Iron Ore: How Low Can It Go?

MetalMiner | Jan 19, 2015 02:59AM ET

Iron ore prices dropped 40% in 2014 (average 62% Fe fines Platts price cost and freight China) to average $97/ton. The peak-to-trough decline was even greater and prices are now below $70/ton. Some iron ore analysts now suggest that prices could go to $50/ton or even below. We don’t think that they will, and the Steel-Insight view is that they may drop below $60/ton for a short period of time, but that they will spend the bulk of the year trading between $65-75/ton.

Can Iron Ore Prices Drop Much Further?

The market is undoubtedly oversupplied and new projects are continuing to arrive, e.g. Anglo American’s Minas Rio project in Brazil (26 million tons per year) and Hancock Mining’s Roy Hill project (55m tpy), although they will take time to ramp up with 2015 output far below capacity. Both projects were at such an advanced stage prior to the price meltdown that they will start production. Meanwhile, the Big Three of Vale, Rio Tinto and BHP Billiton all expect to increase production in 2015. It is reasonable to expect another 100m tpy or so of new supply.

However, to a significant extent these will be offset by cutbacks in supply that we believe are not being appreciated by the market.

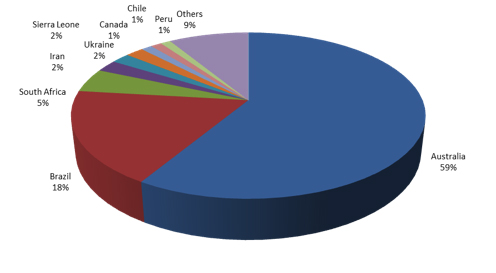

Iron ore imports from outside Australia, Brazil & South Africa will total around 160m tons in 2014 – around 18% of total imports in excess of 900m tonnes. It is our view that these will more than halve in 2015. They are simply not viable at current prices.

- India for the first time will be a net importer of iron ore in 2015. As recently as 2010, it exported nearly 100 m tons. Right now, it is not profitable to export from India given the cost structure, the domestic price and the export tariff. It supplied 7 m tons to China in 2014.

- Iran supplied over 20 m tons to China in 2014. Many smaller and inland mines are simply not viable at current prices and have closed. Realistically exports will halve in 2015.

- Higher-cost suppliers such as Canada and Sierra Leone – where the key cost is significantly higher freight to get to market – will also struggle, and cut their long-distance sales to Asia.

- Third-tier suppliers (Indonesia, Malaysia, Burma, Laos, Vietnam, Honduras, Thailand and a host of smaller countries) are likely to capitulate in 2015. The Chinese spot market is their sole destination and their typically lower grades mean that they sell at a discount of 10-20% to the 62% index.

- Smaller mines in Australia and Brazil will also cut back as they are not profitable.

Finally, the cutbacks will be in Chinese iron ore production itself. Year-on-year output fell in November for the first time. Chinese output in January-February is always significantly lower due to seasonal closures in northern China due to winter weather, but they may not come back if prices stay low. It is our view that Chinese iron ore output in 2015 will be lower by around 20% year-on-year – taking around 80m tpy (of 62% Fe equivalent) out of the market.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.