Is A Correction For S&P 500 And Gold Looming?

Monica Kingsley | Feb 12, 2021 05:06PM ET

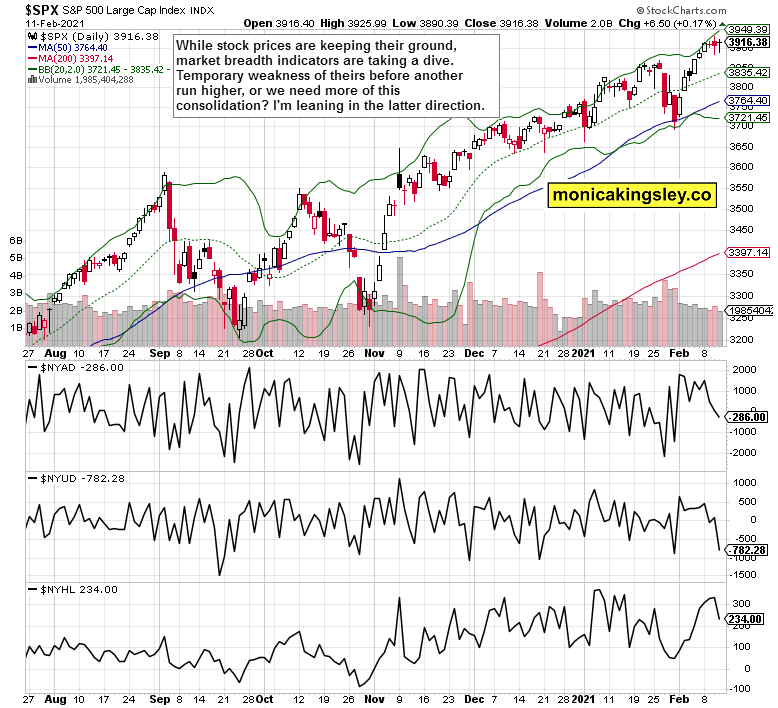

Stocks are clinging to the 3,900 level, and the bulls aren't yielding. Without much fanfare, both the sentiment readings and put/call ratio are at the greedy end of the spectrum again. How long can it last? And what shape could the upcoming correction take? Right now, the warning signs are mounting, yet the bears shouldn‘t put all their eggs into the correction basket, for it shapes to be a shallow one – one in time, rather than in price.

Gold's hardship is another cup of tea, standing in stark comparison to how well silver and platinum are doing. At the same time, the dollar hasn't really moved to the upside – there is no dollar breakout. If the greenback were to break to the upside, that would mean a dollar bull market, which I don't view as a proposition fittingly describing the reality. The world reserve currency will remain on the defensive this year. We saw not a retest, but a local top.

This has powerful implications for precious metals, where the only question is whether we get a weak corrective move to the downside or whether we can base in a narrow range, followed by another upleg (think spring). February isn't the strongest month for precious metals seasonally, but it isn't a disaster either.

One more note concerning the markets – in our print-and-spend-happy world, where the give or take $1.9-trillion stimulus will sooner or later come in one way or another, we better prepare on repricing downside risk in precious metals. Also, we better not to fixate on the premature bubble pop talk too closely. I have been stating repeatedly that things have to get really ridiculous first, and this just doesn‘t qualify yet in my view. All those serious correction calls have to wait – in tech and elsewhere, for we‘re going higher overall – like it or not.

Let‘s get right into the charts (all courtesy of yesterday still apply today:

'(…) I think this corrective span has a bit further to run in time really. (…) the bears are just rocking the boat, that‘s all.'

The market breadth indicators are deteriorating, without stock prices actually following them down. Thus far, the correction is indeed shaping to be one in time and characterized by mostly sideways trading. Unless you look at the following chart.

Volatility has died down recently, yet a brief spike (not reaching anywhere high, just beating the 24 level) wouldn‘t be unimaginable to visit us by the nearest Wednesday. In all likelihood, it would be accompanied by lower stock prices. It is well worth watching.

Credit Markets And Tech

There is a growing discrepancy between high-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) and its investment grade counterpart (iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD). Both leading credit market ratios have been diverging not only since the end of January, but practically throughout 2021. The theme of rising yields is exerting pressure on the higher end of the debt market as the stock investment fever goes on.

No, this is not a bubble – not a parabolic one. The tech sector is gradually assuming leadership in the S&P 500 advance, accompanied by micro-rotations as value goes into favor and falls out of it, relatively speaking. Higher highs are coming, earnings are doing great and valuations aren't an issue still.

Summary

The stock market tremors aren‘t over, and the signs of deterioration keep creeping in. The bull run isn't in jeopardy, however, and there are no signals thus far pointing to an onset of a deeper correction right now.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.