Time To Short Salesforce?

Estimize | May 18, 2016 12:59AM ET

Salesforce.com (NYSE:CRM) Information Technology - Software | Reports May 17, Before Market Opens

Key Takeaways

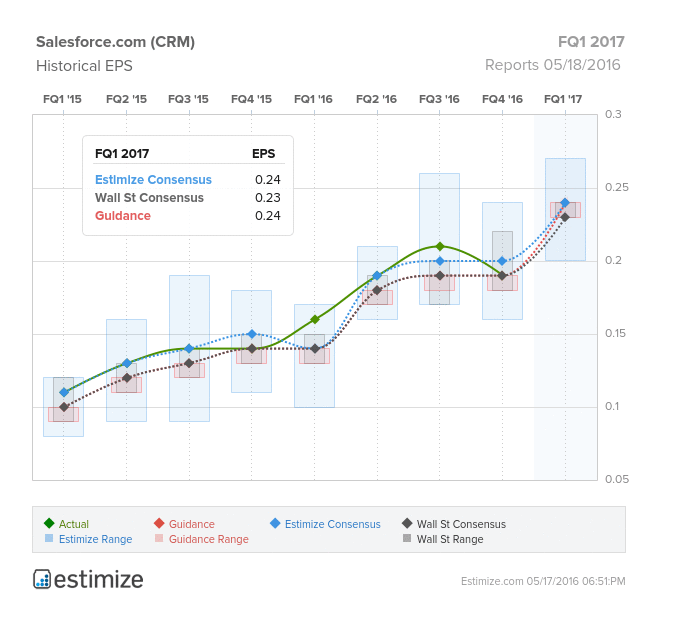

- The Estimize consensus is calling for a profit of 24 cents per share on $1.9 billion in revenue, 1 cent higher than Wall Street on the bottom line and $6 million on the top

- Salesforce recently announced its intent to launch an IoT cloud on Amazon Web Services, leveraging another high growth vertical

- As growth in the cloud space starts to slow down, Salesforce has focused on new initiatives and acquisitions to maintain its lofty growth rates.

- What are you expecting for CRM ?

By any measure, Salesforce is firing on all cylinders heading into its first quarter report. The leader in CRM software has continually reported double digit gains in both revenue and profit. Strong growth has been fueled by key partnerships with big tech names such as Microsoft (NASDAQ:MSFT), organic sales growth in its cloud based services, and the acquisition of smaller competitors which have been successfully integrated into their own suite. Higher demand for marketing and analytics tools, part of its new lightning platform, presents a new opportunity to sustain rapidly expanding growth rates.

This quarter there are few doubts that Salesforce can deliver another strong earnings report. The Estimize consensus is calling for a profit of 24 cents per share on $1.9 billion in revenue, 1 cent higher than Wall Street on the bottom line and $6 million on the top. Compared to a year earlier this reflects 48% growth in profits and 25% in sales. In this rapidly changing tech environment, strong earnings are simply not enough to push share prices. Despite a 28% gain in the past 3 months, the stock is still down year to date.

Salesforce is one of the leaders in cloud computing and SaaS services. The company’s pipeline of new initiatives continues to grow as they diversify their portfolio of services. In particular, Salesforce is seeing increasing traction from its new pricing strategy surrounding its Lightening UI platform launched late last year. Moreover, adding a layer of analytics to its suite of services will be an important long term driver. International growth also presents a major opportunity for Salesforce. Nearly 75% of revenue currently come from North America, which is okay for now given the strength of the U.S. dollar but diversifying to other regions should not go unexplored. The biggest news coming out of Salesforce recently is its intent to launch an Internet of Things cloud on Amazon Web Services.

That said, the prospect of maintaining double digit growth in perpetuity is clearly a pipe dream. Growth in cloud computing has already begun to slow as the market reaches saturation. Currently the space is concentrated at the top with big tech names like Oracle (NYSE:ORCL), IBM (NYSE:IBM), Microsoft, Google (NASDAQ:GOOGL), and Amazon.com Inc (NASDAQ:AMZN).

Do you think CRM can beat estimates?

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.