Is Everyone Still Bullish? Not the Majority of Analysts Anymore

Investing.com | Jan 08, 2024 07:58AM ET

- Despite initial concerns, the S&P 500 ended 2023 above 4,700 points, challenging the pessimistic expectations at the beginning.

- Looking ahead to 2024, analysts offer conservative projections, with Yardeni Research standing out for a double-digit return prediction.

- While it remains to be seen how 2024 might end, but in the short to medium term, 5000 points is in the cards for the S&P 500.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

Despite the early negative sentiment among analysts, 2023 was a year of strong gains.

Even after the initial pessimism and expectations of a down year for the S&P 500 - the first since 1999 - it concluded at 4,770 points.

The 60/40 portfolio, which faced skepticism following the 2022 collapse, rebounded remarkably, marking its third-worst year on record.

It bounced back with its second-best performance since 1998, delivering an impressive 18% year-on-year gain.

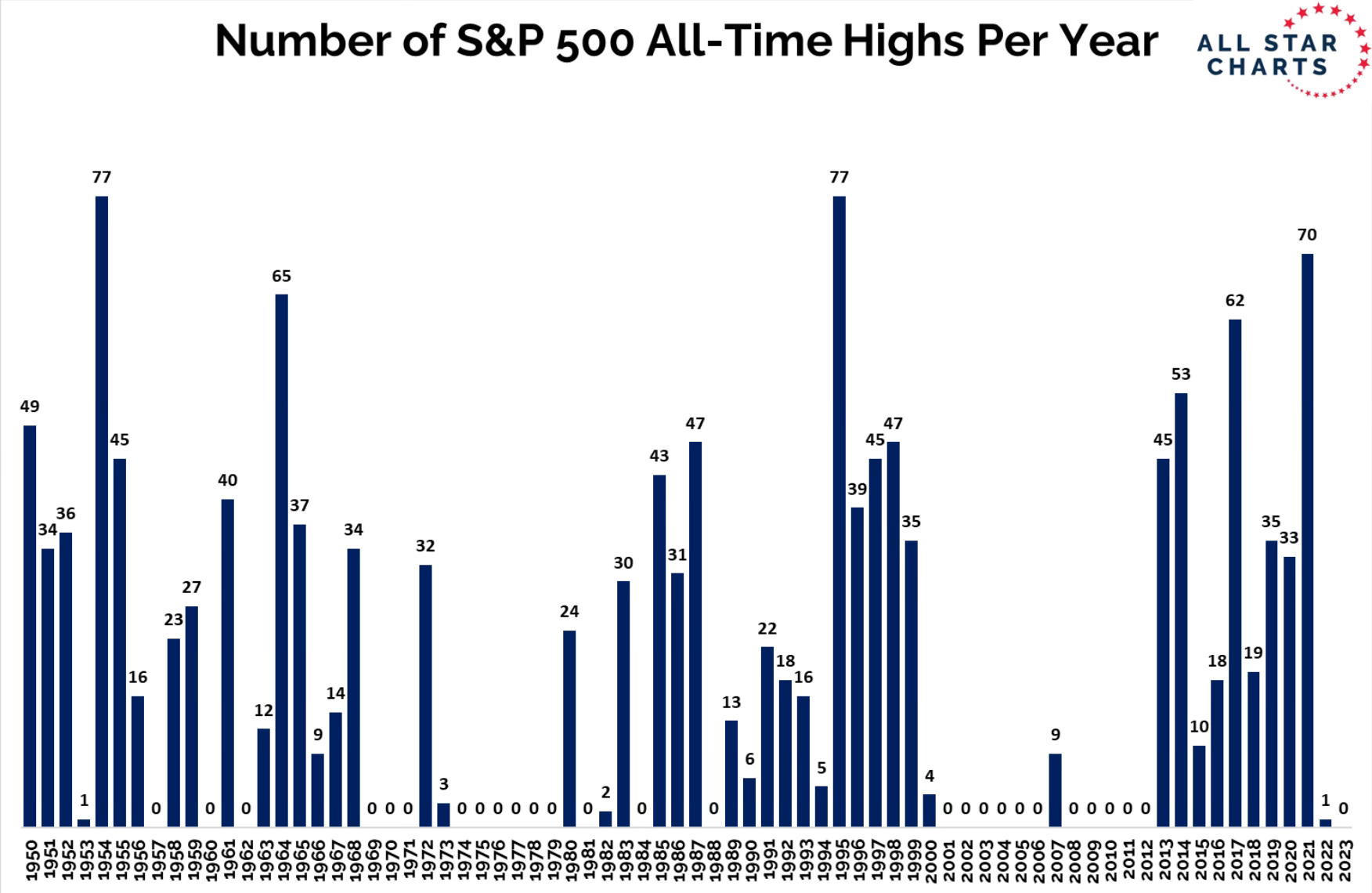

The S&P 500 failed to reach an all-time high despite a strong rise in 2023. The first year since 2012 without an all-time high.

Source: All Star Charts

Now, the question on many investors' minds is:

What can we anticipate for 2024?

According to analysts, expectations are still quite conservative, with only Yardeni Research predicting a double-digit return in 2024, with a target of 5400 points.

The average return among all expected targets is about 2% from current levels, at 4785 points.

Is everyone still bullish? Not the analysts.

I am more bullish for 2024 than the average forecast just seen.

As I wrote in the last analysis, looking at various data, the trend remains bullish and our strategies are based on an objectively positive environment.

Confirming last time's analysis is the very interesting chart that examines what happens after annual gains of +20% for the S&P 500.

Source: Carson

In the year that follows, the market does not perform over +20% like the previous year but ends on a positive note with an average performance of +12% (since 1950) while negative annual closes account for about 20% of the cases.

Bullish Exuberance Keeps Rising

Examining the AAII Sentiment Survey, which gauges individual investors' opinions on the market's direction over the next 6 months, there's a notable shift. In the spring of 2022, a historically bullish event occurred, but enthusiasm for stocks had waned.

Fast forward to today, optimism is at notably elevated levels, currently standing at 48.6%.

This marks the ninth consecutive week where optimism has surpassed the historical average of 37.5%, indicating a sustained period of unusually high investor confidence.

While data can often be noisy and warrant limited consideration, extreme cases, as observed in 2022, merit attention. The current scenario, marked by high optimism at 48.6%, suggests a potential need for vigilance.

In situations like these, where sentiment reaches extremes, it's prudent to stay alert. The historical context underscores that excessive optimism can precede periods of volatility.

I expect a retracement during the year and it could even be over 10% at some point. But this is market psychology and should be expected.

The question remains: will it just be short-term noise on the course to a rally above 5,000 points?

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology,

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.