Is Manufacturing’s Potency Fading For U.S. Business Cycle Analysis?

James Picerno | Jul 16, 2019 07:28AM ET

There are no silver bullets in the search for early warnings of economic recession, but manufacturing activity has long been on the short list of key variables to watch. No surprise, given the mostly reliable tendency of output to stumble in this corner in the early stages of contraction, if not directly ahead of a downturn’s start. But that record looks challenged since the last recession, raising the question: Has manufacturing’s value as a business cycle indicator faded?

The current issue of The Economist entertains the possibility, noting that “a third of America’s 20th-century recessions were caused by industrial slumps or oil-price shocks, according to Goldman Sachs (NYSE:GS). Today manufacturing is just 11% of GDP and each dollar of output requires a quarter less energy than in 1999. Services have become even more vital, at 70% of output.”

Instead of fickle factories and Florida condos, investment has shifted to intellectual property, which now accounts for more than a quarter of the total. After the searing experience of 2008, the value of the housing stock is 143% of gdp, well below the peak of 188%. Banks are rammed full of capital.

The services sector offers the benefit of being less volatile, and so perhaps the business cycle fluctuations have become smoother. Only time will tell. Meantime, there are other risks that will no doubt conspire to create the next recession. The only mystery: will industrial activity play a central role on par with it’s history?

It’s unclear how many analysts, if any, are downplaying manufacturing’s influence on US recessions, but it’s likely that old habits die hard. Several years ago, for instance, a widely followed investor (a former hedge fund manager) outlined the case for elevating manufacturing to the top of the list for estimating business cycle risk. The Capital Spectator was skeptical of the advice (and remains so), primarily on the well-founded assumption that any one indicator’s value waxes and wanes through time in the cause of calling new recessions in real-time. A more reliable system is tracking a diversified set of financial and economic indicators.

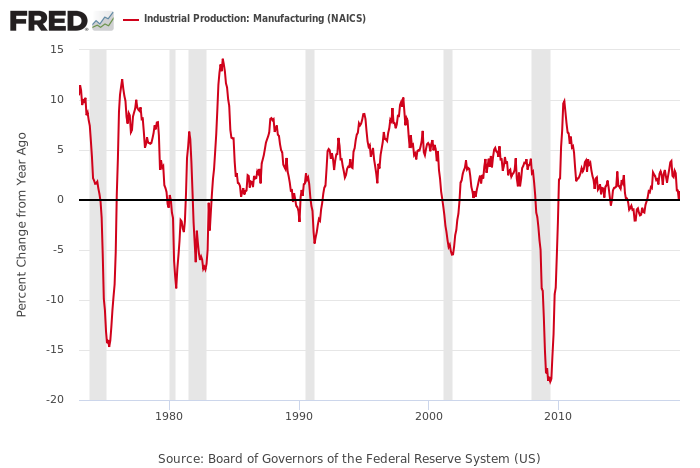

Manufacturing surely deserves to be on the list, but the last several years suggest that this piece of the economy’s business cycle signal has weakened. Consider how the Federal Reserve’s measure of the manufacturing component of US industrial output fares. As the chart below shows, manufacturing over the past half-century has reliably fallen into negative year-over-year comparisons, either just ahead of NBER-defined recessions or shortly after the start of contractions. But since the last downturn ended in 2009, this metric has issued false signals.

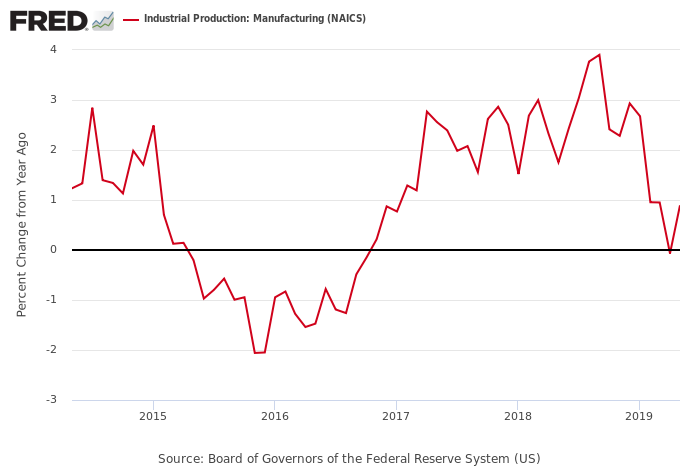

For a clearer view of recent history, the next chart focuses on manufacturing’s one-year changes since 2014. Notice that the trend went negative twice in this period: for an extended period in 2015-2016 and ever so briefly and fractionally in April of this year. Although the US hit a soft patch in 2015-2016, it’s now clear that the economy didn’t slide into recession. The Capital Spectator’s multi-indicator business cycle model reflected the weakness at the time, although the real-time analysis consistently advised that recession risk remained a low probability (see the October 2015 and March 2016 updates, for instance).

The latest dip into negative terrain for manufacturing’s trend, so far, appears to be another false signal, although the final word has yet to be written, given that April was relatively recent and the economy has slowed over the last several months. The 2015-2016 slide, by contrast, is clearly a black eye for thinking that manufacturing is always and everywhere a reliable predictor of NBER recessions.

The lesson is a reminder that betting the farm on any one indicator is problematic for real-time recession-risk analysis. That includes the Treasury yield curve, which is currently “predicting” a recession in the near term, based on the negative spread between the 10-Year Note’s rate less the 3-Month T-bill yield. Here, too, history suggests a reliable record of anticipating US downturns. The question is whether this flawless record is now flawed?

No one knows although skeptics point out that the extraordinary monetary policy over the past decade has degraded the yield curve’s signal. Note, too, that the widely followed 10-year/2-year spread has yet to go negative. In any case, it’s short-sighted to assume that the yield curve, manufacturing or any other one-indicator-wonder is the last word for estimating the probability that a recession is near (or has already started).

If only it were that easy. The reality is that developing reliable and timely recession signals requires a deeper dive. Most folks, by contrast, are looking for short cuts by focusing on one or two numbers to do all the heavy lifting.

In fact, history reminds that out-of-sample results tend to disappoint relative to in-sample modeling. One solution is to diversify the out-of-sample risk by using a carefully diversified set of indicators. The price tag, of course, is that the signal will likely arrive a bit later, but it’ll probably offer a higher degree of reliability. Note that you can improve the timeliness factor a bit by extrapolating nowcasts into the near-term future (no more than two to three months) by estimating a broad set of indicators (as an example, see the Actual vs. Estimates chart here , along with the accompanying analysis/description).

To be fair, manufacturing’s latest run of weakness, and/or the inverted yield curve, may prove to be accurate predictors of recession… or not. The issue is that in real time we don’t know which indicators will fail or succeed. The good news is that the uncertainty about single-indicator reliability can be minimized, to a degree, by focusing on a broad data set. By contrast, expecting a 30-second review of manufacturing or the yield curve, in isolation, to solve business cycle modeling challenges is the econometric equivalent of elevating faith over science.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.