Is Gold Really An Inflation Hedge?

Sunshine Profits | Jun 11, 2021 11:24AM ET

Inflation is back, and that’s usually depicted as good for gold. But is the yellow metal still a hedge against inflation, or has something changed?

Inflation has returned. This is partly understandable. After all, during the COVID inflation will turn out to be higher and/or more permanent than many analysts believe.

From the fundamental point of view, gold should benefit from higher inflation. But why? In theory, there are several channels by which inflation supports the yellow metal. First, the inflationary increase in the the scientific paper by Lucey and others finds a reliable long-run relationship between gold and the U.S. money supply.

Second, gold is a real, tangible and rare good with limited supply that cannot be increased quickly or at will. These features make gold a key element during the so-called flight into real values or into hard assets, which happens when inflation gets out of control. In other words, gold is the ultimate store of value which proved to hold its worth over time, unlike paper currencies that are subject to inflation and lose their value systematically.

Third, inflation means the loss of purchasing power of the currency, so when the real interest rates decline, supporting gold prices.

Fifth, high inflation increases economic uncertainty, which increases portfolio diversifier . During inflation, bonds underperform, so gold’s attractiveness increases.

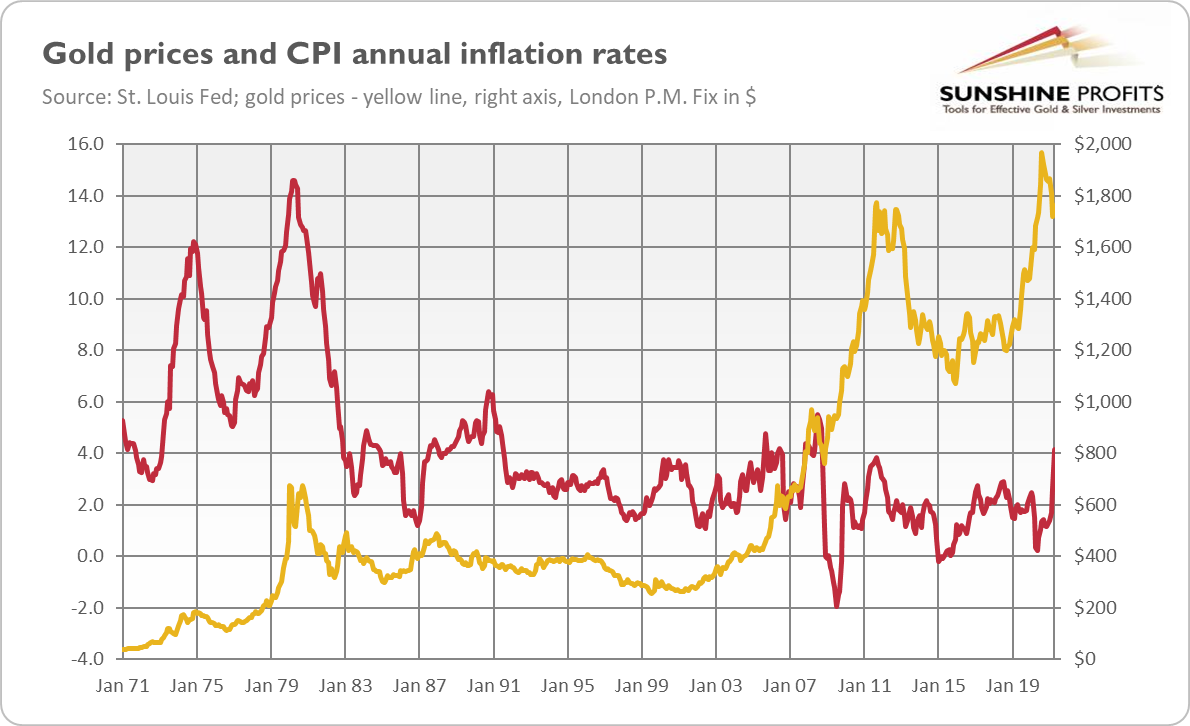

And last but definitely not least, gold is perceived as an . But is it really a good hedge against inflation? I analyzed this issue a few years ago. It would be nice to provide an update in light of more recent developments. So, let’s take a look at the chart below, which shows gold prices and CPI annual inflation rates.

