Is The End Near For Tableau?

Estimize | Aug 02, 2016 09:41AM ET

Tableau Software, Inc. (NYSE:DATA) Information Technology - Software | Reports May 5, After Market Closes

Key Takeaways

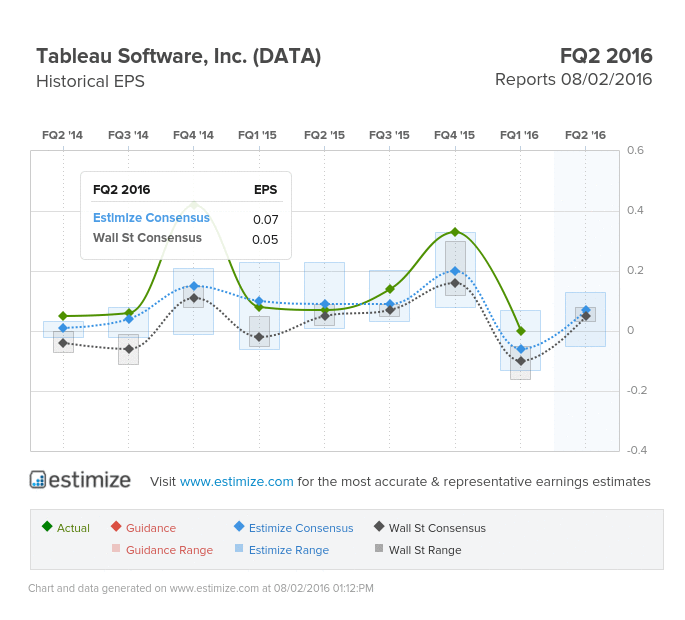

- The Estimize consensus is looking for earnings per share of 7 cents on $195.51 million in revenue, slightly higher than the Wall Street consensus

- This quarter featured an acquisitions of HyPer, the launch of Tableau 9.3 and debut of Android mobile, and analytics partnerships with the Lynda.com, Pluralsight, Udacity and General Assembly

- Just this week Deutsche Bank (DE:DBKGn) downgraded the stock to “hold” from “buy” on concerns of slow margin growth

Data visualization company, Tableau is scheduled to report second quarter earnings tonight, after the market closes. The stock is perpetually one of the most beaten down during earnings season. After Q4 earnings, shares dropped nearly 50%, only to drop an additional 10% following Q1 earnings. Early indications appear as if they are heading in the same direction ahead of tonight’s report. Just this week Deutsche Bank downgraded the stock to “hold” from “buy” on concerns of slow margin growth. For Tableau to stop the slow bleed, it will have to convince investors that this and future quarters can generate sustainable growth.

The Estimize consensus is looking for earnings per share of 7 cents, down 16% from the same period last year. That estimate has soared 138% since Tableau’s last report in May. Revenue is anticipated up 30% to $195.51 million, markedly slower than previous quarters. Shares of Tableau are down 50% in the past 12 months.

A large portion of the decline can be attributed to systemic obstacles that the whole industry is facing like currency headwinds, weak spending conditions and macroeconomic volatility. Meanwhile, Tableau also operates in a highly concentrated data visualization industry where it must compete with big tech companies like Oracle (NYSE:ORCL) and IBM (NYSE:IBM). The recently launched Business intelligence tool from Microsoft (NASDAQ:MSFT) has also put a great deal of pressure on Tableau.

Fortunately, Tableau holds a dominant position in data visualization tools with many industry leaders praising the product as leaps and bounds ahead of the competition. Tableau has been aggressive in expanding that lead with more strategic pricing and discounting measures on top of broader enterprise license agreements.

This quarter featured an acquisitions of HyPer, the launched of Tableau 9.3 and debut of Android mobile, and analytics partnerships with the Lynda.com, Pluralsight, Udacity and General Assembly.

Do you think DATA can beat estimates?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.