

As noted Tuesday, the weight of the evidence has been improving, but many markets around the globe remain below areas of possible resistance. Therefore, we will be using two levels as guideposts in the coming days:

- 1943 on the S&P 500

- 10,301 on the NYSE Composite

The rationale for 10,301 was covered on tweet . We have already started to redeploy some of our cash, but have done so in modest amounts given the S&P has not closed above 1943. It will be easier to add to the equity side at a faster rate if the S&P 500 can hold above 1943 and the NYSE Composite can close above 10,301 this week.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.