Is AutoZone A Little Out Of The Zone?

F.A.S.T. Graphs | Jun 20, 2012 04:40AM ET

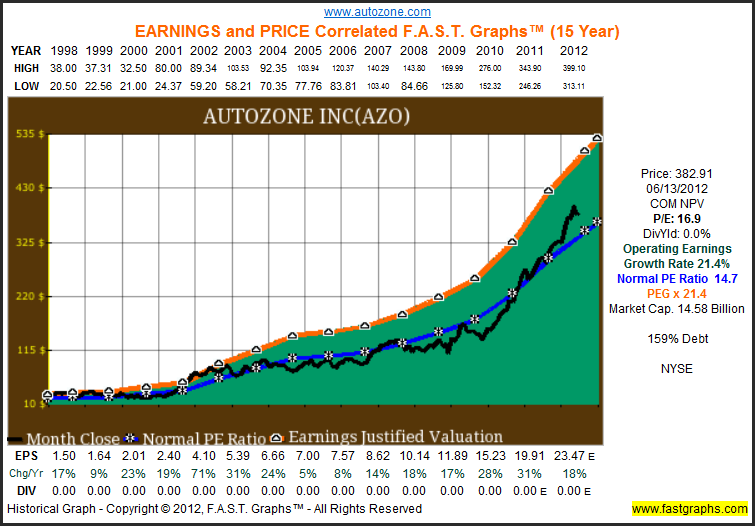

A good growth company is always a nice addition to a portfolio, but you have to watch to make sure you are not paying too much. The old saying is: “You make your money on the buy side.” Looking at AutoZone (AZO) at a glance, we see that it normally trades (Normal Historical PE – the blue line) at or below its historical operating earnings growth rate (the orange line). However, you can see that it has recently begun to trade modestly above its Normal Historical PE. Therefore, it appears that AutoZone may be trading at a slight premium to its historical valuation.

Growth stocks are defined as companies with high rates of change of earnings growth of 15% to 20% or better. Growth stocks offer the potential for share prices to rise in lockstep with their profit growth in the long run. Therefore, the PEG ratio formula (price equals growth rate) tends to be the most appropriate formula used to value growth stocks. However, due to the exponential nature of compounding large numbers, PEG ratio forecasts are capped at 40%.

Because of the higher valuation typically awarded to fast growth, growth stocks offer the potential for greater capital appreciation. On the other hand, they also offer higher risk. First of all, they tend to command much higher than average PE ratios, and second, achieving very high levels of growth is very difficult to sustain. Consequently, forecasting future earnings growth is more important with high growth stocks than any other class of stock. Also, the average growth stock typically ploughs all of its profits back into the company to fund its future growth, instead of paying dividends.

AutoZone Inc: Large-cap Growth at an Attractive Price

“AutoZone is the leading retailer and a leading distributor of automotive replacement parts and accessories in the United States. Each store carries an extensive product line for cars, sport utility vehicles, vans and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. Many stores also have a commercial sales program that provides commercial credit and prompt delivery of parts and other products to local, regional and national repair garages, dealers, service stations, and public sector accounts. AutoZone also sells the ALLDATA brand diagnostic and repair software through www.alldata.com. Additionally, we sell automotive hard parts, maintenance items, accessories, non-automotive products and subscriptions to the ALLDATAdiy product through www.autozone.com, and our commercial customers can make purchases through www.autozonepro.com. AutoZone does not derive revenue from automotive repair or installation.”

Earnings Determine Market Price: The following earnings and price correlated F.A.S.T. Graphs™ clearly illustrates the importance of earnings. The Earnings Growth Rate Line or True Worth™ Line (orange line with white triangles) is correlated with the historical stock price line. On graph after graph the lines will move in tandem. If the stock price strays away from the earnings line (over or under), inevitably it will come back to earnings.

AutoZone Inc: Historical Earnings, Price, Dividends and Normal PE Since 1998.

Performance Table AutoZone Inc

The Two Keys to Long-Term Performance

Years of research and experience have taught us that there are two critically important keys to achieving above-average, long-term shareholder returns at reasonably controlled levels of risk. The first key is earnings growth, or what we like to call the rate of change of earnings growth. The faster a company can grow its business (i.e. earnings), the larger the income stream it can produce with which to reward shareholders. This is because of the power of compounding, which Albert Einstein was alleged to have called "the most powerful force on earth." Ultimately, both capital appreciation and dividend income will be a function of a company's ability to grow its profits.

