iPhone Manufacturer Scraping By On Thin Margins And Risks Of Factory

Sober Look | Sep 25, 2012 03:23AM ET

As consumers await to receive the shiny new iPhones they recently ordered, attention shifts to Apple's Taiwan-based primary supplier, Foxconn Technology Co. Ltd (otherwise known as Hon Hai Precision Industry Co). Can the company deliver on time? Or would the next factory closure disrupt production? After all, Apple's customers, particularly Americans don't like to wait.

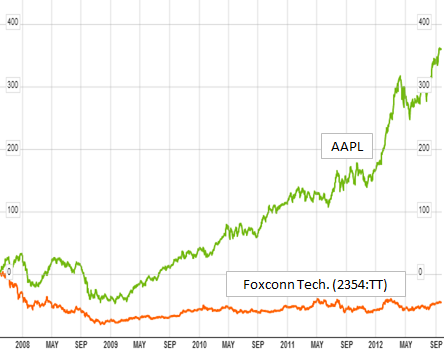

Foxconn employs some million workers in China to meet this demand for Apple's as well as Amazon's, Nintendo's, and Mocrosoft's products (iPad, iPhone, iPod, Kindle, PlayStation 3, and Xbox 360.) With its massive manufacturing capabilities and Apple as a major client, one would think that Foxconn's shares should have benefited at least somewhat from AAPL's parabolic growth. But they haven't.

In fact Foxconn's shares even lag the Taipei stock index (TWSE) over the past five years in spite of these huge orders from Apple. It seems that the bulk of product margin goes to Foxconn's large clients. Working with thin margins makes Foxconn vulnerable - as the share price clearly shows. Foxconn's story is littered with complaints of poor working conditions and worker abuses (even suicides) as well as riots and factory shutdowns.

Foxconn has invested heavily to improve conditions for workers - which hit its bottom line. But recently a reporter from the Shanghai Evening Post infiltrated a Foxconn factory and detailed his experience as an assembly line worker. A "rough" English translation of his story is available worker discontent and factory shutdowns are on the rise. As a longer term strategy, Apple and others must be considering alternate suppliers outside of China, which does not bode well for China's manufacturing sector.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.