Is Microsoft Suddenly A Bargain?

Louis Basenese | Jul 23, 2013 01:37PM ET

Talk about whiffing!

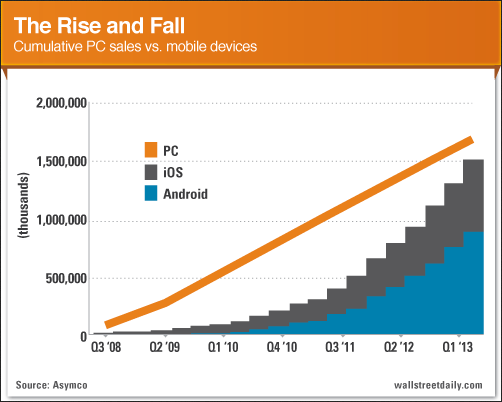

Computing giant Microsoft (AAPL ) iOS devices have almost surpassed PCs.

Or, put another way, we’re talking about “a computing category that did not exist six years ago [that] has come to overtake one that has been around for 38 years,” says Asymco’s Horace Dediu.

Even a fifth grader is smart enough to know this is a trend that’s not going to reverse itself.

Failure to Launch

Microsoft’s launch of the Surface RT last fall was supposed to resurrect the company by tapping into the blistering demand for tablets. I’d love to put CEO Steve Ballmer on Dr. Phil’s show to hear him ask, “How’s that working out for you?”

Not so good. Microsoft recently announced that it’s slashing prices by 30% to entice buyers. Suffice it to say, when you have to drastically cut prices within one year of the original launch to drum up demand, things aren’t going as planned.

Or, to put it more bluntly, as Yahoo! News’ Jason Gilbert says, “Microsoft’s Surface RT launch was an absolute and total disaster.” Indeed!

So the PC business, which accounts for the overwhelming majority of Microsoft’s business, is sucking wind. And the company’s efforts to branch out into mobile devices have belly flopped.

Could the investment case possibly get worse for Microsoft?

Yes, it can!

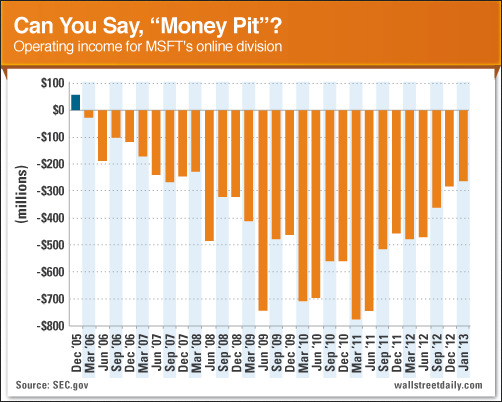

Despite aggressive advertising efforts to try to convince us to use Bing instead of Google, the company’s Online Services Division is nothing but a money pit. Take a look:

Since 2005, Microsoft has reported losses of almost $12 billion from its online operations. Perhaps one day management will finally figure out how the internet works. For now, though, the division promises to keep weighing on the company’s overall results.

It’s true that CEO Steve Ballmer recently announced a “reorganization plan.” But that’s nothing more than a plea for investors to be patient.

It’s also true that activist investor, ValueAct Capital – which purchased $2-billion worth of shares in April – is stepping up its efforts to unlock value for shareholders. And, historically, activist investors succeed.

The latest research out of S&P Capital IQ reveals that investors who follow the lead of activists can expect an excess return of 14.1% over the S&P 500 Index over the course of a year.

But is that really enough compensation to put your hard-earned capital on the line in Microsoft?

Remember, turning around a tanker takes time. And when it comes to a company with a $265-billion market cap, it could take a lot more time than it’s worth – given all the trends working against the company.

Bottom Line

Microsoft’s monopoly isn’t worth nearly as much as it used to be. Even after the sudden selloff, I wouldn’t bet on the company’s ability to reinvent itself and reenergize profit growth. It’d be a stupid bet, not a contrarian one.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.