Is Pfizer Preparing For A Rebound?

JFD Team | Jan 11, 2021 07:09AM ET

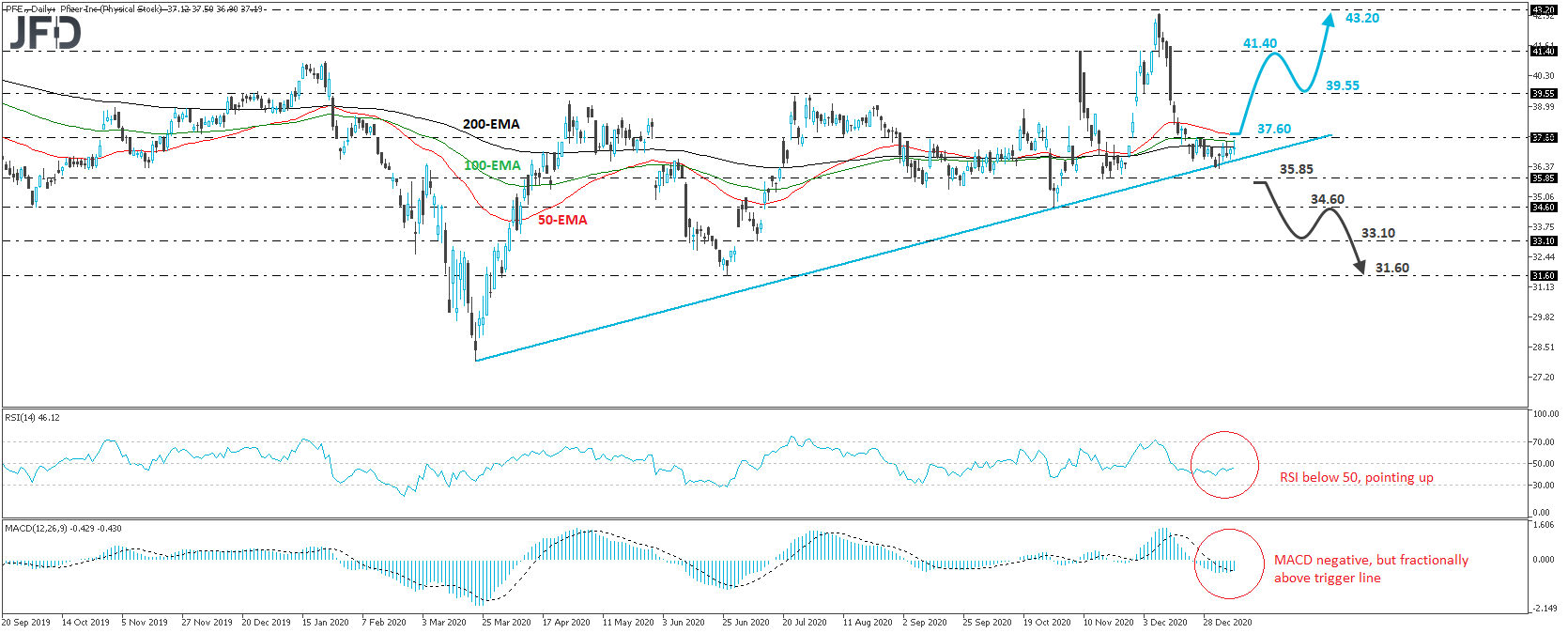

Pfizer (NYSE:PFE) traded in a consolidative manner the last few days, staying slightly above the upside support line drawn from the low of Mar. 23. As long as the stock stays above that line, we would see decent chances for a rebound, but we would start examining such a case only if we see a break above the peak of Dec. 24, at 37.60.

As we already noted, a break above 37.60 may confirm a potential rebound in this stock, and may initially pave the way towards the inside swing low of Dec. 3, at 39.55. If investors are not willing to stop there, then the next barrier to consider as a resistance may be the 41.40 zone, marked by the highs of Nov. 9 and Dec. 2.

Another break, above 41.40, could pave the way towards the 43.20 hurdle, which is fractionally above the peak of Dec. 9, and is marked by the low of July 29, 2019.

Taking a look at our daily oscillators, we see that the RSI lies slightly below 50 but points up, while the MACD, although negative, has bottomed and moved back above its trigger line. Both indicators detect diminishing downside speed, which enhances the case for a potential rebound soon.

In order to start examining the case of larger declines, we would like to see a dip below 35.85, marked by the lows of Nov. 17 and 19. The price would already be below the aforementioned upside line, and we may thereby see declines towards the low of Oct. 29, at 34.60. If that level is not able to halt the slide, its break may set the stage for the 33.10 barrier, marked by the low of July 9, the break of which may carry extensions towards the low of June 26, at 31.60.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.