As one can see, the relationship between these two series is far from being perfect. Actually, the CPI annual percentage change and the price of gold on a monthly basis.

In other words, the data shows that gold may serve as an inflation hedge only in the long run, as gold indeed preserves its value over a long time (for example, in the period from 1895 to 1999, the real price of gold increased on average by 0.3% per year). It is a good choice for investors also when there is relatively high and accelerating inflation, usually accompanied by fears about the current state of the U.S. dollar and a lack of confidence in the Fed and the global monetary system based on fiat monies .

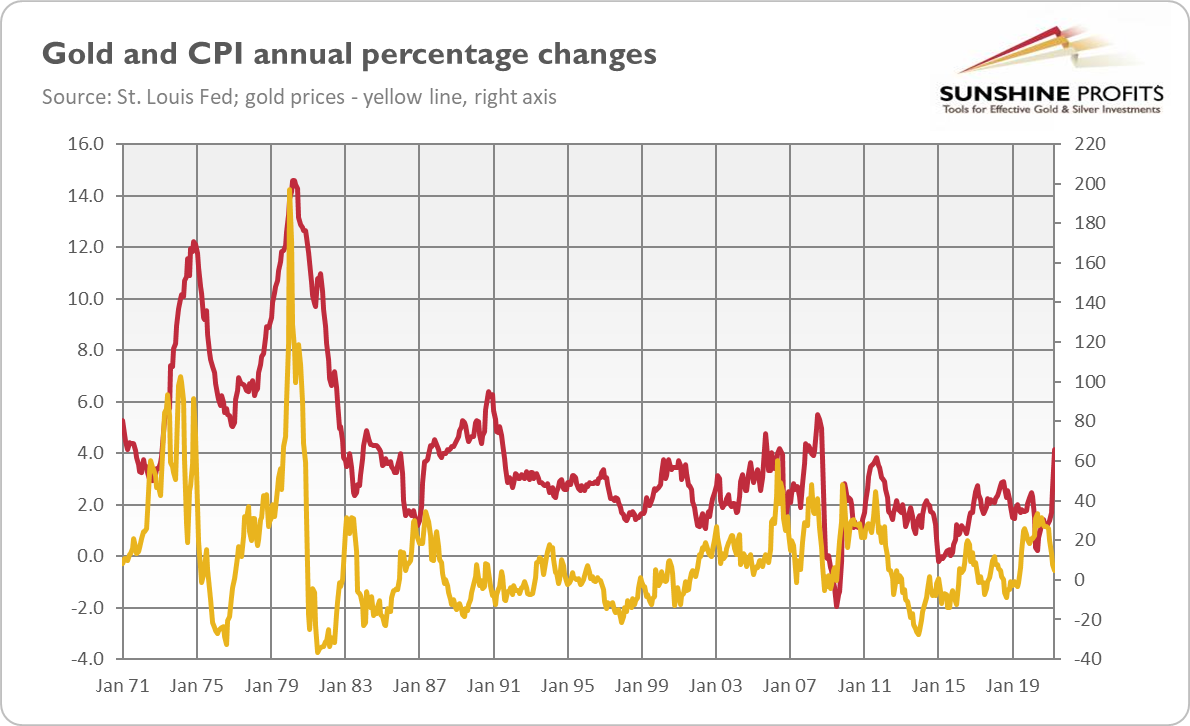

However, let’s not draw conclusions too hastily. The chart below also presents the CPI and gold – but this time both series are year-on-year percentage changes (previously we had gold prices, now we have annual percentage changes in these prices).

Have you noticed something? Yup, this time both series behave much more similarly. Indeed, the correlation coefficient is now positive (0.44). Hence, there is a positive relationship between gold and inflation, although not always seen in absolute prices (but in changes in these prices), and not always seen in the CPI (as inflation has broader effects not limited only to consumer prices).

Summing up the above analysis, it seems justified to claim that gold could benefit from the current elevated levels of inflation, especially if it turns out to be more lasting than commonly believed. It will also be good for gold if the Fed remains dovish and tolerant of inflation surpassing its target significantly.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.