Is The Bond Market Wrong About The Global Economy?

Callum Thomas | Sep 25, 2017 12:25AM ET

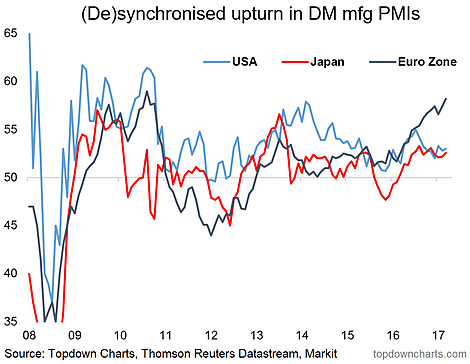

The September round of flash manufacturing PMIs saw our composite "global flash PMI" rising +0.4pts to 54.7 - the same level it got to in January before ranging as low as 53.9. Looking at the breakdown, all 3 major components were up in September: Eurozone +0.8 to 58.2, USA +0.2 to 53.0, Japan +0.4 to 52.6.

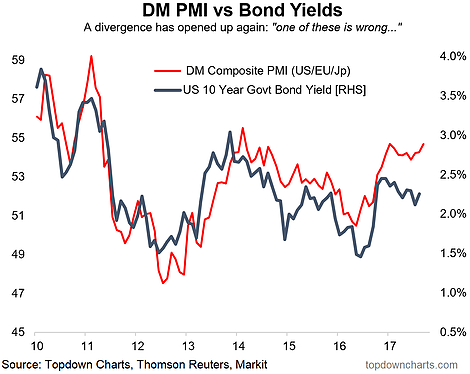

The global (developed markets) composite PMI has averaged 54.3 YTD, vs an average 51.9 in 2016. Despite the slight slowing in the first half of the year, it has been the strongest patch of growth since the post-crisis rebound, and that's where it gets interesting...

What's also worth noting is that across the major developed economies, spare capacity is quickly running out. Solid global growth, particularly in the developed economies, paired with tightening capacity utilization in industry and the labor market is typically a recipe for inflation. Stronger growth and higher inflation are typically the key ingredients for higher bond yields, and certainly make it harder to argue for ongoing QE: we've already seen the Fed announce bond yield has diverged to the downside against the DM composite PMI, whose September flash reading jumped to the highest level since January.

As noted previously, the strength in the Eurozone PMI puts the ECB in a difficult position regarding its QE program, and it will likely soon back away from its QE program. Thus the best days of QE globally are likely behind us for now, and this will likely put upward pressure on bond yields.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.