The second key is valuation. When a company can be purchased at its intrinsic value based on earnings and cash flow generation, the shareholders' rate of return or long-term capital appreciation will inevitably correlate to and/or equal its earnings growth rate. Overvaluation will lower that rate of return and conversely, undervaluation will increase it. Consequently, paying strict attention to the valuation you pay to buy a stock is a critical component of both greater return and taking lower risk to achieve it. Because, ironically, when you overpay for even the best business, you simultaneously lower your return potential while increasing your risk of achieving the lower return.

The associated performance results with the earnings and price correlated graph, validates the above discussion regarding the two keys to long-term performance. Notice the impact that valuation (black line above or below orange earnings justified valuation line) had on the following performance results.

The following graph plots the historically normal PE ratio (the dark blue line) correlated with 10-year Treasury note interest. Notice that the current price earnings ratio on this quality company is as normal as it has been since 1998.

A further indication of valuation can be seen by examining a company’s current price to sales ratio relative to its historical price to sales ratio. The current price to sales ratio for AutoZone Inc is 1.72 which is historically high.

Looking to the Future

Extensive research has provided a preponderance of conclusive evidence that future long-term returns are a function of two critical determinants:

1. The rate of change (growth rate) of the company’s earnings

2. The price or valuation you pay to buy those earnings

Forecasting future earnings growth, bought at sound valuations, is the key to safe, sound, and profitable performance.

Therefore, it logically follows that measuring performance without simultaneously measuring valuation is a job half done. AutoZone Inc is clearly an industry leading superior business, which based on the consensus estimates from leading analysts, appears to be capable of growing earnings at an above-average rate for the foreseeable future. At its current price, which is attractively aligned with its True Worth™ valuation, AutoZone Inc represents an opportunity for growth at a reasonable price. The important factor is that AutoZone Inc, with its strong balance sheet and potential for future earnings growth, has real assets and cash flow underpinning its stock price. This solid economic foundation offers shareholders the potential for both a strong margin of safety and an opportunity for outsized future returns.

The Estimated Earnings and Return Calculator Tool is a simple yet powerful resource that empowers the user to calculate and run various investing scenarios that generate precise rate of return potentialities. Thinking the investment through to its logical conclusion is an important component towards making sound and prudent commonsense investing decisions.

The consensus of 23 leading analysts reporting to Capital IQ forecast AutoZone Inc’s long-term earnings growth at 15%. AutoZone Inc has high long-term debt at 159% of capital. AutoZone Inc is currently trading at a P/E of 16.9, which is inside the value corridor (defined by the five orange lines) of a maximum P/E of 18. If the earnings materialize as forecast, AutoZone Inc’s True Worth™ valuation would be $709.59 at the end of 2017, which would be a 12.5% annual rate of return from the current price.

Earnings Yield Estimates

Discounted Future Cash Flows: All companies derive their value from the future cash flows (earnings) they are capable of generating for their stake holders over time. Therefore, because Earnings Determine Market Price in the long run, we expect the future earnings of a company to justify the price we pay.

Since all investments potentially compete with all other investments, it is useful to compare investing in any perspective company to that of a comparable investment in low risk Treasury bonds. Comparing an investment in AutoZone Inc to an equal investment in 10 year Treasury bonds, illustrates that AutoZone Inc’s expected earnings would be 7.6 times that of the 10 Year T-Bond Interest. (See EYE chart below). This is the essence of the importance of proper valuation as a critical investing component.

Summary & Conclusions

This report presented essential “fundamentals at a glance” illustrating the past and present valuation based on earnings achievements as reported. Future forecasts for earnings growth are based on the consensus of leading analysts. Although, with just a quick glance you can know a lot about the company, it’s imperative that the reader conducts their own due diligence in order to validate whether the consensus estimates seem reasonable or not.

AutoZone is a stock with a solid record of above-average earnings growth. At its current valuation it still offers above-average long-term rate of return, although its valuation is a little high historically. Therefore, the prudent investor looking for above-average growth might want to include AutoZone on its watch list. We believe it’s a good buy at current levels, but it would be an even better buy if the price were to fall even modestly.

Disclosure: No position at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation. A comprehensive due diligence effort is recommended.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.