Is It The Great Rotation Or Bad Behavior?

Lance Roberts | Jul 25, 2013 02:25PM ET

There has been a significant number of articles written since the beginning of this year pronouncing that the "Great Rotation" of money from bonds into equities has finally arrived. Most recently, my colleague Josh Brown, Is This A 2007 Redux, the similarities in the current market environment, and the 2007 peak, are surprisingly similar from the perspective of leverage, earnings and economic growth. We can now add investor behavior to that list.

Tyler Durden at Zero Hedge recently posted the following, which further supports my concern:

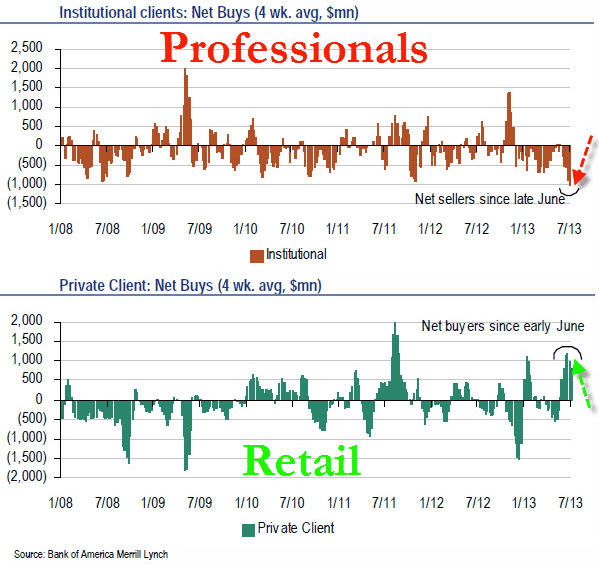

Much has been made of the inflows into US equity markets in the last few weeks with the heralding of The Great Rotation that will lift us to Dow 36,000 and beyond. The only problem...is that, as BofAML notes, institutional investors have never (that's a long time) sold as much stock as they have in the last four weeks -- as retail has been piling in.

On a four-week average basis, net sales by the Institutional clients group are the largest in our data history (since 2008). Private clients have been net buyers of US stocks on a four-week average basis since early June. Private clients' net buying streak is currently their longest since late 2011.

So it would appear the 'real' great rotation is passing the hot-potato of liquidity-driven stocks from the 'smart' money to the 'dumb' money once again."

I very much agree with this sentiment. As article after article is written chastising investors for not "jumping into the market" the psychological "fear" of being "missing out" is dragging the remaining retail holdouts back into the market.

The reality is that we have witnessed this same behavior by retail investors time and time again the outcome of which has never been good. Despite words of advice from some of the great investors of our time that the road to investment success is paved by knowing when to:

- "buy low and sell high"

- "cut losers short and let winners run," or;

- "buy fear and sell greed"

Retail investors repeatedly do the opposite. As markets rise, and reach extreme levels of exuberance, it is only then that retail investors believe it is time to jump in. Unfortunately, as shown by the BofAML study, much of that belief is driven by the self-serving interests of the Wall Street community that profits the most from retail investors emotionally driven decisions.

When will we ever learn?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.